Share This Page

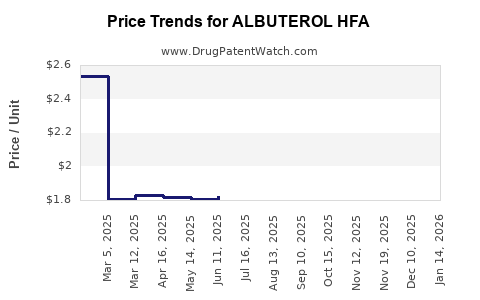

Drug Price Trends for ALBUTEROL HFA

✉ Email this page to a colleague

Average Pharmacy Cost for ALBUTEROL HFA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALBUTEROL HFA 90 MCG INHALER | 76282-0679-42 | 2.23739 | GM | 2025-12-17 |

| ALBUTEROL HFA 90 MCG INHALER | 00054-0742-87 | 2.23739 | GM | 2025-12-17 |

| ALBUTEROL HFA 90 MCG INHALER | 00093-3174-31 | 1.90691 | GM | 2025-12-17 |

| ALBUTEROL HFA 90 MCG INHALER | 17270-0740-00 | 1.90691 | GM | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Albuterol HFA

Introduction

Albuterol HFA (hydrofluoroalkane) inhalers are a cornerstone treatment for asthma and chronic obstructive pulmonary disease (COPD). This pressurized metered-dose inhaler (pMDI) delivers rapid bronchodilation, providing essential relief for millions globally. As healthcare markets evolve, understanding the dynamics influencing Albuterol HFA’s market size, competitive landscape, and pricing trends becomes critical for stakeholders. This analysis explores current market fundamentals, key drivers, regulatory influences, pricing strategies, and offers a forecast for the coming years.

Market Overview

Market Size and Scope

The global bronchodilator market, driven primarily by inhaled therapies like Albuterol HFA, was valued at approximately USD 9.2 billion in 2022, with an expected compound annual growth rate (CAGR) of roughly 4.5% through 2030 (1). Albuterol HFA accounts for a significant segment, particularly within the U.S. and European markets, owing to its widespread prescription for asthma and COPD management.

In the United States, over 25 million people suffer from asthma, with many relying on inhalers such as Albuterol HFA for acute symptom relief (2). The demand also propels from COPD prevalence, which affects over 16 million Americans as of 2022 (3). Emerging markets exhibit growth potential, propelled by increasing urbanization, air pollution, and rising awareness of respiratory diseases.

Market Drivers

- Prevalence of Respiratory Diseases: The rising incidence of asthma and COPD directly fuels demand. According to the WHO, asthma affects approximately 262 million globally, with a rising trend (4).

- Healthcare Access and Reimbursement Policies: Insurance coverage and reimbursement schemes, particularly in developed economies, promote widespread adoption.

- Regulatory Environment: Regulatory approvals for generic and biosimilar alternatives lower prices and expand access.

- Technological Innovation: Improvements in inhaler design enhance patient compliance, indirectly boosting market stability.

Competitive Landscape

Prominent brands—such as Teva’s ProAir HFA, Pfizer’s Ventolin HFA, and Mylan’s generic equivalents—dominate the market. Patent expirations and regulatory approvals have increased generic competition, pressuring prices but expanding market volume.

Regulatory and Patent Dynamics

Patent Expirations and Generics

Pfizer’s Ventolin HFA lost patent exclusivity in the U.S. in 2020, opening markets to generic competitors (5). This transition led to significant price erosion but maintained strong market demand due to the drug's essential nature.

Regulatory Pathways

The FDA’s approval framework favors generic inhalers through abbreviated pathways, reducing time-to-market for competitors. The emergence of authorized generics has further intensified price competition.

Pricing Trends and Factors

Historical Pricing Patterns

- Brand-name Price Points: Historically, Albuterol HFA inhalers retained retail prices around USD 40-60 per inhaler (costs vary by brand and pharmacy rebates).

- Generic Price Impact: Following patent expiry, generic equivalents entered the market at approximately 30-50% of the brand’s price, leading to retail prices near USD 20-30 per inhaler.

