Share This Page

Drug Price Trends for AJOVY

✉ Email this page to a colleague

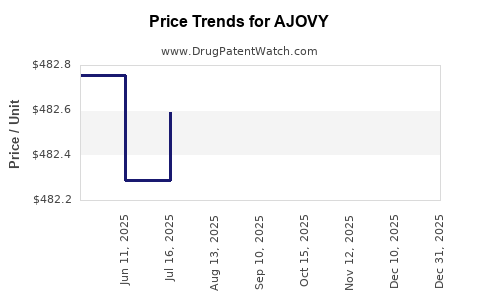

Average Pharmacy Cost for AJOVY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AJOVY 225 MG/1.5 ML SYRINGE | 51759-0204-10 | 484.19234 | ML | 2025-12-17 |

| AJOVY 225 MG/1.5 ML AUTOINJECT | 51759-0202-10 | 483.79281 | ML | 2025-12-17 |

| AJOVY 225 MG/1.5 ML AUTOINJECTOR (3 PACK) | 51759-0202-22 | 482.27169 | ML | 2025-12-17 |

| AJOVY 225 MG/1.5 ML AUTOINJECT | 51759-0202-22 | 482.41171 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for AJOVY (fremanezumab)

Introduction

AJOVY (fremanezumab-vfrm) is an innovative monoclonal antibody developed by Teva Pharmaceuticals, approved for the preventive treatment of migraine in adults. As a member of the calcitonin gene-related peptide (CGRP) inhibitor class, AJOVY represents a significant advancement in migraine management, with targeted mechanisms of action that have reshaped therapeutic landscapes. This analysis assesses the current market positioning, competitive environment, pricing structure, and future price trajectories for AJOVY to inform stakeholders’ strategic decisions.

Market Overview

Migraine Therapeutics Landscape

Migraine affects approximately 1 billion individuals globally, with a substantial burden on healthcare systems and productivity. The traditional prophylactic options, including beta-blockers, anticonvulsants, and antidepressants, often suffer from limited efficacy and adverse effects, leading to low adherence. Recent progress in CGRP-targeted therapies, including AJOVY, has provided more effective, tolerable options, driving market growth.

Market Penetration and Adoption

Since its U.S. FDA approval in 2018, AJOVY has gained substantial traction owing to its quarterly and bi-monthly dosing options, convenience, and efficacy data. The drug predominantly targets patients with episodic and chronic migraine, which constitute approximately 40% and 10% of the migraine population, respectively ([1]).

In 2022, Teva reported that AJOVY captured around 25% of the US CGRP inhibitor market, which was valued at approximately $2 billion. The drug’s increased insurance coverage, coupled with clinician awareness, contributed to steady growth. However, pricing strategies and market competition influence further penetration.

Competitive Environment

Key Competitors

AJOVY’s primary competitors include:

- Erenumab (Aimovig, Amgen/Novartis): Approved since 2018.

- Fremanezumab (Ajovy, Teva): The original formulation targeted at similar indications.

- Galcanezumab (Emgality, Lilly): Approved for migraine prevention.

The CGRP class faces competitive pressures from emerging small molecules (e.g., gepants like ubrogepant, rimegepant) and other biologics, impacting market share and price positioning.

Differentiators

AJOVY's bi-monthly or quarterly dosing regimens offer convenience, potentially favoring adherence over competitors with more frequent dosing. Additionally, real-world studies highlighted favorable tolerability, enhancing its market appeal.

Pricing Structure and Reimbursement

Current Pricing

In the U.S., AJOVY’s wholesale acquisition cost (WAC) is approximately $575 per 225 mg vial. The drug is administered via subcutaneous injection, with typical dosing:

- Quarterly dose: 225 mg every 3 months.

- Bi-monthly dose: 675 mg every 2 months.

The actual out-of-pocket costs to patients vary based on insurance coverage, copay assistance, and manufacturer rebates. Teva offers copay programs, reducing patient expenses, which indirectly influences market uptake.

