Last updated: July 27, 2025

Introduction

Adefovir Dipivoxil, marketed under the brand name Hepsera among others, is an oral antiviral medication primarily used in the management of chronic hepatitis B virus (HBV) infection. Approved by regulatory agencies such as the FDA in 2002, it functions as a nucleotide analogue reverse transcriptase inhibitor, suppressing HBV DNA replication. The treatment landscape for HBV has evolved over the last two decades, influencing the market dynamics and pricing strategies for Adefovir Dipivoxil. This report provides an in-depth market analysis and price projection outlook based on current trends, competitive pipelines, regulatory environments, and epidemiological factors.

Market Overview

Global Prevalence of Hepatitis B and Market Demand

Chronic hepatitis B remains a significant global health challenge, with an estimated 296 million people living with HBV infection worldwide as of 2019 [1]. The burden is particularly high in regions like Asia-Pacific, Sub-Saharan Africa, and parts of Eastern Europe. The persistent high prevalence fuels sustainable demand for antiviral therapies, including Adefovir Dipivoxil, especially in endemic regions.

Current Therapeutic Landscape

Adefovir Dipivoxil has historically been positioned as a second-line therapy due to its efficacy and safety profile. More recently, the emergence of potent, once-daily nucleos(t)ide analogues like entecavir and tenofovir disoproxil fumarate (TDF) has redefined treatment hierarchies. These alternatives outperform Adefovir in terms of resistance profiles and safety, leading to a decline in its market share [2].

Regulatory and Reimbursement Trends

While Adefovir remains approved in multiple regions, some national agencies, including the European Medicines Agency (EMA), have recognized its replacement by newer agents. Nevertheless, in low-resource settings, Adefovir remains a vital, cost-effective option due to its affordability and availability. This stratification influences regional uptake and pricing strategies.

Market Dynamics and Competitive Landscape

Market Share and Usage Trends

Despite being an older drug, Adefovir continues to serve a niche, primarily in regions where newer agents are unavailable or prohibitively expensive. The global market share of Adefovir is estimated to decline at a compound annual growth rate (CAGR) of approximately 4% over the next five years, driven by the expanding use of tenofovir-based therapies [3].

Key Players and Distribution Channels

Major generic manufacturers and patent-holding pharmaceutical companies supply Adefovir Dipivoxil. Market penetration is highest in India, China, and Africa, where generic formulations predominate. Supply chain stability and licensing agreements heavily influence regional availability and pricing.

Pipeline and Innovation

Several novel therapies and long-acting formulations are under development, potentially impacting residual demand for traditional Adefovir formulations. Yet, the long-term impact on prices is currently limited due to the late-stage development of these pipeline products.

Price Trends and Projections

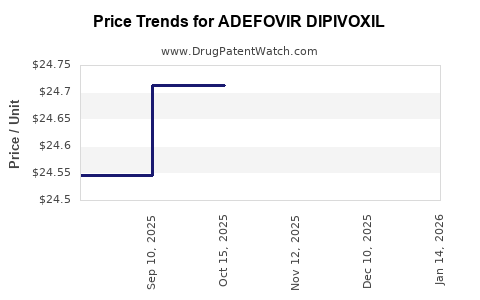

Historical Pricing Patterns

Adefovir Dipivoxil's pricing has historically been influenced by regional healthcare policies, generic competition, and manufacturing costs. In high-income countries, the treatment course could cost upwards of $10,000 annually; in contrast, prices in low-income regions can fall below $100 per year due to generic manufacturing [4].

Factors Influencing Future Pricing

- Generic Competition: The proliferation of generics is expected to continue exerting downward pressure on prices in all regions where patents have expired or are nearing expiry.

- Regulatory Approvals: Any regulatory restrictions or approvals for combination therapies or new formulations could alter demand dynamics.

- Manufacturing Costs: Advances in synthesis and manufacturing efficiencies may further decrease unit costs, making Adefovir more affordable.

Price Projection (2023-2028)

Given current trends, the average price per treatment course for Adefovir Dipivoxil is forecasted to decline annually by approximately 5-7%. Particular emphasis is placed on the following regions:

- High-Income Markets: Marginal decreases, with current prices stabilizing around $8,000-$10,000 per year, facilitated by patent protections or high-quality formulations.

- Emerging Markets: Substantial reductions, with projected annual costs falling from $50-$100 to $30-$75, incentivized by increased generic proliferation.

- Low-Income Endemic Regions: The price may plateau at $10-$20 due to supply constraints but is expected to trend downwards with increasing generic availability.

Impact of Policy Interventions

Government-led price control measures and international health organization initiatives (e.g., WHO prequalification) can further modulate prices, especially in resource-limited settings, promoting broader access.

Strategic Considerations for Stakeholders

- Pharmaceutical Companies: Focus on maintaining cost competitiveness by optimizing manufacturing processes and exploring regional licensing agreements.

- Healthcare Providers: Emphasize the drug's role in resistance management and affordability in specific markets.

- Policy Makers: Support policies that facilitate generic entry and encourage the adoption of cost-effective treatments.

- Investors: Monitor emerging therapies that could relegate Adefovir further down therapeutic hierarchy, potentially impacting market valuation.

Key Takeaways

- Market Demand: Driven predominantly by HBV prevalence, with continued significance in low-income and endemic regions.

- Competitive Positioning: Adefovir Dipivoxil remains relevant mainly in resource-limited markets; its share diminishes elsewhere due to the advent of superior agents.

- Pricing Trends: Expect a gradual decline in unit prices, especially in generics and emerging markets, underscoring increasing accessibility.

- Future Outlook: A competitive landscape defined by continued generic proliferation and evolving treatment protocols suggests persistent downward pressure on prices over the next five years.

- Opportunities: Strategic licensing, cost reduction innovations, and regional partnerships can optimize market penetration and profitability.

FAQs

1. What factors primarily influence the future pricing of Adefovir Dipivoxil?

Generic competition, manufacturing efficiencies, regional healthcare policies, and patent statuses are central. Market demand in resource-limited settings also plays a significant role.

2. How does Adefovir Dipivoxil compare to newer hepatitis B treatments in terms of price?

While newer agents like tenofovir tend to be more expensive initially, their superior efficacy and resistance profiles often justify higher costs. Conversely, Adefovir remains a more affordable alternative, especially in developing regions.

3. Will Adefovir Dipivoxil maintain its market presence amid evolving HBV treatment options?

Yes, particularly in low-resource settings where affordability and availability are prioritized. Its niche persists where newer agents are inaccessible or cost-prohibitive.

4. Are there upcoming innovations that could impact Adefovir's market?

Long-acting formulations and combination therapies under development may gradually reduce the reliance on traditional oral agents like Adefovir. However, their impact will depend on regulatory approvals and cost considerations.

5. How might healthcare policies affect Adefovir pricing in the future?

Policy interventions promoting generic medicine use and international procurement standards are likely to continue exerting downward pressure on prices, especially in emerging and low-income markets.

References

- World Health Organization. Global hepatitis report 2019. WHO; 2019.

- European Medicines Agency. Hepsera (Adefovir Dipivoxil) Summary of Product Characteristics. 2002.

- MarketsandMarkets. Hepatitis treatment market analysis. 2021.

- IMS Health. Global Pharmaceutical Pricing Trends. 2020.

In conclusion, the Adefovir Dipivoxil market is characterized by a declining trajectory in high-income regions, stabilized or growing demand in resource-constrained environments, and continuous price erosion driven by generics. Stakeholders should align strategies accordingly, emphasizing cost reduction, regional licensing, and adapting to evolving treatment paradigms to maximize benefits.