Last updated: July 28, 2025

Introduction

Acetic acid, also known as ethanoic acid, is a fundamental chemical in the industrial sector with a wide range of applications—from manufacturing vinyl acetate monomer (VAM), acetic anhydride, and ester solvents to food preservatives and textiles. The global acetic acid market's dynamics are influenced by the increasing demand in construction, automotive, packaging, and textiles industries, alongside technological advancements and regional manufacturing shifts. This report provides a comprehensive market analysis and projected price trends for acetic acid over the coming years, essential for stakeholders across manufacturing, trading, and investment domains.

Market Overview and Key Drivers

Global Market Size and Growth

The global acetic acid market was valued at approximately $10.2 billion in 2022 and is forecasted to grow at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030 [1]. This expansion is driven by rising demand in emerging economies and steady growth in traditional sectors such as adhesives, paints, and textiles.

Major End-Use Industries

- Vinyl Acetate Monomer (VAM) Production: Approximately 60% of global acetic acid consumption is for VAM, used in paints, adhesives, and sealants.

- Acetic Anhydride Manufacturing: Utilized in producing cellulose acetate fiber, explosives, and pharmaceuticals.

- Food and Pharmaceutical Sectors: As a food additive (e.g., vinegar) and solvent in pharmaceutical synthesis.

- Textile and Leather Processing: For dyeing, tanning, and finishing.

Regional Market Dynamics

- Asia-Pacific: Leading the market with over 50% share owing to robust industrial growth in China, India, and Southeast Asia.

- North America: Driven by shale gas reserves, facilitating price competitiveness and increased production.

- Europe: Stabilized demand with focus on sustainable and bio-based acetic acid sources.

Supply Chain and Production Technologies

Manufacturing Processes

- Methanol Carbonylation: The predominant process used by major producers like Eastman Chemical and Celanese, representing roughly 80% of global output.

- Bio-based Production: Emerging as a sustainable alternative; companies are exploring fermentation processes to produce acetic acid from biomass.

Major Suppliers and Market Concentration

The market exhibits high concentration, with top players including Eastman Chemical, Celanese, and BASF, controlling around 70% of capacity globally [2]. Expansion projects and technological upgrades are ongoing, indicating potential shifts in supply dynamics.

Price Trends and Projections

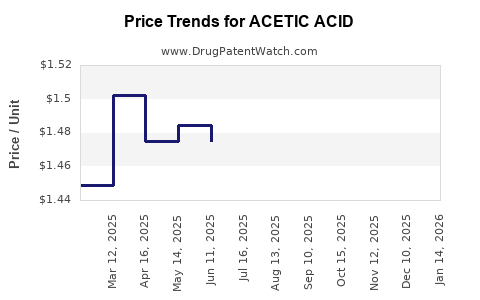

Historical Price Trends

Between 2018 and 2022, the average spot price for acetic acid fluctuated between $700 and $950 per ton. Periods of oversupply, notably linked to new capacity launches in North America, caused downward pressure, while regional demand surges supported higher prices.

Factors Influencing Future Prices

- Feedstock Costs: Methanol, a primary raw material, correlates strongly with natural gas prices. Stable or declining methanol costs tend to suppress acetic acid prices.

- Supply-Demand Equilibrium: Capacity additions, particularly bio-based facilities, could alter the supply landscape.

- Regulatory Environment: Environmental policies targeting chemical manufacturing emissions may increase production costs, influencing prices.

- Regional Demand Fluctuations: Rapid industrialization in Asia might push prices upward regionally, while mature markets may see stabilization.

Forecasted Price Range (2023-2030)

Based on current market trends, technological trajectories, and macroeconomic factors, acetic acid prices are projected to trend towards an average of $900-$1,050 per ton by 2030, with potential peaks during periods of supply tightness or increased feedstock costs. The overall CAGR is expected to remain around 4.5–5%.

Competitive Landscape and Market Opportunities

- Emerging Bio-based Production: Companies investing in fermentation technology could disrupt traditional manufacturers, offering more sustainable products and potentially more competitive pricing.

- Regional Capacity Expansion: The Asia-Pacific region will likely see the most capacity increases, reducing dependence on imports in other regions.

- Application Diversification: Innovations in end-use applications, like biodegradable plastics and specialty chemicals, present growth avenues that could influence demand and pricing dynamics.

Risks and Uncertainties

- Environmental Regulations: Stricter controls may elevate compliance costs or restrict certain production methods.

- Feedstock Price Volatility: Fluctuating methanol and natural gas prices directly impact acetic acid production costs and pricing.

- Trade Policies: Tariffs, trade restrictions, or geopolitical tensions could disrupt supply chains or alter regional market shares.

Conclusion

The acetic acid market is poised for steady growth driven by expanding end-use sectors and regional industrialization, particularly in Asia-Pacific. Prices are expected to maintain an upward trajectory, influenced by feedstock costs, technological innovation, and regulatory factors. Stakeholders should monitor capacity expansions, technological developments, and policy landscapes to optimize procurement and investment strategies.

Key Takeaways

- The global acetic acid market is forecasted to grow at a CAGR of around 4.8% through 2030, reaching substantial market value.

- Price projections indicate an average of $900-$1,050 per ton by 2030, subject to feedstock costs and supply-demand dynamics.

- Asia-Pacific dominates the market, with significant capacity growth expected, impacting regional pricing.

- Technological advances like bio-based production may influence supply and cost structures in the coming years.

- Monitoring environmental regulations and geopolitical developments is crucial for strategic planning.

FAQs

1. How do feedstock prices impact acetic acid pricing?

Feedstock costs, primarily methanol derived from natural gas, are a significant component of acetic acid production costs. Fluctuations in natural gas and methanol prices directly influence acetic acid prices, with lower feedstock costs generally leading to price decreases.

2. What are the primary applications driving demand for acetic acid?

VAM production for paints and adhesives remains the largest application. Additionally, demand in the production of acetic anhydride, for textile fibers, packaging, and food preservatives, sustains overall market growth.

3. Which regions are expected to see the most capacity expansion?

Asia-Pacific, especially China and India, will dominate capacity additions due to rapid industrial growth and investments in bio-based production technologies.

4. How might environmental policies influence acetic acid markets?

Tighter regulations on emissions and chemical manufacturing could increase operational costs, potentially elevating prices. Conversely, standards favoring sustainable production methods might accelerate the adoption of bio-based acetic acid.

5. What are the emerging trends that could disrupt current market dynamics?

Development of bio-based production methods, technological innovations reducing production costs, and shifting trade policies are key factors that could reshape supply chains and influence prices.

References

[1] MarketWatch, "Global Acetic Acid Market Size, Share & Trends," 2023.

[2] Chemical Week, "Major Players in the Acetic Acid Industry," 2022.