Share This Page

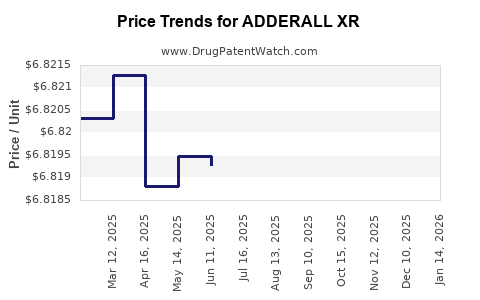

Drug Price Trends for ADDERALL XR

✉ Email this page to a colleague

Average Pharmacy Cost for ADDERALL XR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ADDERALL XR 5 MG CAPSULE | 54092-0381-01 | 6.80820 | EACH | 2025-12-17 |

| ADDERALL XR 10 MG CAPSULE | 54092-0383-01 | 6.81889 | EACH | 2025-12-17 |

| ADDERALL XR 15 MG CAPSULE | 54092-0385-01 | 6.81476 | EACH | 2025-12-17 |

| ADDERALL XR 25 MG CAPSULE | 54092-0389-01 | 6.81547 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ADDERALL XR

Introduction

ADDERALL XR, an extended-release formulation of dextroamphetamine and amphetamine salts, is a pivotal therapeutic option for Attention Deficit Hyperactivity Disorder (ADHD) and narcolepsy. As a globally recognized psychostimulant, its market dynamics are shaped by high prevalence rates of ADHD, evolving prescription trends, regulatory policies, and patent landscapes. This analysis offers a comprehensive overview of ADDERALL XR’s current market environment, competitive positioning, regulatory considerations, and price trajectory forecasts, aimed at informing industry stakeholders and investors.

Market Overview

Global Prevalence and Therapeutic Demand

ADHD affects approximately 5-10% of children and 2-5% of adults worldwide, with increasing diagnosis rates driven by heightened awareness and improved screening protocols [1]. Pharmacotherapy remains the cornerstone of management, with stimulants like ADDERALL XR accounting for an estimated 70-80% of prescriptions for ADHD in the United States (US) alone [2]. The rising prevalence, coupled with the expanding acceptance of medication as a standard treatment, sustains high demand for ADDERALL XR.

Competitive Landscape

ADDERALL XR is marketed primarily by Janssen Pharmaceuticals, a division of Johnson & Johnson. Its primary competitors include other extended-release stimulants such as Vyvanse (lisdexamfetamine), Concerta (methylphenidate ER), and Focalin XR (dexmethylphenidate). The competitive edge of ADDERALL XR stems from its unique pharmacokinetic profile, once-daily dosing, and proven efficacy.

The landscape also involves non-stimulant treatments like atomoxetine (Strattera) and newer agents, which are gaining traction depending on patient-specific factors and regulatory approvals.

Regulatory Environment

In the US, ADDERALL XR is approved by the FDA for ADHD and narcolepsy. Regulatory considerations directly influence market access and pricing strategies. Factors such as patent protections, exclusivity periods, and potential biosimilar or generic entries significantly impact pricing and revenue forecasts. Notably, patent expiry timelines are critical; the patent for ADDERALL XR was initially granted in 2007, with subsequent patent extensions delaying generics until around 2023-2025 [3].

Market Trends and Drivers

Prescription Trends

Prescription volumes for ADDERALL XR have shown steady growth over the past decade, driven by increased ADHD diagnosis, wider clinician acceptance, and patient preference for once-daily formulations [4]. The COVID-19 pandemic initially caused disruptions but ultimately accelerated telehealth services and medication adherence, further boosting prescriptions.

Reimbursement and Pricing Policies

Insurance reimbursement policies favor branded medications like ADDERALL XR due to formulary preferences and negotiated discounts. However, heightened cost-containment pressures and rising generic competition influence net pricing strategies.

Emerging Markets Opportunity

Expanding healthcare infrastructure and rising ADHD awareness in emerging markets (China, India, Latin America) point to future growth prospects, contingent on regulatory approvals and affordability initiatives.

Price Charts and Historical Trends

US Pricing Dynamics

Historically, the list price of ADDERALL XR per 30-count bottle ranged between $400 to $500 in the early 2010s. Over time, due to patent protections and market exclusivity, prices maintained stability or increased slightly, notably with formulary positioning and tiered reimbursement strategies.

Post-patent expiration around 2023, a significant reduction in net prices is anticipated owing to generic competition. Industry estimates project a decline of approximately 30-50% in list prices within the first two years following generic entry, consistent with trends observed for other branded medications [5].

Impact of Patent Expiration and Generics

The entry of generic dextroamphetamine/amphetamine citrate formulations is expected to drastically influence the pricing landscape. The initial price erosion might be mitigated briefly by supply chain consolidations and promotional activities but will ultimately result in a more competitive market with lower consumer prices.

