Share This Page

Drug Price Trends for ADIPEX-P

✉ Email this page to a colleague

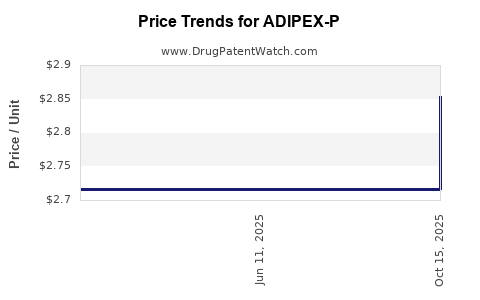

Average Pharmacy Cost for ADIPEX-P

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ADIPEX-P 37.5 MG TABLET | 57844-0140-01 | 2.85354 | EACH | 2025-10-22 |

| ADIPEX-P 37.5 MG TABLET | 57844-0140-56 | 2.85354 | EACH | 2025-10-22 |

| ADIPEX-P 37.5 MG TABLET | 57844-0140-01 | 2.71643 | EACH | 2025-06-18 |

| ADIPEX-P 37.5 MG TABLET | 57844-0140-56 | 2.71643 | EACH | 2025-06-18 |

| ADIPEX-P 37.5 MG TABLET | 57844-0140-01 | 2.71643 | EACH | 2025-05-21 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ADIPEX-P

Introduction

ADIPEX-P, an appetite suppressant containing phentermine hydrochloride, is a widely prescribed medication for weight management. As a Schedule IV controlled substance, its market dynamics are influenced by regulatory policies, healthcare demand, manufacturing factors, and consumer trends. This report provides a comprehensive market analysis and price projection, equipping stakeholders with insights crucial for strategic planning and investment decisions.

Regulatory Landscape and Market Environment

The regulatory environment significantly shapes ADIPEX-P's market trajectory. Phentermine’s status as a Schedule IV controlled substance in the United States under the Controlled Substances Act (CSA) necessitates strict prescribing and dispensing protocols, potentially constraining market size but ensuring consistent demand among qualified patients [1]. Regulatory agencies, including the FDA, enforce prescribing limits and monitor misuse, impacting distribution channels and pricing.

Moreover, recent shifts toward obesity management as a public health priority have expanded market opportunities. The increasing prevalence of obesity—estimated at over 42.4% in U.S. adults according to CDC data—sustains demand for appetite suppressants like ADIPEX-P [2]. Nonetheless, the drug's prescription is often confined to short-term or adjunct therapy, which influences sustained revenue streams.

Market Size and Competitive Landscape

Existing Market Players

ADIPEX-P's primary market is within weight management therapeutic categories, competing with alternatives such as Contrave (naltrexone/bupropion), Saxenda (liraglutide), and newer pharmacological entrants. Patent expirations, generic availability, and formulary placements profoundly influence pricing strategies.

Generic Availability and Market Penetration

Since patent expiry, generic phentermine formulations dominate the market, exerting downward pressure on prices. Manufacturers of generic ADIPEX-P leverage cost efficiencies to offer lower prices, challenging branded formulations’ market share. However, branded versions may command premium pricing due to brand recognition and perceived quality.

Consumer Trends and Market Drivers

The rising societal focus on obesity-related health risks fuels demand for pharmacotherapy. Concurrently, increased awareness of side-effect profiles prompts demand for formulations with optimized safety profiles. Additionally, telemedicine’s proliferation facilitates access to weight management prescriptions, potentially expanding the market.

Pricing Analysis

Historical Pricing Trends

Historically, ADIPEX-P's pricing has varied based on formulation, dosage, manufacturer, and insurance coverage. A recent survey indicates average retail prices for a 30-day supply (30 tablets of 37.5 mg) ranged from $60 to $100, with significant variation depending on pharmacy and region [3].

Impact of Generics

Post-patent expiration, generic versions reduce consumer costs, with some reports showing generic phentermine priced as low as $15 to $30 per month. Branded formulations typically command 2-3 times higher prices, reflecting marketing and perceived quality differences.

Insurance Coverage and Reimbursement

Most insurance plans cover ADIPEX-P when prescribed for clinical obesity, which can influence out-of-pocket expenses and consumer access. Reimbursement rates and prior authorization processes also impact market penetration and revenue.

