Share This Page

Drug Price Trends for ACUVAIL

✉ Email this page to a colleague

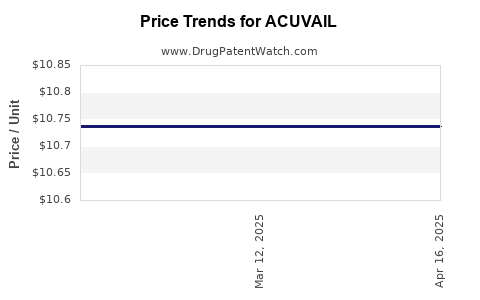

Average Pharmacy Cost for ACUVAIL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ACUVAIL 0.45% OPHTH SOLUTION | 00023-3507-31 | 10.73674 | EACH | 2025-04-23 |

| ACUVAIL 0.45% OPHTH SOLUTION | 00023-3507-31 | 10.73674 | EACH | 2025-03-19 |

| ACUVAIL 0.45% OPHTH SOLUTION | 00023-3507-31 | 10.73674 | EACH | 2025-02-19 |

| ACUVAIL 0.45% OPHTH SOLUTION | 00023-3507-31 | 10.71694 | EACH | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ACUVAIL

Introduction

ACUVAIL (ketorolac ophthalmic solution 0.45%) is a non-steroidal anti-inflammatory drug (NSAID) developed by Alcon for the treatment of postoperative ocular inflammation and pain, primarily after cataract surgery. With its unique formulation and established clinical profile, ACUVAIL holds a significant position within the ophthalmic anti-inflammatory market. This analysis explores the current market landscape, competitive dynamics, pricing strategies, and future price projections to assist stakeholders in informed decision-making.

Market Overview

Therapeutic Context and Clinical Indications

ACUVAIL targets postoperative inflammation and pain, conditions commonly associated with cataract extraction—a procedure performed annually on over 20 million patients globally [1]. Effective pain management remains critical for postoperative recovery, encapsulating a multibillion-dollar segment within ophthalmology. The drug's mechanism involves inhibiting cyclooxygenase enzymes (COX-1 and COX-2), reducing prostaglandin synthesis and subsequent inflammation and pain.

Market Size and Growth Drivers

The global ophthalmic anti-inflammatory market was valued at approximately USD 2.1 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4-6% over the next five years, driven by an aging population, increasing cataract surgery volume, and rising awareness of postoperative care [2].

Key drivers include:

- Demographic Shifts: The increasing global elderly population, boosting cataract surgery demand.

- Technological advancements: Phacoemulsification techniques reducing surgical trauma.

- Regulatory approvals: Expanded indications and formulations enhancing patient options.

Current Competitive Landscape

ACUVAIL is one among several NSAID ophthalmic solutions, competing against products such as BromSite (bromfenac ophthalmic solution), Ilevro (nepafenac), and Voltaren (diclofenac). While ACUVAIL holds unique data supporting its efficacy, market penetration is influenced by factors including:

- Formulation convenience and tolerability

- Pricing and reimbursement policies

- Physician prescribing habits

Market Position and Commercial Dynamics

Regulatory and Reimbursement Framework

ACUVAIL received FDA approval in 2010, with subsequent approvals in various markets. Reimbursement by insurance schemes significantly influences adoption rates. Price sensitivity varies across regions, notably between the U.S., Europe, and emerging markets.

Distribution Channels

Ophthalmologists and surgical centers remain primary channels. Direct sales and distributor partnerships facilitate market expansion, especially in regions with increasing cataract surgery rates.

Market Penetration and Growth Prospects

Despite established efficacy, ACUVAIL's market share remains moderate due to competition from other NSAIDs and corticosteroids. Nonetheless, expanding indications and growing surgical volumes present substantial growth opportunities.

Price Analysis and Historical Trends

Pricing Strategies

ACUVAIL's pricing aligns with high-value ophthalmic agents, employing a premium model justified by clinical efficacy and safety profile. Pricing varies significantly across regions, adjusted for local reimbursement, competitive landscape, and payer dynamics.

Current Pricing Data

In the U.S., the average wholesale price (AWP) for a 5 mL bottle hovers around USD 150-180, translating to approximately USD 30-36 per mL [3]. Discounting to net prices, reimbursements typically range from USD 100-130 per bottle.

