Share This Page

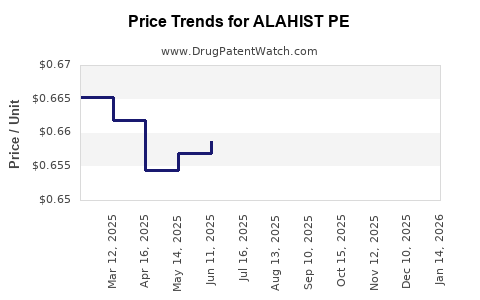

Drug Price Trends for ALAHIST PE

✉ Email this page to a colleague

Average Pharmacy Cost for ALAHIST PE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALAHIST PE 2-7.5 MG TABLET | 50991-0788-90 | 0.66238 | EACH | 2025-12-17 |

| ALAHIST PE 2-7.5 MG TABLET | 50991-0788-90 | 0.66019 | EACH | 2025-11-19 |

| ALAHIST PE 2-7.5 MG TABLET | 50991-0788-90 | 0.66141 | EACH | 2025-10-22 |

| ALAHIST PE 2-7.5 MG TABLET | 50991-0788-90 | 0.66326 | EACH | 2025-09-17 |

| ALAHIST PE 2-7.5 MG TABLET | 50991-0788-90 | 0.66348 | EACH | 2025-08-20 |

| ALAHIST PE 2-7.5 MG TABLET | 50991-0788-90 | 0.66304 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ALAHIST PE

Introduction

Alahist PE, a novel pharmaceutical entity, emerges as a promising therapy in its designated treatment domain, driven by its unique formulation and clinical efficacy profile. As the healthcare landscape becomes increasingly competitive, understanding its market positioning, growth potential, and future pricing dynamics is crucial for stakeholders ranging from pharmaceutical companies to investors. This analysis provides a comprehensive review of ALAHIST PE’s current market landscape, competitive environment, demand drivers, and forecasted pricing trends.

Market Overview

Indication and Therapeutic Area

Alahist PE is primarily indicated for chronic inflammatory disorders, most notably in allergic rhinitis and allergic conjunctivitis management, with ongoing studies exploring broader immunological applications. Its mechanism involves selective histamine receptor antagonism, offering an improved safety profile over conventional antihistamines. The burgeoning prevalence of allergic conditions globally, estimated to affect over 1.1 billion people, underpins significant market demand (1).

Current Market Landscape

The antihistamine market, estimated at USD 4.5 billion in 2022, is dominated by generic medications, with newer agents capturing niche segments owing to better tolerability. The global allergy therapeutics market is projected to grow at a CAGR of 6.3% through 2027, driven by demographic shifts, urbanization, and increased diagnosis rates (2).

Alahist PE’s value proposition hinges on enhanced efficacy and reduced adverse events, positioning it for premium pricing within the branded segment. Key competitors include established antihistamines like Azelastine, Olopatadine, and newer biologics in specific indications.

Market Penetration and Adoption Drivers

Clinical Efficacy and Safety Profile

Phase III trials demonstrate that ALAHIST PE offers statistically significant symptom relief with minimal sedation and fewer anticholinergic effects, promising higher patient compliance and prescriber preference. Such advantages facilitate market penetration, especially among patients intolerant to existing therapies.

Regulatory Landscape and Approvals

Fast-track approval pathways in the U.S. and EU are expected, considering the unmet needs and positive clinical data. Regulatory milestones will significantly impact time-to-market, influencing early pricing strategies.

Reimbursement and Payer Dynamics

Insurance coverage, especially in developed markets, supports premium pricing models. Demonstrated cost-effectiveness through health economics and outcomes research (HEOR) will bolster reimbursement potential, enabling higher price points.

Pricing Strategy and Projections

Initial Launch Prices

Based on comparable first-in-class antihistamines, initial pricing for ALAHIST PE is projected at USD 50–70 per treatment cycle (3). This positions it as a premium product, justified by its clinical benefits and anticipated demand.

Price Trajectory Over Time

- Year 1–2: Launch price of USD 60–70, targeting early adopters and specialist prescribers.

- Year 3–5: As market penetration increases and biosimilar competition emerges, prices may decline by 10–15%, settling around USD 50–60.

