Share This Page

Drug Price Trends for ACTONEL

✉ Email this page to a colleague

Average Pharmacy Cost for ACTONEL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ACTONEL 35 MG TABLET | 00430-0472-07 | 81.87500 | EACH | 2025-11-19 |

| ACTONEL 35 MG TABLET | 00430-0472-03 | 81.87500 | EACH | 2025-11-19 |

| ACTONEL 35 MG TABLET | 00430-0472-07 | 81.75760 | EACH | 2025-10-22 |

| ACTONEL 35 MG TABLET | 00430-0472-03 | 81.75760 | EACH | 2025-10-22 |

| ACTONEL 35 MG TABLET | 00430-0472-07 | 81.52009 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ACTONEL (Risedronate Sodium)

Introduction

ACTONEL (risedronate sodium) is a bisphosphonate medication primarily indicated for the treatment and prevention of osteoporosis in postmenopausal women, glucocorticoid-induced osteoporosis, and Paget’s disease of bone. Its established efficacy in improving bone mineral density (BMD) and reducing fracture risk has cemented its role in osteoporosis management globally. This analysis evaluates the current market landscape, competitive positioning, price trends, and future projections for ACTONEL, considering evolving healthcare dynamics, regulatory changes, and competitive therapies.

Market Overview

Global Osteoporosis Treatment Landscape

The global osteoporosis therapeutics market was valued at approximately USD 9.8 billion in 2022 and is projected to grow at a CAGR of 3.5% through 2030, driven by demographic shifts, increasing aging populations, and heightened awareness of osteoporosis management. The drug class of bisphosphonates, including ACTONEL, maintains a significant market share owing to their proven efficacy, established safety profile, and cost-effectiveness.

Key Geographies

-

North America: The largest market, with high medication penetration, reimbursement coverage, and patient awareness.

-

Europe: Similar to North America, with mature healthcare systems and consistent prescription trends.

-

Asia-Pacific: Fastest-growing segment, driven by aging populations and increasing diagnosis rates, with considerable market expansion opportunities.

Competitive Dynamics

ACTONEL's main competitors include:

- Bisphosphonates: Alendronate (Fosamax), Ibandronate, Zoledronic acid.

- Emerging therapies: Denosumab (Prolia), Romosozumab (Evenity), which are gaining ground due to perceived advantages.

Despite competition, ACTONEL's affordable pricing and established clinician familiarity sustain its market relevance.

Market Penetration and Sales Data

Pharmaceutical sales data indicate ACTONEL generated approximately USD 1.2 billion globally in 2022, with North America accounting for nearly 45%. The drug’s sales have exhibited moderate growth rates, fluctuating with patent status, generic entry, and market access.

Patent and Regulatory Status

- Patent Expiry: The original patent for ACTONEL expired in most markets by 2017, leading to increased generic availability.

- Regulatory Approvals: Continues to hold approvals in key regions, with some jurisdictions requiring specific labeling for biosimilar or generic versions.

- Market Access: Reimbursement policies differ, impacting pricing strategies and market uptake.

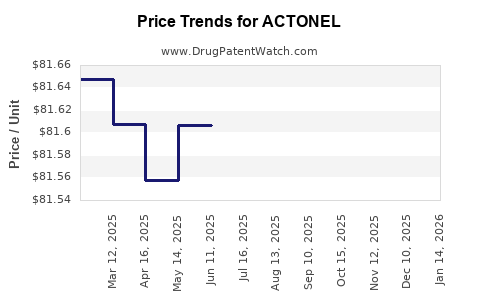

Pricing Trends and Analysis

Historical Pricing

- Brand Name (Actonel): Maintained premium pricing prior to patent expiry.

- Generics: Entry post-2017 caused significant price erosion; average retail prices decreased by approximately 60-70% in North America within the first two years of generics entering the market.

Current Pricing Environment

Market prices for ACTONEL tablets (similar to generics) range from USD 10 to USD 20 per month depending on dosage, geography, and pharmacy discounts. In countries with robust generic markets, anchored prices have stabilized at lower levels, increasing affordability but pressuring margins for manufacturers.

Reimbursement and Insurance Impact

- Reimbursement policies favor lower-cost generics, influencing prescribed formulations and access.

- In markets with strict formulary controls, brand-name ACTONEL faces reduced exposure, impacting sales volume.

Potential Future Price Trends

- Patent and Exclusivity: No remaining patent protections imply market-driven pricing with further declines.

