Share This Page

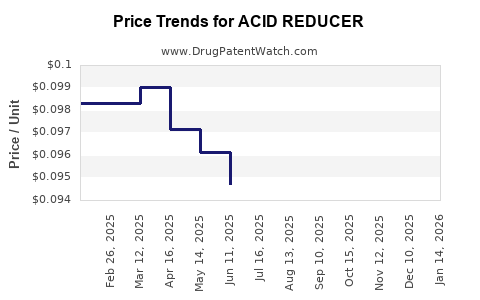

Drug Price Trends for ACID REDUCER

✉ Email this page to a colleague

Average Pharmacy Cost for ACID REDUCER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ACID REDUCER 20 MG TABLET | 70000-0710-01 | 0.14686 | EACH | 2025-12-17 |

| ACID REDUCER 20 MG TABLET | 24385-0385-71 | 0.14686 | EACH | 2025-12-17 |

| ACID REDUCER 20 MG TABLET | 70000-0049-01 | 0.14686 | EACH | 2025-12-17 |

| ACID REDUCER 10 MG TABLET | 46122-0394-65 | 0.09922 | EACH | 2025-12-17 |

| ACID REDUCER 20 MG TABLET | 49483-0720-01 | 0.14686 | EACH | 2025-12-17 |

| ACID REDUCER 10 MG TABLET | 70000-0048-01 | 0.09922 | EACH | 2025-12-17 |

| ACID REDUCER 20 MG TABLET | 24385-0385-63 | 0.14686 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for the Acid Reducer

Introduction

Acid reducers, a class of pharmaceutical agents used to mitigate gastroesophageal reflux disease (GERD), peptic ulcers, and other acid-related disorders, represent a significant segment within the global gastrointestinal (GI) therapeutic market. Given their widespread adoption and the evolving landscape of treatment options, understanding market dynamics and pricing trends for acid reducers is essential for pharmaceutical stakeholders. This analysis offers an in-depth review of current market conditions, competitive landscape, regulatory influences, and future price projections.

Market Overview

The global acid reducer market primarily encompasses proton pump inhibitors (PPIs), H2 receptor antagonists, and antacids. Among these, PPIs occupy the dominant position due to their superior efficacy and safety profile, accounting for approximately 70-80% of sales within the acid reducers segment (1).

The increasing prevalence of GERD, peptic ulcer disease, and lifestyle-related gastrointestinal conditions fuels demand. According to the Global Burden of Disease Study, GERD prevalence varies widely, with developed nations exhibiting higher rates—up to 20% in North America—thereby expanding the market (2).

Market Size and Growth Rate

As of 2022, the global acid reducer market was valued around USD 14 billion, with projections suggesting a compound annual growth rate (CAGR) of approximately 3-5% through 2030 (3). This growth is driven by factors such as aging populations, rising obesity cases, and increased awareness of safe, effective management of acid-related disorders.

Competitive Landscape

Key players include Pfizer (Protonix), AstraZeneca (Nexium), Takeda Pharmaceuticals (Dexilant), and newer entrants offering generic formulations. The patent expirations of leading brands, notably Prilosec (omeprazole), have triggered a surge in generic competition, exerting downward pressure on prices.

Meanwhile, innovative drug formulations, such as dual-action agents and novel delivery systems, are entering the market, potentially influencing pricing strategies. Biosimilar and generic entries typically lead to significant price reductions—often 20-60% below branded counterparts—within the first few years of patent expiration (4).

Regulatory and Patent Dynamics

Patent expirations remain pivotal in shaping market prices. For example, the expiration of AstraZeneca’s Nexium patent in 2015 resulted in a sharp price decline due to generics flooding the market (5). Conversely, patent protections in emerging markets continue to create premium pricing opportunities.

Regulatory authorities are increasingly scrutinizing high drug prices, pushing for transparent pricing models and encouraging biosimilar adoption. This regulatory environment influences future pricing trajectories for acid reducers (6).

Pricing Trends and Projections

Current Pricing Landscape

- Branded PPIs typically retail between USD 30-50 per month for a standard course.

- Generics have reduced prices, often to USD 10-20 monthly, with variations based on geographic location.

