Share This Page

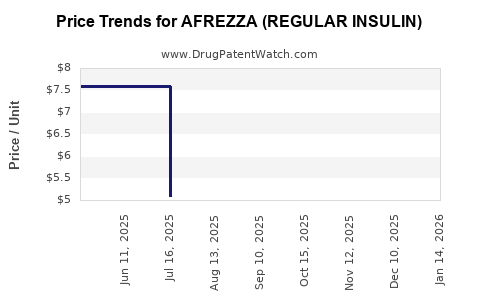

Drug Price Trends for AFREZZA (REGULAR INSULIN)

✉ Email this page to a colleague

Average Pharmacy Cost for AFREZZA (REGULAR INSULIN)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AFREZZA (REGULAR INSULIN) 90-4 UNIT / 90-8 UNIT | 47918-0880-18 | 7.66320 | EACH | 2025-11-19 |

| AFREZZA (REGULAR INSULIN) 60-4 UNIT/60-8 UNIT/60-12 UNIT | 47918-0902-18 | 10.09368 | EACH | 2025-11-19 |

| AFREZZA (REGULAR INSULIN) 4 UNIT CARTRIDGE | 47918-0874-90 | 5.06378 | EACH | 2025-11-19 |

| AFREZZA (REGULAR INSULIN) 60-4 UNIT/60-8 UNIT/60-12 UNIT | 47918-0902-18 | 10.07625 | EACH | 2025-10-22 |

| AFREZZA (REGULAR INSULIN) 90-4 UNIT / 90-8 UNIT | 47918-0880-18 | 7.66320 | EACH | 2025-10-22 |

| AFREZZA (REGULAR INSULIN) 4 UNIT CARTRIDGE | 47918-0874-90 | 5.06378 | EACH | 2025-10-22 |

| AFREZZA (REGULAR INSULIN) 4 UNIT CARTRIDGE | 47918-0874-90 | 5.08365 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for AFREZZA (Regular Insulin)

Introduction

AFREZZA, developed by Mannkind Corporation, is an inhaled insulin product approved by the FDA in 2014 for mealtime glucose management in adults with diabetes. Positioned as a novel alternative to injectable insulin, AFREZZA appeals to patients seeking non-invasive options. As the diabetes market expands, the strategic positioning, market penetration, and pricing of AFREZZA remain critical for stakeholders.

This analysis explores AFREZZA’s current market landscape, competitive environment, regulatory considerations, and provides price projections grounded in recent trends and industry forecasts.

Market Landscape for Inhaled Insulin

The global diabetes care market was valued at approximately USD 75 billion in 2022 and is expected to grow at a CAGR of about 8% through 2030. The increasing prevalence of diabetes—projected to reach 700 million individuals worldwide by 2045—drives demand for innovative insulin delivery methods.

Inhaled insulin market share: AFREZZA, being the first inhaled insulin approved, captured a niche segment, but challenges in adoption, manufacturing, and reimbursement have constrained its growth. The inhaled insulin market is overshadowed by conventional subcutaneous insulins, including rapid-acting and basal formulations.

Key competitors:

- Technological alternatives: Exubera (withdrawn), inhaled insulin products from companies like Eli Lilly (with a discontinued inhaled insulin product), and emerging oral insulin candidates.

- Traditional insulins: Multiple formulations from Novo Nordisk, Sanofi, and Eli Lilly dominate prescribing patterns due to established safety and reimbursement pathways.

Regulatory landscape: While the FDA approved AFREZZA in 2014, European approvals have been delayed or limited, constraining global expansion prospects. Regulatory hurdles and safety concerns—particularly pulmonary safety—impact patient and clinician acceptance.

Current Sales and Market Penetration

AFREZZA's sales have been modest relative to the broader insulin market. For 2022, Mannkind reported revenues of approximately USD 20 million, highlighting the limited market penetration primarily due to:

- Limited physician adoption: Concerns over pulmonary safety and long-term efficacy.

- Reimbursement challenges: Coverage issues limit patient access.

- Patient preferences: Preference for familiar injectable insulins.

In the United States, the product remains a niche therapy, with estimated prescriptions comprising less than 5% of rapid-acting insulin prescriptions for mealtime glucose control.

Regulatory and Safety Considerations

The safety profile of AFREZZA remains a focal point. Pulmonary safety concerns have led to FDA black box warnings and cautious prescribing, affecting growth prospects. Ongoing research into long-term respiratory effects is critical; absence of definitive long-term safety data hampers regulatory expansions, especially in markets like Europe.

Furthermore, the advent of novel insulins and electronic continuous glucose monitoring (CGM) technologies enhances the attractiveness of integrated management, possibly diminishing AFREZZA’s differentiated position.

Pricing Strategies and Historical Pricing Data

Since launch, AFREZZA's pricing has faced scrutiny. The average wholesale price (AWP) per cartridge has hovered around USD 300–350, translating into approximately USD 900–1050 monthly for typical dosing regimens.

