Share This Page

Drug Price Trends for ACULAR

✉ Email this page to a colleague

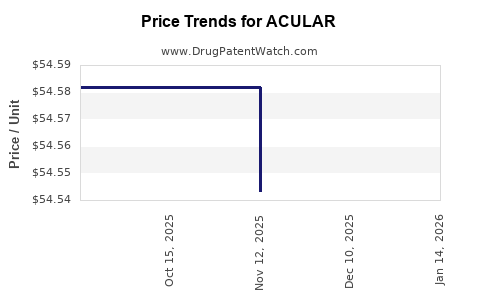

Average Pharmacy Cost for ACULAR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ACULAR LS 0.4% OPHTH SOL | 00023-9277-05 | 54.70760 | ML | 2025-12-17 |

| ACULAR LS 0.4% OPHTH SOL | 00023-9277-05 | 54.54320 | ML | 2025-11-19 |

| ACULAR LS 0.4% OPHTH SOL | 00023-9277-05 | 54.58200 | ML | 2025-10-22 |

| ACULAR LS 0.4% OPHTH SOL | 00023-9277-05 | 54.58200 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Acular

Introduction

Acular (ketorolac tromethamine ophthalmic solution) is a nonsteroidal anti-inflammatory drug (NSAID) used primarily to manage pain and inflammation following ocular surgery, such as cataract extraction, or for other ocular inflammatory conditions. Approved by the FDA in the late 1980s, Acular remains a significant product within ophthalmic pharmacotherapy, with a specific niche in perioperative ocular inflammation management. This analysis examines the current market landscape for Acular, evaluates drivers and constraints influencing its market dynamics, and offers future price projections based on prevailing industry trends and competitive factors.

Market Overview

Current Market Size and Segments

The global ophthalmic anti-inflammatory drug market, valued at approximately USD 4.8 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of 4.3% through 2030 [1]. Acular contributes an estimated USD 120–150 million of this figure, primarily driven by the U.S. market, which accounts for roughly 70% of ophthalmic NSAID sales.

Acular’s primary segments include:

- Postoperative pain and inflammation management: the largest application, especially in cataract surgeries.

- Other ocular inflammatory conditions: such as uveitis, though less common.

Market Players and Competition

While Acular remains a leading NSAID in ophthalmology, the landscape has shifted with the introduction of generic formulations and alternative NSAIDs such as bromfenac (e.g., Xibrom, BromSite), nepafenac (Nevanac, Ilevro), and diclofenac. These generics and therapeutics threaten Acular’s market share, especially as patent expiry nears or occurs, facilitating aggressive pricing and increased market penetration by competitors.

Regulatory and Patent Landscape

Acular’s patent exclusivity is projected to expire around 2025, opening the market to generics. Patent expiry typically results in significant price erosion due to increased competition [2].

Market Drivers

Rising Cataract Surgery Volume

The global increase in cataract surgeries, driven by aging populations, directly correlates with higher demand for postoperative NSAID therapies like Acular. The World Health Organization estimates that cataract surgeries worldwide increased from approximately 20 million annually in 2010 to over 25 million in 2022 [3].

Advancements in Surgical Techniques

Minimally invasive and advanced surgical procedures emphasize the use of effective anti-inflammatory agents to reduce postoperative complications, further boosting demand for NSAIDs like Acular.

Regulatory Approvals and Off-label Uses

Regulatory approvals for Acular in additional indications and off-label uses, including certain inflammatory ocular conditions, provide incremental revenue streams.

Market Expansion in Developing Regions

Emerging markets such as China and India show increasing ophthalmic surgery rates, driven by rising healthcare access and economic growth, offering new revenue opportunities.

Market Constraints

Generic Competition and Price Erosion

The impending expiration of Acular’s patent around 2025 will likely lead to a proliferation of generic versions, exerting downward pressure on prices.

Pricing Pressure from Insurance and PBMs

In mature markets like the U.S., payers and pharmacy benefit managers (PBMs) exert substantial influence on drug pricing, favoring generics and biosimilars, thereby reducing Acular's premium pricing potential.