- Over-the-counter (OTC) formulations are priced more competitively, further pressing prescribed drug prices.

Future Price Projections (2023-2030)

Given ongoing patent expirations and increasing generic market penetration, prices are expected to decline further:

- Immediate-term (2023-2025): Prices for branded PPIs will stabilize but remain under pressure due to generic competition. Expect an average decrease of 10-15% annually.

- Mid-term (2026-2028): As more generics enter, branded prices could decline by up to 40%, with some markets experiencing a 50% drop in median drug price.

- Long-term (2029-2030): Market saturation with generics and biosimilars will further suppress prices. Predictions suggest average prices could decrease by an additional 20-25%. Innovative formulations with differentiation potential might maintain premium pricing but likely at reduced margins.

Potential Influences on Price Dynamics

- Uptake of biosimilars and biosimilar-like formulations.

- Policy reforms aimed at cost containment.

- Introduction of OTC variants, which could alter prescription market pricing.

- Growth of direct-to-consumer marketing influencing consumer demand and thus pricing strategies.

Market Opportunities and Challenges

Opportunities

- Expansion into emerging markets where GI disorders are on the rise.

- Development of combination therapies to enhance efficacy.

- Leveraging digital health tools for better adherence and market penetration.

Challenges

- Price erosion due to patent cliffs and generic entry.

- Regulatory hurdles affecting drug approval timelines.

- Market saturation limits growth potential in mature regions.

- Consumer preference shifts towards non-pharmacological interventions.

Conclusion

The acid reducer market exhibits resilient growth, underpinned by disease prevalence and aging demographics. Nonetheless, rapid patent expirations and aggressive generic competition are dictating a downward price trend. Stakeholders focusing on innovation, strategic patent management, and market diversification can mitigate adverse pricing pressures. As drug prices continue to decline, investment in differentiated products and cost-effective delivery strategies will be essential for maintaining profitability.

Key Takeaways

- The global acid reducer market was valued at approximately USD 14 billion in 2022 and is projected to grow modestly at 3-5% CAGR through 2030.

- Patent expirations have led to significant price reductions, especially for branded PPIs, with generic options now dominating key markets.

- Future pricing is expected to decline annually by 10-15% in the short term, with further declines possible as more generics and biosimilars enter the market.

- Innovation and market expansion into developing regions offer growth opportunities, but regulatory and patent challenges persist.

- Strategic focus on differentiating products and market diversification will be vital in sustaining profitability amid declining prices.

FAQs

1. How will patent expirations affect acid reducer prices in the coming years?

Patent expirations typically lead to the entry of generics, resulting in substantial price reductions. As major brands lose patent protection, average prices are expected to decline by up to 50%, with average yearly decreases around 10-15% during the transition period.

2. What are the key factors influencing the future pricing of acid reducers?

Factors include patent status, generic competition, regulatory policies, biosimilar development, pharmaceutical innovation, and market demand dynamics, especially in emerging markets.

3. Are there opportunities for premium pricing in the acid reducer market?

Yes; niche formulations such as combination therapies, targeted delivery systems, and innovations addressing unmet needs can command higher prices, especially in specialized or underserved segments.

4. How do regulatory changes impact acid reducer pricing?

Regulators pushing for transparency and cost containment can accelerate price declines, especially through increased biosimilar approval and substitution policies favoring generics.

5. Which geographic regions are expected to see the most significant price declines or growth?

Developed markets such as North America and Europe are experiencing notable price compression due to mature generic markets. Conversely, emerging markets offer growth potential but may still have higher prices due to regulatory and patent protections.

References

- IQVIA. (2022). The Global GI Market Report.

- GBD 2019 Diseases and Injuries Collaborators. (2020). Global Burden of Disease Study.

- Research and Markets. (2022). Global Acid Reducers Market Forecast.

- Mendell, M. et al. (2019). Patent Expiry and Generic Entry Impact. Journal of Pharmaceutical Economics.

- AstraZeneca Annual Reports. (2015). Nexium Patent Analysis.

- World Health Organization. (2021). Price Transparency and Access Policies.

More… ↓