Reimbursement Landscape

Insurance coverage remains broad, with Medicare and Medicaid inclusion facilitating access. Nonetheless, high list prices prompt scrutiny from payers, leading to utilization controlled by prior authorization and step therapy protocols. The pricing strategy balances optimizing revenue, market access, and payer negotiations.

Price Projections and Future Trends

Factors Influencing Price Trajectory

- Market Competition: The entry of biosimilar or more cost-effective therapies could exert downward pressure on prices.

- Development of Value-Based Pricing: Payers increasingly demand evidence of cost-effectiveness, potentially leading to value-based reimbursement agreements.

- Regulatory and Policy Changes: Moves toward transparency, price regulation, and value-based arrangements may influence future pricing.

Forecast Analysis

Based on historical trends and competitive dynamics, AJOVY’s price is expected to stabilize in the short term, with possible modest reductions over the next 3–5 years due to increased competition. Given its current premium pricing and market penetration, a projected price decrease of 10-15% by 2026 appears plausible, contingent on payer negotiations and market saturation.

In the long term, as newer therapies and biosimilars potentially enter the market, a gradual price erosion of approximately 20-25% over ten years could occur. However, premium features like dosing convenience and clinician preference for established biologics may sustain higher prices relative to newer entrants.

Market Demand and Revenue Forecast

CAGR (compound annual growth rate) for the CGRP inhibitor market is estimated at 10-12% through 2028, fueled by rising migraine prevalence and expanding indications. AJOVY’s revenues are projected to grow in line with market expansion, with revenues possibly surpassing $1.5 billion annually by 2028 if market share increases to 30-35%.

Sales momentum will depend on:

- Physician and patient awareness

- Insurer acceptance

- Durability of clinical benefits

Key Challenges and Opportunities

Challenges

- High drug costs potentially limit access, impacting adherence.

- Competitive entry from emerging therapies eroding market share.

- Payer push for value-based pricing and alternatives.

Opportunities

- Expanding indications (heter migraine, cluster headache).

- Increasing global adoption, especially in markets with rising migraine prevalence.

- Developing biosimilar versions could reduce prices.

Conclusion

AJOVY maintains a strong position within the migraine prophylaxis market, driven by its convenience, proven efficacy, and wide reimbursement coverage. Its current pricing reflects its premium biologic status, with a future trend towards slight price reductions due to competition and market maturation. Stakeholders should monitor payer dynamics, evolving competitive landscape, and policy shifts to optimize market strategies.

Key Takeaways

- AJOVY’s current U.S. wholesale price is approximately $575 per 225 mg vial, with dosing flexibility offering added value.

- Market penetration remains robust, but increased competition and biosimilar development could influence pricing over the next decade.

- Price projections suggest stabilization in the medium term, with potential decreases of up to 15% by 2026 owing to payer negotiations and market expansion.

- Long-term forecasts indicate possible price erosion of 20-25%, balanced against premium features and brand loyalty.

- Effective market positioning should focus on expanding indications, reinforcing clinical benefits, and optimizing payer negotiations.

FAQs

-

What factors influence AJOVY’s pricing strategy?

Ingredient costs, competitive landscape, payer negotiations, patient access programs, and clinical differentiation largely shape AJOVY’s pricing. -

How does AJOVY compare cost-wise to other CGRP inhibitors?

While list prices are similar, dosing frequency and administration convenience can influence overall treatment costs and patient adherence, indirectly affecting perceived value. -

Are there upcoming patent or biosimilar developments that could impact AJOVY’s price?

The patent landscape remains competitive, with biosimilar development likely in the longer term, which may drive price reductions. -

What role do healthcare policies play in price fluctuations?

Increasing emphasis on value-based care and price transparency initiatives could lead to downward pressure and more negotiated pricing. -

How does the global market outlook for AJOVY differ from the U.S.?

Emerging markets may adopt AJOVY at lower prices due to different healthcare economics, while mature markets may sustain premium prices aligned with clinical benefits.

Sources:

[1] GlobalData. "Migraine Market Analysis and Forecast." 2022.

More… ↓