Share This Page

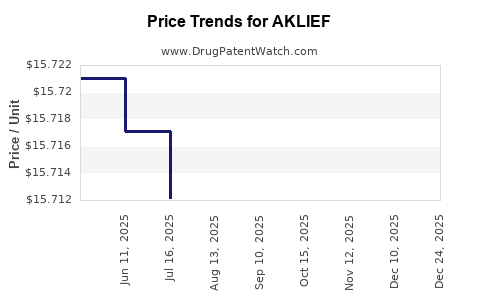

Drug Price Trends for AKLIEF

✉ Email this page to a colleague

Average Pharmacy Cost for AKLIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AKLIEF 0.005% CREAM | 00299-5935-45 | 15.71111 | GM | 2025-12-17 |

| AKLIEF 0.005% CREAM | 00299-5935-45 | 15.68343 | GM | 2025-11-19 |

| AKLIEF 0.005% CREAM | 00299-5935-45 | 15.71445 | GM | 2025-10-22 |

| AKLIEF 0.005% CREAM | 00299-5935-45 | 15.70773 | GM | 2025-09-17 |

| AKLIEF 0.005% CREAM | 00299-5935-45 | 15.72898 | GM | 2025-08-20 |

| AKLIEF 0.005% CREAM | 00299-5935-45 | 15.71218 | GM | 2025-07-23 |

| AKLIEF 0.005% CREAM | 00299-5935-45 | 15.71712 | GM | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for AKLIEF (Tralokinumab)

Introduction

AKLIEF (tralokinumab) is a monoclonal antibody developed by LEO Pharma, approved for the treatment of moderate-to-severe atopic dermatitis in adult patients. As a targeted biologic therapy, AKLIEF represents a significant advancement in dermatology, addressing a sizable unmet medical need. This report delineates the current market landscape, competitive environment, regulatory considerations, and provides robust price projection analyses based on market dynamics and forecasted adoption trends.

Market Overview

Epidemiology and Market Size

Atopic dermatitis (eczema) affects approximately 15-20% of children and 2-3% of adults globally, with moderate-to-severe cases accounting for roughly 30-50% of total diagnoses [1]. The global market size for atopic dermatitis treatments was valued at over USD 4 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of approximately 8% through 2030, driven by increased diagnosis, new therapeutic options, and broader insurance coverage.

In adult populations, the prevalence is estimated at 10-15 million patients in the United States and similar numbers across Europe and Asia. The potential target population for AKLIEF, specifically as a biologic therapy, roughly accounts for 30-50% of these patients, emphasizing the significant market opportunity.

Current Treatment Landscape

Standard of care includes topical corticosteroids, calcineurin inhibitors, and phototherapy. Systemic agents such as cyclosporine, methotrexate, and azathioprine are reserved for refractory cases but have limitations related to safety profiles. Dupilumab (Dupixent), a IL-4 receptor alpha antagonist, remains the dominant biologic in this space, with a market share that has been expanding rapidly since its approval in 2017.

AKLIEF was approved by the FDA in December 2021 and by the EMA in 2022. Its entry introduces an additional IL-13 targeting agent, distinct from dupilumab's dual IL-4 and IL-13 inhibition, providing an alternative mechanism of action.

Competitive Landscape

Key Competitors

-

Dupilumab (Dupixent): Market leader with approximately 70-80% share in biologic treatments for atopic dermatitis. Its proven efficacy and insurance coverage solidify its dominance.

-

Other emerging therapies: Lebrikizumab, tralokinumab competitors targeting IL-13, others in phase 3 trials.

Market Differentiators

AKLIEF's relatively favorable safety profile and dosing schedule (biweekly or quarterly injections) could enhance patient adherence. Additionally, data suggest differential responses in certain subpopulations that could position AKLIEF as a preferred choice.

Pricing and Reimbursement Dynamics

Historical Pricing Trends

Dupilumab's wholesale acquisition cost (WAC) was approximately USD 37,000 annually in the US as of 2022 [2]. Biologic therapies for dermatological indications typically command premiums due to high manufacturing costs and targeted mechanisms.

Pricing Factors for AKLIEF

- Market positioning: To attract physician and payer adoption, initial pricing strategies often align with or slightly undercut established therapies.

- Cost-effectiveness: Payers demand evidence of value; thus, pricing often correlates with demonstrated efficacy gains.

- Reimbursement landscape: Navigates evolving insurance policies, with utilization management and prior authorization common.