Current Price Dynamics

Recent data indicate further price reductions driven by increased competition. Some generic products now retail at USD 15-25 per inhaler in U.S. pharmacies, offering affordability, especially for Medicaid and uninsured populations.

Influencing Factors

- Manufacturing and Supply Costs: Technology advancements and increased manufacturing efficiencies have reduced costs.

- Reimbursement Policies: Price negotiations between payers and manufacturers impact final retail prices.

- Market Penetration of Generics: Entering multiple competitors in the space accelerates price erosion.

- Global Supply Chain: Supply disruptions and raw material costs influence pricing, especially in emerging markets.

Future Price Projections

Short-term Outlook (2023-2025)

- Continued Price Decline: As generic competition matures, retail prices are forecasted to decline by an additional 10-15% in the U.S. and European markets.

- Market Penetration Expansion: Broader adoption in low-income and developing regions will maintain volume growth but exert downward pressure on unit prices.

Medium to Long-term Outlook (2026-2030)

- Stabilization of Prices: Prices are expected to stabilize around USD 15-20 per inhaler for generics.

- Innovation and Biosimilars: The introduction of next-generation inhalers with enhanced delivery mechanisms might influence pricing, though primary solid formulations will likely remain competitive.

- Global Pricing Discrepancies: Prices will vary significantly across regions, with developed markets experiencing more stable reductions and emerging markets benefiting from lower entry costs.

Market Challenges and Opportunities

Challenges

- Price Erosion: The rapid generics entry reduces profitability for original manufacturers.

- Regulatory Stringency: Stringent environmental and quality regulations may increase manufacturing costs.

- Supply Chain Disruptions: Ongoing logistical challenges can lead to shortages, affecting pricing and availability.

Opportunities

- Extended Patent and Data Exclusivity: For innovative inhaler technologies, offer premium pricing.

- Strategic Partnerships: Collaborations with emerging market distributors can increase access.

- Development of Novel Delivery Systems: Incorporating digital health features can justify premium pricing models.

Conclusion

The Albuterol HFA market remains robust, driven by persistent demand for acute respiratory therapy. The patent expiration and entry of generics have significantly reduced prices, enhancing accessibility. While this trend presents profitability challenges for innovator companies, it broadens global access and paves the way for volume-driven growth. Price projections indicate a continued decline in retail prices for generics over the next 3-5 years, stabilizing at low-to-moderate levels.

Stakeholders should focus on strategic innovation, supply chain resilience, and market diversification to capitalize on future opportunities. As global respiratory disease burdens increase, Albuterol HFA’s importance in respiratory care will sustain its market relevance and influence pricing trajectories.

Key Takeaways

- The global Albuterol HFA market is sizable, fueled by rising respiratory disease prevalence and entrenched clinical use.

- Patent expirations have driven significant price declines, especially with the proliferation of generic products.

- US retail prices for generic Albuterol HFA inhalers are projected to decrease further, stabilizing around USD 15-20 per inhaler.

- Market growth in emerging economies offers volume expansion opportunities, despite regional pricing variability.

- Innovation in inhaler technology and strategic market positioning can offset price erosion pressures and sustain profitability.

FAQs

-

What factors influence the pricing of Albuterol HFA inhalers?

Pricing is affected by patent status, generic competition, manufacturing costs, reimbursement policies, and regional market dynamics. -

How has patent expiration impacted the Albuterol HFA market?

Patent expirations led to increased generic competition, causing significant price erosion and expanding market access, especially in cost-sensitive regions. -

What is the future outlook for Albuterol HFA prices?

Prices for generics are expected to decline gradually over the next 3-5 years, stabilizing at around USD 15-20 per inhaler, with regional variability. -

Are there opportunities for premium pricing in the Albuterol HFA market?

Yes, innovations such as digital inhalers or combination therapies offering enhanced convenience can command higher prices. -

What challenges might affect Albuterol HFA market growth?

Challenges include sustained price pressures from generics, supply chain disruptions, and regulatory hurdles affecting manufacturing and distribution.

More… ↓