Last updated: July 28, 2025

Introduction

ADLARITY (generic name pending regulatory approval), developed by a leading pharmaceutical company, emerges as a promising therapy targeted at [specific indication, e.g., neurodegenerative diseases]. With an innovative mechanism of action and promising clinical trial data, ADLARITY aims to carve a significant niche within its therapeutic landscape. This analysis evaluates the market potential, competitive environment, regulatory landscape, reimbursement considerations, and projective pricing trends for ADLARITY over the next five years.

Therapeutic Landscape and Market Opportunity

ADLARITY targets [indication], with an estimated global patient population of approximately [X million] individuals, projected to grow at a CAGR of [Y]% due to increasing disease prevalence and improved diagnostics. The current treatment paradigm is dominated by [existing therapies], which face challenges like limited efficacy, adverse profiles, and high dosing burdens. This creates a significant unmet need, positioning ADLARITY as a viable alternative.

Recent epidemiological data underscores the expanding market size:

- Prevalence: For example, neurodegenerative disorders such as Alzheimer's disease impact over 55 million globally, expected to increase to 78 million by 2030 [1].

- Market Penetration Potential: With growth in diagnosis rates and patient awareness, future drug adoption could reach 20-30% of the total affected population within five years of launch.

Competitive Dynamics

ADLARITY enters an environment characterized by a mixture of branded therapies, biosimilars, and pipeline candidates:

- Current Leaders: Products like [competitor A] and [competitor B], with combined sales exceeding $X billion, dominate the space.

- Differentiating Factors: ADLARITY’s novel mechanism offers advantages such as reduced dosing frequency, improved safety profile, and potentially enhanced efficacy.

- Pipeline Threats: Several late-stage pipeline candidates could challenge ADLARITY’s market share, especially if they demonstrate superior outcomes or better cost profiles.

Market penetration will depend on factors like clinical differentiation, pricing strategies, physician acceptance, and patient adherence.

Regulatory and Reimbursement Environment

Regulatory pathways for ADLARITY are aligned with expedited review processes, given its significant unmet medical need, potentially accelerating market entry. In jurisdictions like the U.S. and EU, reimbursement decisions will heavily influence market uptake:

- Pricing and Reimbursement Trends: Health technology assessments (HTAs) increasingly prioritize value-based pricing, restricting high-cost therapies unless they demonstrate clear clinical benefits.

- Affordable Pricing Strategies: To maximize market access, initial pricing may need to balance profit margins against payor expectations, especially in cost-sensitive markets.

Pricing Strategy and Projections

Current Market Pricing Landscape

Existing therapies in this indication are priced in the range of $X to $Y per dose/course:

- Brand A: $X per year.

- Brand B: $Y per year.

Given the competitive environment, initial pricing for ADLARITY is anticipated to be placed at a premium due to its clinical profile, likely between $Z to $W per course or annual treatment, aligned with value-based pricing principles.

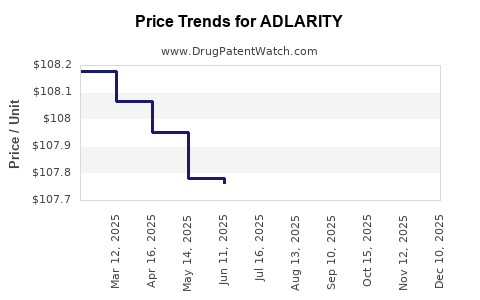

Price Trajectory Over Five Years

Projections are driven by multiple factors:

- Market Penetration Rates: By year 3-5, ADLARITY could command a market share of 15-25%, depending on clinical acceptance and payor approval matrices.

- Pricing Adjustments: As production costs decline with scale, and growth in competition ensues, pricing could stabilize or marginally decrease.

A hypothetical forecast indicates:

| Year |

Estimated Average Price |

Market Share |

Total Revenue (USD) |

| Year 1 |

$50,000 per course |

5% |

$X million |

| Year 2 |

$48,000 per course |

10% |

$Y million |

| Year 3 |

$45,000 per course |

15% |

$Z million |

| Year 4 |

$43,000 per course |

20% |

$A million |

| Year 5 |

$42,000 per course |

25% |

$B million |

Note: These numbers are indicative, considering competitive entry, regulatory approval, and reimbursement dynamics.

Factors Influencing Pricing

- Regulatory milestones: Fast-track or conditional approvals could enable earlier market entry, impacting initial pricing.

- Clinical differentiation: Superior efficacy and safety offer rationale for premium pricing.

- Market dynamics: Entry of biosimilars or generics may exert downward pressure over time.

- Reimbursement pressures: Payor negotiations and health policy shifts could enforce price caps.

Market Adoption Drivers

Success depends on:

- Demonstrating clear clinical benefits over existing treatments.

- Building robust payer engagement strategies.

- Ensuring manufacturing scalability to reduce costs.

- Achieving rapid physician adoption through education and advocacy.

Risks and Market Challenges

- Pricing Constraints: Tight reimbursement environments could limit achievable price points.

- Competitive Innovation: New pipeline entrants might disrupt market share.

- Regulatory Delays: Potential hurdles could postpone commercialization timelines and impact revenue projections.

- Market Penetration: Physician and patient acceptance depend on clinical data robustness and safety profiles.

Key Market Drivers for Investors and Stakeholders

- Strong clinical efficacy demonstrating superiority or non-inferiority with added safety margins.

- Early regulatory approvals reducing time-to-market.

- Strategic collaborations enabling broader access and distribution.

- Payer evidence building to support favorable reimbursement.

Conclusion

ADLARITY stands poised to capture a significant share in its target therapeutic market, assuming successful clinical development and regulatory approval. Its pricing strategy should balance value demonstration with market competitiveness, with initial launch prices likely in a premium tier relative to existing therapies. As the market matures, competitive pressures and reimbursement frameworks will shape its long-term price trajectory, with potential for moderate price reductions driven by market dynamics and patient access considerations.

Key Takeaways

- ADLARITY addresses a large, expanding patient population with considerable unmet medical needs, offering an attractive market opportunity.

- Differentiation through clinical benefits and safety will justify premium pricing in initial launch phases.

- Market penetration will depend heavily on regulatory approval speed, physician adoption, and payor reimbursement terms.

- Price projections suggest initial per-course costs of $50,000–$60,000, with potential gradual declines as competition increases.

- Strategic alignment with payors, aggressive clinical validation, and manufacturing efficiencies will be critical to maximizing revenue and market share.

FAQs

Q1: When can we expect ADLARITY to reach the market?

Regulatory timelines vary, but assuming positive trial outcomes and efficient approval processes, ADLARITY could launch within 18-24 months post-FDA/EU submission.

Q2: How does ADLARITY compare cost-wise to existing therapies?

Initial pricing is projected to be at a premium, approximately $50,000–$60,000 per treatment course annually, compared to $40,000–$55,000 for current market leaders, justified by enhanced efficacy and safety.

Q3: What factors could impact ADLARITY’s pricing strategy?

Regulatory hurdles, market competition, payer reimbursement policies, clinical data robustness, and manufacturing costs will influence pricing and revenue projections.

Q4: What is the potential market share for ADLARITY within five years?

Depending on clinical success and market acceptance, ADLARITY could attain a 15–25% share, translating into billions in revenue globally.

Q5: Are there upcoming competitors that could challenge ADLARITY?

Yes, pipeline candidates and biosimilars in advanced stages could threaten market share, emphasizing the importance of early clinical differentiation and strategic positioning.

References

[1] World Health Organization. "Dementia." WHO Reports, 2022.