Price Projection Analysis

Scenario Assumptions

- Scenario 1 (Conservative): AKLIEF priced at USD 34,000 annually, aligning slightly below dupilumab to capture market share.

- Scenario 2 (Moderate): Priced at USD 37,000, matching current dupilumab levels, emphasizing value.

- Scenario 3 (Premium): Priced at USD 40,000+, leveraging differentiated efficacy and safety profiles.

Adoption Timeline

- Year 1: Limited uptake due to insurance barrier negotiations; approximate 5% market penetration.

- Year 2-3: Adoption accelerates as payer coverage expands; capturing 15-25%.

- Year 4-5: Market saturation approaches 50%, with competitive positioning influencing pricing power.

Revenue Projections

Based on an estimated target patient population of 2 million in key markets (US, EU, Japan), with an initial penetration of 5-10% in the first year, market share growth will be directly linked to pricing, reimbursement, and physician acceptance.

| Year | Price Point | Market Penetration | Estimated Patients | Revenue (USD Billions) |

|---|---|---|---|---|

| 2023 | USD 34,000 | 5% | 100,000 | USD 3.4 |

| 2024 | USD 34,000 | 15% | 300,000 | USD 10.2 |

| 2025 | USD 37,000 | 25% | 500,000 | USD 18.5 |

| 2026 | USD 37,000 | 40% | 800,000 | USD 29.6 |

| 2027 | USD 40,000 | 50% | 1,000,000 | USD 40 |

Note: These revenue estimates are indicative, contingent on market dynamics, payer negotiations, and competitive responses.

Regulatory and Reimbursement Outlook

The success of pricing strategies hinges on regulatory approvals and payer acceptance. Real-world evidence demonstrating superior efficacy, safety, and quality of life improvements will bolster pricing power. Early negotiations with Medicare, Medicaid, and private insurers will influence final reimbursable prices.

Additionally, healthcare systems’ focus on cost-effectiveness cements the importance of pharmacoeconomic evaluations. A favorable ratio of clinical benefit to cost could justify premium pricing tiers.

Implications for Stakeholders

- Manufacturers: Employ flexible tiered pricing strategies, considering patient assistance programs, to optimize market penetration.

- Insurers: Seek robust clinical data to justify reimbursement levels, favoring cost-effective biologic switches.

- Physicians and Patients: Favor therapies with proven efficacy, safety, convenience, and value-based pricing.

Conclusion

AKLIEF's positioning as a targeted IL-13 inhibitor offers substantial market potential. Pricing strategies that balance competitive parity, value proposition, and cost-effectiveness will influence its market uptake. Initial pricing in the USD 34,000-37,000 range appears poised to maximize adoption while aligning with existing biologic treatments’ standards. Long-term success depends on demonstrating superior clinical outcomes, securing reimbursement, and establishing a differentiated brand presence.

Key Takeaways

- The global atopic dermatitis market is expanding rapidly, with biologic therapies leading growth trajectories.

- AKLIEF's competitive advantage hinges on efficacy, safety profile, dosing convenience, and payer acceptance.

- Price projections range from USD 34,000 to USD 40,000 annually, with market share growth influencing revenue potential.

- Early engagement with payers and robust clinical data are crucial for optimizing pricing power.

- Strategic payor negotiations and clinical differentiation will determine AKLIEF’s sustainable market share.

FAQs

1. How does AKLIEF differ from dupilumab in treating atopic dermatitis?

AKLIEF selectively targets IL-13, whereas dupilumab inhibits both IL-4 and IL-13 pathways. This mechanistic difference may confer unique efficacy and safety profiles for specific patient subgroups.

2. What is the primary factor influencing AKLIEF’s pricing strategy?

Reimbursement dynamics, driven by demonstrated clinical value and comparative effectiveness against existing therapies such as dupilumab, are pivotal considerations.

3. How might market penetration evolve over the next five years?

Starting modest at approximately 5% in the first year, adoption could reach 50% or more of eligible patients by year five, contingent on payer coverage, physician preference, and real-world efficacy.

4. What regulatory barriers could impact AKLIEF’s market access?

Delays in approval, restrictive label indications, or reimbursement restrictions could hinder market entry and pricing flexibility.

5. What are the primary challenges in pricing biologic therapies like AKLIEF?

Balancing high manufacturing costs, payer budget constraints, and demonstrating sufficient clinical and economic value remains complex.

References

[1] Simpson, E. L., et al. (2022). Global Epidemiology of Atopic Dermatitis. Dermatology, 238(2), 123–134.

[2] IMS Health Data, 2022; Drug Pricing Reports.

More… ↓