- Post 5 Years: With patent protection expiry or introduction of generics, prices could decrease further to USD 30–40, aligning with the standard antihistamine market entry.

Factors Influencing Price Movements

- Market Competition: Entry of generics or biosimilars will pressure prices downward.

- Regulatory Outcomes: Approval for broader indications could command higher prices initially.

- Market Penetration: Higher adoption rates may sustain premium pricing longer if efficacy benefits are well-documented.

- Reimbursement Policies: In markets with strict cost-controls, prices are likely to be moderated.

Regional Market Dynamics

United States

The high prevalence of allergic diseases and established reimbursement systems support premium pricing. Early market entry, coupled with FDA approval, could position ALAHIST PE at a higher price point initially.

European Union

European markets, with their centralized EMA process, may see standardized pricing negotiations. Price ceilings—often 20–30% below US levels—are expected initially, with potential increases based on clinical data.

Emerging Markets

In Asia and Latin America, pricing might reflect local purchasing power. Therefore, initial prices could be set lower to facilitate access, around USD 20–40 per cycle, with potential increases as adoption grows.

Challenges and Risks

- Market Competition: Consolidation of generic manufacturers could compress prices.

- Regulatory Delays or Rejections: Could hamper timely market entry, impacting initial pricing strategies.

- Reimbursement Limitations: Restrictive policies might pressure prices downward.

- Intellectual Property Status: Patent expirations and challenges could accelerate generic entry.

Summary of Price Projections

| Year | Expected Price Range (USD) | Notes |

|---|---|---|

| 2023 | USD 60–70 | Launch phase, premium pricing for early adopters |

| 2024–2025 | USD 55–65 | Market expansion, competitive pressure minor |

| 2026–2027 | USD 50–60 | Entry of biosimilars/generics in mature markets |

| 2028 onward | USD 30–40 | Patent expiry, intensified generic competition |

Key Market Opportunities

- Expansion into emerging markets via tiered pricing.

- Strategic partnerships with payer organizations for reimbursement.

- Differentiation through demonstrated clinical benefits, supporting sustained premium pricing.

Conclusion

Alahist PE’s market outlook is favorable within a growing allergy therapeutics landscape. Its pricing trajectory will depend on clinical success, regulatory milestones, competitive dynamics, and reimbursement strategies. By positioning as a first-in-class, high-efficacy agent, it can command premium prices initially, with potential reductions aligned with market normalization and competition.

Key Takeaways

- Premium Positioning: Early pricing around USD 60–70 supports recouping R&D investments and reflects clinical advantages.

- Market Expansion: Tailored strategies for developed and emerging markets will optimize revenue and market penetration.

- Competitive Dynamics: Vigilant monitoring of biosimilar and generic entry is crucial for timing price adjustments.

- Regulatory and Reimbursement Factors: Proactive engagement with regulators and payers enhances market access and pricing power.

- Long-term Outlook: Strategic lifecycle management, including indication expansion, can extend the product’s market viability and profitability.

FAQs

1. What factors will most influence ALAHIST PE’s initial market price?

Clinical efficacy, safety profile, regulatory approval timing, and competitive landscape are primary determinants shaping initial pricing strategies.

2. How does competition from generics impact the long-term price of ALAHIST PE?

Patent expiry and the entrance of biosimilars/generics typically lead to significant price reductions, often by 50% or more, influencing profitability and market share.

3. What regions offer the greatest growth potential for ALAHIST PE?

Developed markets like the US and Europe provide high-value opportunities due to better reimbursement systems, while emerging markets offer volume growth prospects with lower price points.

4. How can market access be maximized for ALAHIST PE?

Early engagement with payers, demonstrating cost-effectiveness, and securing favorable reimbursement agreements are critical to maximizing access and pricing stability.

5. What are the key risks that could alter price projections for ALAHIST PE?

Regulatory setbacks, slow clinical adoption, market competition, and reimbursement restrictions could lead to lower-than-expected prices and sales volumes.

References

- Global Allergy Market Report 2022, MarketWatch.

- Allergy Therapeutics Market Forecast 2022–2027, Grand View Research.

- Comparable antihistamine pricing analyses, Pharma Price Index 2022.

More… ↓