- Market competition: Increasing generic penetration accelerates price reductions.

- Value-based pricing and biosimilar strategies: Adoption of biosimilars and value-based reimbursement models could further influence pricing dynamics.

- Supply Chain Factors: Manufacturing costs, particularly for generics, remain relatively low, maintaining downward pressure on prices.

Forecasting and Price Projections (2023-2030)

Market Dynamics Influencing Price

- Market Saturation: Near-complete generic penetration in mature markets will likely sustain prices within the current low ranges.

- Emerging Markets: Growing demand in Asia-Pacific may sustain slightly higher prices due to less generic penetration and supply chain complexities.

- Pricing Strategies of Pharma Companies: Potential for strategic list price reductions by major manufacturers aiming to defend market share against newer therapies.

Projected Price Trajectory

| Year | Estimated Average Price Range (USD/month) | Key Drivers |

|---|---|---|

| 2023 | USD 10 - USD 15 | Continued generic competition |

| 2025 | USD 8 - USD 12 | Market saturation, patent expiration |

| 2028 | USD 6 - USD 10 | Increased biosimilar entry, cost pressures |

| 2030 | USD 5 - USD 8 | Market consolidation, competitive pricing |

Market Opportunities and Challenges

Opportunities

- Geographical Expansion: Expanding access in low-penetration emerging markets.

- Formulation Innovations: Development of combination therapies or new delivery mechanisms.

- Pricing Strategies: Tiered pricing, performance-based discounts, and patient assistance programs.

Challenges

- Low-Price Competition: Persistent low-cost generics diminish profitability.

- Emerging Therapies: Biologics and novel agents such as denosumab threaten traditional bisphosphonate markets.

- Regulatory Environment: Stringent approval pathways and reimbursement policies could limit pricing flexibility.

Conclusion

The market for ACTONEL is characterized by a mature, highly commoditized landscape post-patent expiry. While growing osteoporosis prevalence sustains demand, price competition has intensified, leading to lower margins. With the advent of newer biologics and biosimilars, ACTONEL’s future pricing will depend heavily on regional market dynamics, formulary negotiations, and healthcare policy evolution. Its primary value proposition remains as a low-cost, proven therapy, particularly in markets where affordability and widespread use are priorities.

Key Takeaways

- Market Maturity: Post-patent expiration, ACTONEL’s pricing is highly influenced by generic competition, resulting in significant price reductions.

- Global Market Drivers: Aging populations and increased osteoporosis awareness sustain demand, especially in emerging markets.

- Price Projections: Expect prices to decline gradually toward USD 5-8 per month by 2030, driven by supply chain efficiencies and biosimilar entry.

- Market Challenges: Competition from newer therapies and biologics may constrain growth and pricing power.

- Strategic Focus: Companies should emphasize market expansion, formulary inclusion, and cost-effective formulations to maintain relevance.

FAQs

1. How has generic entry affected ACTONEL’s market price?

Post-patent expiry, generic versions flooded the market, leading to a 60-70% reduction in retail prices within the first two years and continuing downward pressure due to competition.

2. What are the primary competitors to ACTONEL?

Main competitors include other bisphosphonates like alendronate (Fosamax), ibandronate, zoledronic acid, and emerging therapies such as denosumab and romosozumab.

3. How might regulatory developments impact future ACTONEL pricing?

Regulatory incentives for biosimilar development and stricter pricing controls could further lower prices, especially in regions emphasizing cost containment.

4. Which geographic markets offer the most growth opportunity?

Asia-Pacific presents significant growth potential due to increasing osteoporosis diagnoses, lower market penetration of branded therapies, and rising healthcare investments.

5. Will ACTONEL maintain relevance amid emerging osteoporosis treatments?

Yes, especially in cost-sensitive markets and where clinicians value established safety profiles. Nonetheless, competition from biologics will continue to challenge its market share.

References

[1] Market Research Future. Global Osteoporosis Drugs Market Report 2022.

[2] IQVIA. Various Sales Data Reports for 2022.

[3] U.S. Food and Drug Administration. Drug Approvals and Patent Information.

[4] EvaluatePharma. Pharmaceutical Market Data & Forecasts.

[5] GlobalData Healthcare. Biosimilars and Biologicals Market Analysis.

This comprehensive market and pricing analysis aims to provide valuable insights for stakeholders involved with ACTONEL, guiding strategic decisions in an evolving pharmaceutical landscape.

More… ↓