Share This Page

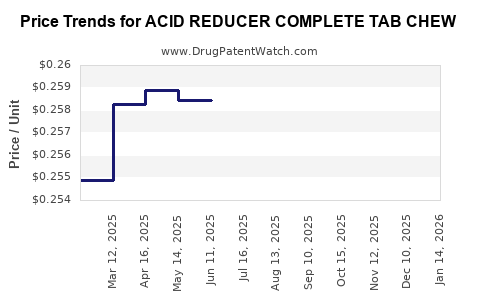

Drug Price Trends for ACID REDUCER COMPLETE TAB CHEW

✉ Email this page to a colleague

Average Pharmacy Cost for ACID REDUCER COMPLETE TAB CHEW

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ACID REDUCER COMPLETE TAB CHEW | 70000-0416-01 | 0.25895 | EACH | 2025-12-17 |

| ACID REDUCER COMPLETE TAB CHEW | 70000-0582-01 | 0.25895 | EACH | 2025-12-17 |

| ACID REDUCER COMPLETE TAB CHEW | 70000-0416-01 | 0.25971 | EACH | 2025-11-19 |

| ACID REDUCER COMPLETE TAB CHEW | 70000-0582-01 | 0.25971 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ACID REDUCER COMPLETE TAB CHEW

Introduction

The global market for over-the-counter (OTC) acid reducers, including formulations like "ACID REDUCER COMPLETE TAB CHEW," has demonstrated robust growth driven by increasing prevalence of gastroesophageal reflux disease (GERD), acid indigestion, and related conditions. As consumers favor convenient, fast-acting, and palatable OTC medications, the demand for chewable formulations has surged. This analysis offers a comprehensive review of the current market landscape, competitive positioning, regulatory considerations, and future pricing forecasts for ACID REDUCER COMPLETE TAB CHEW.

Market Overview

Global OTC Acid Reducer Market

The OTC acid reducers market, encompassing products like antacids, H2 receptor antagonists, and proton pump inhibitors (PPIs), was valued at approximately USD 4.1 billion in 2022 and is projected to grow at a Compound Annual Growth Rate (CAGR) of around 5% through 2028 [1]. Key drivers include increased consumer awareness, lifestyle factors, and the rising aging population, which is more susceptible to acid-related disorders.

Product Positioning

Chewable tablets such as ACID REDUCER COMPLETE TAB CHEW occupy a niche within OTC offerings, appealing to consumers seeking ease of use, quick relief, and portable formats. These products often combine multiple active ingredients—like calcium carbonate, magnesium hydroxide, and simethicone—to target a broader range of symptoms and enhance consumer satisfaction.

Competitive Landscape

Major Players

Leading OTC acid reducer brands include:

- TUMS (GlaxoSmithKline): Known for its rapid relief chewable calcium carbonate tablets.

- Rolaids (Johnson & Johnson): Combines calcium carbonate and magnesium hydroxide.

- Maalox (Bayer): Offers magnesium hydroxide and aluminum hydroxide formulations.

- Generic store brands: Growing presence, often offering lower prices.

The market also features newer entrants with targeted formulations, natural ingredients, or added digestive aids.

Product Differentiation

ACID REDUCER COMPLETE TAB CHEW must differentiate through:

- Efficacy: Fast symptom relief with dual-action ingredients.

- Taste and Texture: Pleasant flavor and chewy texture improve consumer compliance.

- Additional Benefits: Including anti-bloating agents like simethicone or herbal extracts for holistic gut health.

- Pricing Strategy: Competitive pricing aligned with store brands and premium positioning.

Regulatory Environment

Regulations Impacting Pricing and Market Entry

In the U.S., OTC drugs must conform to FDA guidelines, with an approved monograph or new drug application. Compliance influences product labeling, packaging, and marketing strategies. Regulatory changes, such as stricter safety evaluations or ingredient restrictions, could affect manufacturing costs and price points [2].

Other regions operate under national agencies such as the EMA (Europe) or MHRA (UK), with localized requirements influencing market dynamics.