Internationally, prices are generally lower, reflective of regional healthcare economics. For instance, in Europe, the average wholesale price may be around EUR 100-120 per bottle.

Pricing Challenges

Factors influencing pricing include:

- Reimbursement pressures

- Competitive discounts

- Patent exclusivity and biosimilar emergence

Future Price Projections (2023–2030)

Market Dynamics Influencing Pricing

- Increased competition: Entry of biosimilars or generic NSAIDs could exert downward pressure.

- Patent expirations: While ACUVAIL's patent life extends beyond 2030, imminent patent cliff for other NSAIDs may influence overall pricing.

- Regulatory changes: Pricing reforms and drug cost containment initiatives globally may lead to price reductions.

Projected Price Trends

Based on current market trends and competitive pressures:

- United States: Prices are projected to stabilize or slightly decline (~5-8%) over the next five years, driven by reimbursement negotiations and volume growth.

- Europe and Asia: Expected to see moderate declines (~10%) due to increased competition and local price controls.

- Emerging markets: Prices may decline more sharply (~15-20%) to improve accessibility.

Revenue Outlook

Global sales of ACUVAIL are anticipated to grow at a CAGR of approximately 4-6% until 2030, with pricing adjustments balancing volume increases against potential discounts. The overall market environment favors slight price erosion coupled with expanding unit sales.

Key Factors Impacting Price Trends

- Market Expansion: Increasing adoption in emerging markets could sustain revenues despite price pressures.

- Competitive Lock-in: Sustained efficacy and safety data sustain brand loyalty, supporting premium pricing.

- Regulatory Access: Favorable reimbursement policies promote stable pricing.

Conclusion

ACUVAIL holds a strategic niche within the ophthalmic anti-inflammatory landscape. Its pricing, influenced by clinical efficacy, market competition, and regional economic factors, is expected to remain relatively stable in mature markets while declining modestly in regions facing pricing pressures or increased competition. Aligning with surgical volume growth, the drug's revenue potential is poised for moderate expansion over the next decade, contingent on regulatory, technological, and market developments.

Key Takeaways

- ACUVAIL’s market expansion depends heavily on rising cataract surgeries and postoperative care standards.

- Current pricing is aligned with premium ophthalmic NSAIDs, with regional variability.

- Competitive landscape and patent landscape will influence future pricing; slight downward trends are anticipated.

- The drug’s growth prospects are favorable, driven primarily by increased surgical volumes rather than significant price hikes.

- Stakeholders should monitor regulatory policies and competitive entries that could impact pricing strategies.

FAQs

1. How does ACUVAIL’s pricing compare to other NSAID ophthalmic agents?

ACUVAIL’s pricing is generally in line with other premium NSAID eye drops, such as bromfenac or nepafenac. Its premium positioning reflects its clinical efficacy and formulation advantages, with prices typically ranging from USD 30-36 per mL.

2. What factors could lead to a decline in ACUVAIL’s price over the next decade?

Increased market competition, patent expirations for comparable drugs, regulatory pressure on drug pricing, and the entry of biosimilars or generics are key factors likely to contribute to price reductions.

3. Will the rising number of cataract surgeries influence ACUVAIL’s market share?

Yes, the growing volume of cataract surgeries globally enhances the potential market size, positively influencing sales volume even if per-unit prices decline slightly.

4. How do reimbursement policies affect ACUVAIL’s retail price?

Reimbursement policies significantly impact net prices; more favorable reimbursement schemes enable higher access and can sustain premium pricing, whereas tight controls may necessitate discounts.

5. Are there emerging markets where ACUVAIL might see significant price and volume growth?

Emerging markets with expanding ophthalmic healthcare infrastructure and increasing cataract surgery rates present substantial growth opportunities, often realized with tiered or reduced pricing strategies to improve access.

References

[1] World Health Organization. (2022). Cataract Surgery Statistics.

[2] Grand View Research. (2023). Ophthalmic Anti-Inflammatory Market Size & Trends.

[3] Drugs.com. (2023). ACUVAIL pricing and dosage information.

More… ↓