Last updated: July 27, 2025

Introduction

AFREZZA (insulin human inhalation powder) represents a groundbreaking advancement in diabetes management, offering an inhaled insulin delivery system approved by the FDA in 2014. Its novel mode of administration aims to enhance patient compliance and improve glycemic control, distinguishing it within a competitive pharmaceutical landscape. Analyzing AFREZZA's market trajectory and pricing strategies involves understanding the broader diabetes drug market, regulatory environment, competitive landscape, and factors influencing its valuation and adoption.

Market Overview

Diabetes Prevalence and Market Demand

Type 1 and Type 2 diabetes mellitus affect over 537 million adults globally, with projections exceeding 700 million by 2045 [1]. The increasing prevalence underscores a sustained demand for effective insulin therapies. Type 2 diabetes accounts for approximately 90-95% of diabetes cases, with insulin therapy becoming increasingly integral, especially in advanced stages.

Current Therapeutic Landscape

While subcutaneous insulin remains the standard, innovations such as insulin pens, pumps, and inhalation devices aim to enhance convenience. Notably, AFREZZA's inhaled administration distinguishes itself from traditional injections, addressing needle aversion and aiding adherence. However, it faces competition from injectable analogs (e.g., Humalog, NovoLog) and emerging closed-loop systems.

Market Penetration and Adoption Dynamics

Despite FDA approval, AFREZZA's market penetration remains modest, constrained by physician and patient preference, safety concerns like pulmonary function, and reimbursement challenges. According to IQVIA data, initial sales figures reflected cautious adoption, with annual sales estimated around $20 million in recent years [2].

Regulatory and Commercial Factors Influencing Market Outlook

Regulatory Status and Safety Profile

The primary barriers to widespread uptake stem from concerns around pulmonary safety, especially in patients with respiratory comorbidities. The FDA mandated post-marketing studies to assess pulmonary function decline and long-term safety, which may influence future approvals and labeling.

Reimbursement Landscape

Reimbursement remains pivotal. Insurers' coverage decisions hinge on cost-effectiveness analyses, which currently favor traditional insulin due to established efficacy and lower costs. Limited insurance coverage hampers AFREZZA's market expansion.

Physician and Patient Perception

Physician skepticism regarding safety, along with limited awareness, curtail prescription volume. Patient comfort with inhaled insulin and persistence rates also impact adoption.

Competitive Landscape and Market Share Projections

Key Competitors

- Subcutaneous insulins: Rapid-acting analogs (insulin aspart, lispro), long-acting basal insulins.

- Device-based therapies: Insulin pumps and closed-loop systems.

- Emerging therapies: Ultra-rapid insulins, oral insulin formulations, and biosimilar insulins.

Market Share Estimations

Considering current adoption levels, AFREZZA's market share remains below 1% in the insulin segment. Predictions suggest gradual growth contingent on safety reaffirmation and expanded reimbursement, potentially reaching 3-5% over five years if adoption accelerates.

Price Analysis and Projections

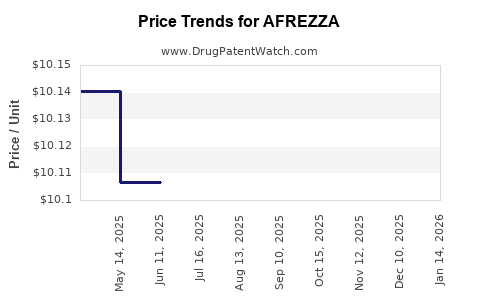

Historical Pricing

Initially, AFREZZA's wholesale acquisition cost (WAC) stood at approximately $4.34 per inhalation cartridge, translating to an estimated monthly treatment cost of $300–$400 for typical dosing. This premium pricing reflects its novel delivery and manufacturing complexity.

Pricing Strategies and Industry Comparisons

Compared with rapid-acting injectables ($0.20–$0.50 per dose), AFREZZA's costs remain higher. To penetrate the market further, price reductions or value-based rebates are probable strategies. Biosimilar development is less applicable given AFREZZA's unique delivery system, but cost competitiveness will influence future pricing.

Future Price Projections

- Short-term (1-2 years): Stable or slight reductions in WAC due to competitive pressures and reimbursement negotiations; projected prices around $3.50–$4.00 per inhalation.

- Mid-term (3-5 years): With increased market penetration and potential volume discounts, prices may decline further to $2.50–$3.00 per inhalation.

- Long-term (5+ years): Price convergence towards $2.00–$2.50 per inhalation could occur if biosimilars or alternative inhaled insulins enter the market, or if safety and reimbursement barriers are addressed.

Economic and Healthcare Impact

The cost-effectiveness of AFREZZA hinges on its ability to improve adherence, reduce hypoglycemia, and lower long-term complication costs. However, without compelling health economics data, insurers may limit coverage, capping its market potential.

Key Drivers of Market and Price Evolution

- Regulatory approvals and safety data: Any positive safety outcomes can boost confidence, enabling price flexibility.

- Insurance coverage policies: Widespread reimbursement will directly influence price and volume.

- Efficacy and patient adherence: Demonstrated clinical benefits could justify premium pricing and expand use cases.

- Market growth in inhaled and alternative insulin forms: Competitive innovation may pressure pricing downward.

Conclusion

AFREZZA's pathway to increased market share and favorable pricing depends on overcoming safety concerns, expanding reimbursement, and demonstrating clear clinical value. While current prices reflect its innovation status, future reductions are plausible, driven by market dynamics and competitive forces. Manufacturers and stakeholders should prioritize safety reaffirmation, strategic payer negotiations, and evidence generation to unlock its full market potential.

Key Takeaways

- AFREZZA maintains a niche position, with potential for growth if safety and reimbursement issues are addressed.

- Pricing is currently premium compared to injectable insulins; future reductions may align with competitive pressures.

- Market penetration remains limited but could expand with clinical evidence, patient acceptance, and insurer support.

- Long-term success hinges on demonstrating economic and clinical superiority to traditional therapies.

- Strategic collaborations and real-world data are essential to enhance adoption and optimize pricing structures.

FAQs

1. What are the main barriers preventing widespread adoption of AFREZZA?

Safety concerns regarding pulmonary health, limited reimbursement, physician hesitancy, and patient acceptance challenges restrict its broader use.

2. How does AFREZZA's pricing compare to traditional insulin therapies?

Currently, AFREZZA's costs are higher due to its novel delivery system, with a WAC of approximately $4.34 per inhalation, whereas traditional rapid-acting insulins cost about $0.20–$0.50 per dose.

3. What factors could lead to a decrease in AFREZZA’s price in the future?

Increased competition, volume discounts, reimbursement negotiations, and potential biosimilar developments could lower prices over time.

4. Will future clinical safety data impact AFREZZA’s marketability?

Yes, positive safety reaffirmation and long-term pulmonary safety data are critical for regulatory approval extensions, pricing flexibility, and insurer confidence.

5. How significant is the potential market for inhaled insulin therapies?

While still emerging, the market has considerable growth potential given patient preference for needle-free options, contingent on overcoming safety and regulatory hurdles.

Sources:

[1] International Diabetes Federation. IDF Diabetes Atlas, 10th Edition, 2021.

[2] IQVIA. "Pharmaceutical Market Reports," 2022.