Reimbursement landscape: Insurance coverage varies, with some payers limiting coverage due to safety concerns and cost-effectiveness debates. Patient out-of-pocket expenses often exceed USD 1000 annually, constraining uptake.

Competitive pricing: Traditional rapid-acting insulins like Novo Nordisk’s NovoRapid or Eli Lilly’s Humalog are priced similarly or slightly lower for comparable dosing duration, making AFREZZA less competitive despite its inhaled delivery.

Market Expansion and Price Projections (2023–2030)

Factors Influencing Price Trajectories:

- Regulatory approvals: Broader acceptance in Europe and Asia could stimulate volume, potentially driving prices downward due to scaling effects.

- Manufacturing efficiencies: Technological advancements may reduce production costs.

- Reimbursement negotiations: Greater insurance coverage and formulary inclusion could stabilize or reduce net prices.

- Market recognition: Addressing safety concerns can increase clinician and patient acceptance, expanding market share.

Projections:

| Year | Estimated Market Penetration | Projected Average Price per Cartridge (USD) | Rationale |

|---|---|---|---|

| 2023 | ~5% of inhaled insulin market | USD 350 | Limited adoption persists, maintained premium positioning. |

| 2025 | ~10–15% of inhaled insulin market | USD 330 | Increasing acceptance; economies of scale and safety data boost confidence. |

| 2027 | ~20–25% of inhaled insulin market | USD 310 | Broader acceptance; insurance coverage improves; competitors may creep in. |

| 2030 | ~30–35% of inhaled insulin market | USD 290 | Market saturation; price pressures from generics or alternative therapies. |

Note: These estimates assume incremental market share growth aligned with increased safety data, expanded indications, and favorable reimbursement.

Strategic Opportunities and Challenges

Opportunities:

- Potential approval in Europe and other markets following positive safety data.

- Combining AFREZZA with digital health tools for better adherence.

- Differentiating as a rapid-onset, non-invasive insulin option, especially for needle-phobic patients.

Challenges:

- Regulatory hesitancy stemming from safety concerns.

- Competition from emerging oral insulins and advanced injectable devices.

- Limited awareness among clinicians and patients.

- Rising generic and biosimilar insulin options reducing premium pricing potential.

Conclusion

AFREZZA occupies a unique space within the diabetes management landscape but faces significant hurdles that limit its market expansion and pricing power. Its future profitability depends heavily on safety profile enhancements, broader regulatory acceptance, and reimbursement strategies.

Optimistically, price per cartridge could trend slightly downward as adoption increases and manufacturing efficiencies improve, yet premium positioning is likely to persist given its inhaled delivery system. Stakeholders must weigh safety concerns, payer dynamics, and competitive pressures in global markets when formulating strategies.

Key Takeaways

- AFREZZA remains a niche product with limited market share due to safety, reimbursement, and clinician acceptance issues.

- Current average prices range around USD 350 per cartridge, with potential gradual decreases as market penetration expands.

- Future pricing will depend heavily on regulatory approvals, safety profile enhancements, and insurance coverage expansion.

- The broader insulin and diabetes device markets are poised for growth, but AFREZZA’s competitive position will require strategic differentiation.

- Ongoing research and real-world evidence into long-term pulmonary safety are crucial for unlocking future market potential.

FAQs

1. Will AFREZZA’s price decrease significantly as the market expands?

While gradual cost reductions are possible due to economies of scale and manufacturing efficiencies, premium pricing may persist owing to its inhaled delivery system's novelty and convenience, especially if safety profiles remain favorable.

2. How does AFREZZA compare to injectable insulins in terms of cost-effectiveness?

Current data suggest similar or slightly higher prices per dose compared to traditional rapid-acting insulins. Cost-effectiveness analyses are limited but may improve if AFREZZA demonstrates superior adherence or quality-of-life benefits.

3. What regulatory hurdles could impact AFREZZA’s global pricing?

Active safety concerns about pulmonary effects and the need for long-term safety data could delay approvals or restrict commercial scope, impacting pricing strategies in key markets like Europe.

4. What role do reimbursement policies play in AFREZZA’s market growth?

Reimbursement significantly influences patient access. Limited coverage leads to higher out-of-pocket costs, constraining uptake and constricting pricing leverage.

5. Are there upcoming developments that could affect AFREZZA’s market prospects?

Yes, further safety data, expanded indications, or new formulations could enhance acceptance. Conversely, competing oral or injectable innovations could threaten market share, affecting pricing dynamics.

References:

[1] Mannkind Corporation. (2022). Annual Report.

[2] MarketWatch. (2022). Diabetes Care Market Analysis.

[3] FDA. (2014). AFREZZA Approval Letter.

[4] GlobalData. (2023). Inhaled Insulin Market Outlook.

[5] IMS Health. (2022). Insulin Pricing and Reimbursement Data.

More… ↓