Price Projections: 2023–2030

Baseline Scenario (With Patent Extinction and Generics)

From 2023 onwards, brutal competition from generic manufacturers is projected to reduce the average wholesale price (AWP) for ADDERALL XR by approximately 35-50%. Retail prices for branded formulations are anticipated to decline to around $250–$300 per 30-count bottle by 2025.

Optimistic Scenario (Limited Generics or Patent Extensions)

If patent litigations or regulatory delays prolong exclusivity, prices may remain relatively stable until 2027–2028, with only moderate reductions (~15-20%). The high brand loyalty and prescriber inertia may sustain premium pricing longer.

Pessimistic Scenario (Rapid Generic Penetration)

In the event of expedited generic approvals and widespread market adoption, prices could fall by up to 60% within three years post-patent expiry, potentially bringing the retail price below $200 per 30-unit bottle.

Long-Term Outlook (2025–2030)

Assuming rapid generic adoption, the price trend will stabilize around $150–$200 per bottle, with minimal upward movement. Market volume growth may offset revenue declines due to lower unit prices, especially if expanded access and new indications emerge.

Emerging Trends Affecting Pricing

- Formulation Innovations: Once-daily extended-release formulations like ADDERALL XR are increasingly substituted by newer technologies, which may lead to price realignments.

- Regulatory and Legal Actions: Patent litigations and settlements could delay genericization, sustaining higher prices.

- Healthcare Policy Shifts: Governments exploring drug price regulation could impose caps, narrowing profit margins across the stimulant market.

Strategic Implications for Stakeholders

Pharmaceutical Companies: To capitalize on current demand, investing in innovative formulations, combination therapies, or targeted marketing remains strategic pre-generic entry. Post-patent expiration, focus shifts to cost-competitiveness and diversification.

Healthcare Providers: Awareness of shifting price dynamics influences formulary choices and prescribing practices, especially considering cost-effectiveness and patient affordability.

Payers and Insurers: Price erosion from generics benefits reimbursement budgets, prompting formulary adjustments and tiered copayment strategies to optimize medication adherence and manage expenses.

Key Takeaways

- Robust Demand: ADHD prevalence and acceptance of stimulant therapies underpin a sustained market for ADDERALL XR, with high prescription volumes expected through 2030.

- Patent and Market Dynamics: Patent expirations around 2023-2025 will usher in significant price reductions owing to generic competition, with an estimated 35-50% decline in prices.

- Price Trajectory: Pre-expiration, ADDERALL XR maintains premium pricing; post-expiration, prices are projected to fall to $150–$200 per 30-count bottle by 2025.

- Market Opportunities: Emerging markets and potential new indications provide expansion avenues, counteracting domestic price erosion.

- Regulatory and Legal Risks: patent litigation, regulatory delays, and policy shifts remain critical uncertainties influencing future pricing and market share.

FAQs

-

When will generic versions of ADDERALL XR enter the market?

Generic dextroamphetamine/amphetamine citrate formulations are expected to enter the US market around 2023–2025, coinciding with patent expiration and litigation timelines [3]. -

How will generic entry impact ADDERALL XR prices?

Generic entry typically results in a 35-50% reduction in list prices within two years, leading to substantial savings for payers and patients. -

Are there alternative medications to ADDERALL XR that are more cost-effective?

Yes, formulations like generic immediate-release amphetamines, lisdexamfetamine (Vyvanse), and non-stimulant options offer competitive efficacy at lower costs, especially post-generic market entry. -

What emerging trends could influence ADDERALL XR’s market share?

Innovations in drug delivery, new pharmacological agents, regulatory hurdles, and changes in prescribing guidelines could shift market dominance towards alternative therapies. -

What is the outlook for ADDERALL XR in emerging markets?

As healthcare infrastructure improves, declassified regulatory pathways and affordability strategies are likely to expand ADDERALL XR’s presence, creating additional revenue streams outside North America.

Sources

- CDC. (2021). Data & Statistics on ADHD.

- IQVIA. (2022). US Prescription Trends for ADHD Medications.

- FDA. (2021). Patent and Exclusivity Data for ADDERALL XR.

- Statista. (2022). Prescription Volumes for ADHD Medications in the US.

- EvaluatePharma. (2022). Price erosion trends post-generic entry.

Conclusion

ADDERALL XR remains a centerpiece in ADHD pharmacotherapy, bolstered by high demand and brand loyalty. Although patent expiration will trigger pricing declines, strategic positioning through innovation and market diversification can sustain revenue streams. Stakeholders should monitor patent statuses, regulatory developments, and emerging market opportunities to optimize portfolio management and investment decisions.

More… ↓