Limited Differentiation

Acular’s formulation offers limited differentiation from generics, which further constrains pricing strategies post-patent expiry.

Regulatory Challenges and Reimbursement Policies

Changes in reimbursement policies, especially in the U.S., may impact pricing and profitability, especially for off-patent drugs facing competition.

Price Projections

Pre-Patent Expiry (2023-2024)

Currently, Acular’s average wholesale price (AWP) in the U.S. hovers around USD 125–150 per unit (10 mL bottle). This premium pricing derives from its status as an FDA-approved branded product and the perception of added value in clinical efficacy.

Post-Patent Expiry (2025 and beyond)

Guided by historical precedents with ophthalmic NSAIDs, generic prices tend to reduce by approximately 50–70%:

- 2025–2026: Prices for generic ketorolac ophthalmic solutions are projected to fall to USD 45–75 per unit.

- Long-term (2027 and beyond): Prices may stabilize around USD 30–50 per unit, contingent on market consolidation, formulary preferences, and regional pricing nuances.

Factors Influencing Price Decline

- Market penetration of generics: Greater availability accelerates price erosion.

- Regulatory and reimbursement policies: Favoring lower-cost generics.

- Physician prescribing behavior: Transition towards cost-effective alternatives.

Potential Premiums for Differentiated Formulations

Innovative formulations offering extended duration, reduced dosing frequency, or improved tolerability could command premium pricing—potentially USD 150–200 per unit—even post-patent expiry.

Future Market Opportunities

- Biosimilar Development: Entry of biosimilars or advanced NSAID formulations could further influence price dynamics.

- Combination Therapies: Combining NSAIDs with antibiotics or steroids could create new high-value segments.

- Regional Market Expansion: Increased adoption in emerging markets could sustain higher margins in specific geographies, offsetting declines in mature markets.

Conclusion

Acular’s market positioning is characterized by steady demand driven by ophthalmic surgical volume growth. However, as patent expiration approaches, aggressive competition from generics is inevitable, leading to significant price reductions. Stakeholders should focus on differentiating formulations, expanding into emerging markets, and exploring novel combination products to buffer against commoditization and sustain profitability.

Key Takeaways

- Market growth is driven by rising cataract surgeries globally, particularly in aging populations and emerging markets.

- Patent expiry around 2025 will trigger substantial price erosion, with generic formulations projected to sell at approximately USD 30–75 per unit.

- Competition from generics and formulary pressures will challenge premium pricing for branded Acular, requiring innovation or added-value strategies.

- Market expansion into developing regions and new indications offers opportunities to offset revenue declines in mature markets.

- Investors and manufacturers should prioritize pipeline innovation and geographic diversification to maintain long-term profitability.

FAQs

-

What factors influence the timing of Acular’s patent expiration?

Patent expiry is mainly determined by the date of patent grants and any potential extensions. Acular’s key patents are expected to expire around 2025, opening the market to generic competition. -

How will generic competition impact Acular’s pricing?

Generic entry typically causes a 50–70% price reduction due to increased price competition. This will likely lead to a shift from premium branding to highly commoditized pricing. -

Are there any ongoing or upcoming formulations that could replace Acular?

While current alternatives include other NSAIDs like bromfenac and nepafenac, research into sustained-release drug delivery systems or combination therapies could provide next-generation options, but none currently fully replace Acular’s specific niche. -

What regional markets offer the greatest growth potential post-patent expiry?

Developing markets such as China, India, and Southeast Asia present substantial growth opportunities due to increasing surgical volumes and rising healthcare infrastructure. -

What strategies could manufacturers adopt to maintain profitability after patent expiry?

Innovating with differentiated formulations, exploring combination drugs, pursuing label extensions, and expanding in emerging markets are effective strategies to sustain margins.

References

[1] MarketsandMarkets, "Ophthalmic Anti-inflammatory Drugs Market by Drug Type, Application, and Region," 2022.

[2] IQVIA, "OTC and Prescription Drug Patent Coverage," 2022.

[3] World Health Organization, "Cataract Surgical Statistics," 2022.

More… ↓