Pricing Dynamics and Projections

Current Price Range

In the retail market, the typical price of a 20-30 chewable tablet pack of acid reducers like ACID REDUCER COMPLETE TAB CHEW ranges from USD 6 to USD 10, depending on brand, formulation, and retail channel. Store brands often retail at approximately USD 4 to USD 6.

Factors Affecting Future Prices

- Raw Material Costs: Fluctuations in calcium carbonate, magnesium compounds, and flavoring agents influence manufacturing expenses.

- Regulatory Costs: Additional testing or ingredient approvals could elevate costs.

- Consumer Pricing Sensitivity: Price elasticity varies across demographics; premium formulations can command higher prices, while commodity generics compete aggressively.

- Distribution Channels: Online direct-to-consumer sales may reduce supply chain costs, enabling price adjustments.

Price Projection (2023–2028)

Given market growth and competitive pressures, retail prices are expected to remain relatively stable with minor fluctuations:

- Base Scenario: Steady pricing at USD 6–8 per pack.

- Upside Potential: Introduction of value-added features or natural ingredients could elevate prices to USD 8–10.

- Downside Risks: Price wars with generics and private labels could drive prices downward, especially in mature markets.

Overall, a moderate CAGR of roughly 3–4% in retail prices is projected, aligning with inflationary trends and raw material costs.

Market Opportunities and Challenges

Opportunities

- Innovation: Combining efficacy with pleasant taste and additional digestive health benefits.

- Digital Marketing: Engaging consumers via health apps, influencer endorsements, and targeted advertising.

- Emerging Markets: Growing middle classes in Asia-Pacific and Latin America present significant expansion opportunities.

Challenges

- Generic Competition: Similar formulations pressure pricing.

- Regulatory Hurdles: Stringent compliance requirements could delay new product launches.

- Consumer Preferences: Increasing demand for natural and organic ingredients may necessitate reformulation.

Conclusion

The market for chewable OTC acid reducers like ACID REDUCER COMPLETE TAB CHEW is poised for steady growth, driven by consumer demand for convenience and effective symptom relief. Price stability amid moderate increases is expected through 2028, with potential for premium pricing through innovation and branding. Manufacturers must focus on differentiating product offerings and closely monitoring regulatory and raw material cost trends to optimize profitability.

Key Takeaways

- The OTC acid reducers market is projected to grow at approximately 5% CAGR, bolstered by aging populations and lifestyle-related health trends.

- Chewable formulations effectively meet consumer preferences, providing a competitive advantage through taste, convenience, and multi-action benefits.

- Price projections indicate stable retail pricing around USD 6–8 per pack, with some upward movement for innovative and premium formulations.

- Raw material costs, regulatory compliance, and competitive dynamics are the primary influences on pricing strategies.

- Opportunities exist in product innovation, digital engagement, and expanding into emerging markets, despite challenges from generic competition and evolving consumer preferences.

FAQs

1. What key ingredients are typically found in ACID REDUCER COMPLETE TAB CHEW?

Common ingredients include calcium carbonate and magnesium hydroxide for neutralizing acid, possibly combined with simethicone for gas relief and flavoring agents to enhance palatability.

2. How does the competition shape the pricing of chewable acid reducers?

Brand-name products like TUMS command premium prices due to brand recognition and perceived efficacy, while store brands offer lower-cost options, leading to a competitive pricing environment that drives value-focused innovation.

3. What regulatory considerations most impact the pricing and marketing of OTC acid reducers?

Compliance with local OTC drug monographs, safety testing, accurate labeling, and marketing claims influence formulation costs and regulatory expenses, impacting overall pricing strategies.

4. How are consumer preferences influencing product development and pricing?

Consumers are increasingly seeking natural ingredients, better taste, and added health benefits, prompting upgrades that may command higher prices but also require significant R&D investment.

5. What future trends could influence the market for ACID REDUCER COMPLETE TAB CHEW?

Trends include growth in natural/organic formulations, personalized gut health solutions, and digital engagement strategies, all of which can influence product positioning and pricing models.

References

[1] MarketsandMarkets. “Over-the-counter (OTC) Drugs Market by Product.” 2022.

[2] FDA. “OTC Drug Review Process and Regulations.” 2023.

More… ↓