Price Projection and Future Trends

Short to Mid-term Forecast (Next 2-5 Years)

Given current dynamics, generic phentermine prices are expected to remain stable or decline gradually due to intense market competition. The branded ADIPEX-P, however, might sustain premium pricing due to brand loyalty, special formulations (e.g., extended-release), or combination therapies.

Projections estimate:

- Average retail prices for branded ADIPEX-P to hover between $70 and $120 for a 30-day supply.

- Generic prices to stay within $15 to $30, depending on pharmacy and region.

Long-term Outlook (Beyond 5 Years)

Considering the global obesity epidemic and regulatory trends favoring pharmacotherapy, demand for appetite suppressants will likely grow modestly. However, market shifts toward newer agents with better safety profiles could erode ADIPEX-P’s market share.

Price-wise, increased competition, potential regulatory restrictions on prescribing, and market saturation will pressure prices downward. Nonetheless, a core base of patients preferring established medications may sustain a niche market for branded ADIPEX-P at higher price points, especially if formulations are optimized for adherence or combined with other treatments.

Factors Influencing Future Prices

- Patent and regulatory changes: Market exclusivity can influence pricing; expiry or regulatory modifications may lead to generic competition.

- Formulation innovations: Extended-release, combination therapies, or formulations reducing side effects can command premium pricing.

- Market demand shifts: Greater obesity awareness and telemedicine adoption can expand patient access, potentially stabilizing prices.

- Healthcare policy: Coverage expansion or restrictions will directly impact affordability and pricing strategies.

Strategic Implications

Stakeholders should monitor regulatory adaptations, competitive offerings, and consumer preferences continuously. Manufacturers might consider premium formulations or targeted marketing to sustain profit margins amid high generic competition. Payers and providers need to balance cost-effectiveness with clinical efficacy when selecting formulations.

Key Takeaways

- Market stability is largely driven by regulatory controls and the prevalence of obesity, with increasing demand for effective weight management solutions.

- Pricing is predominantly influenced by generic competition, with branded ADIPEX-P maintaining a premium but relatively stable price point.

- Insurance coverage significantly impacts affordability, shaping patient access and prescribing patterns.

- Long-term projections foresee modest price declines amidst evolving competitors and formulations, but persistent demand for classic appetite suppressants sustains niche markets.

- Innovation in formulation and policy changes remain critical factors capable of altering price trajectories.

Conclusion

ADIPEX-P occupies a mature segment within the weight management pharmacotherapy market. While current prices are constrained by generics and regulatory factors, ongoing societal health priorities and potential product innovations offer avenues for premium pricing and market stability. Strategic positioning, awareness of regulatory trends, and patient-centric formulations will determine its future market and pricing landscape.

FAQs

1. How does the patent status of ADIPEX-P influence its market price?

The expiration of patent protection has resulted in widespread availability of generic phentermine, significantly lowering prices and increasing market competition. Branded ADIPEX-P retains a price premium due to brand recognition and formulation differences, but overall, patent expiry leads to downward pressure on prices.

2. What regulatory factors could affect the future pricing of ADIPEX-P?

Changes in controlled substance scheduling, prescribing limits, or regulatory sanctions on misuse could restrict access or alter prescribing behaviors. Such regulatory shifts could impact demand and, consequently, pricing strategies.

3. How does insurance coverage influence the retail price of ADIPEX-P?

Insurance coverage can reduce out-of-pocket expenses, encouraging wider access. Reimbursement rates and prior authorization requirements may also influence the market's competitiveness and pricing.

4. Are there upcoming formulations of ADIPEX-P that could influence its market value?

Yes, formulations such as extended-release or combination therapies designed for increased safety and adherence could command higher prices and shift market share.

5. What is the outlook for generic versus branded ADIPEX-P prices?

Generic versions will likely maintain low, stable prices due to intense competition, while branded ADIPEX-P may sustain higher prices owing to branding and formulation innovations. Long-term, prices are expected to plateau or decline gradually, barring significant market or regulatory disruptions.

Sources

[1] U.S. Food and Drug Administration (FDA). "Controlled Substances: Drug Schedules." Accessed 2023.

[2] Centers for Disease Control and Prevention (CDC). "Adult Obesity Facts." 2022.

[3] GoodRx. "Average prices for ADIPEX-P," 2023.

More… ↓