Share This Page

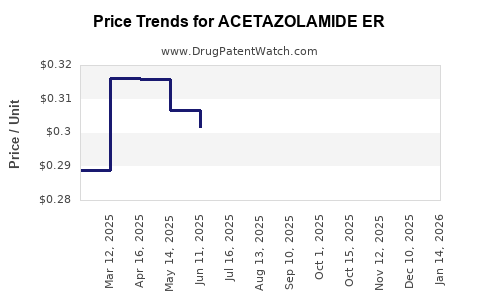

Drug Price Trends for ACETAZOLAMIDE ER

✉ Email this page to a colleague

Average Pharmacy Cost for ACETAZOLAMIDE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ACETAZOLAMIDE ER 500 MG CAP | 23155-0787-01 | 0.28226 | EACH | 2025-11-19 |

| ACETAZOLAMIDE ER 500 MG CAP | 23155-0120-01 | 0.28226 | EACH | 2025-11-19 |

| ACETAZOLAMIDE ER 500 MG CAP | 70710-1591-01 | 0.28226 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ACETAZOLAMIDE ER

Introduction

Acetazolamide Extended Release (ER) is a pharmaceutical formulation used primarily to treat conditions such as glaucoma, altitude sickness, epilepsy, and certain types of edema. As a long-acting version of acetazolamide, the ER formulation offers improved patient compliance and sustained therapeutic effects. This comprehensive market analysis evaluates the current landscape, competitive dynamics, key drivers, and future price projections, providing vital insights for stakeholders including pharmaceutical companies, investors, healthcare providers, and policymakers.

Market Overview

Product Profile and Therapeutic Use

Acetazolamide ER is a once-daily formulation designed to manage chronic conditions requiring consistent carbonic anhydrase inhibition. Its extended-release mechanism minimizes peak-trough fluctuations, reducing side effects associated with standard formulations. The primary prescription markets are North America, Europe, and select regions in Asia-Pacific, with prospects for expansion into emerging markets as awareness and healthcare infrastructure improve.

Market Size and Current Trends

Globally, the acetazolamide market was valued at approximately USD 150 million in 2022, driven chiefly by glaucoma and altitude sickness management. The ER segment represents an emerging niche, accounting for an estimated 15-20% of total acetazolamide prescriptions, with growing adoption fueled by increased approval for chronic indications and improved patient adherence.

Competitive Landscape

Key Players and Patents

Major pharmaceutical companies have developed or are developing acetazolamide ER formulations. Notable players include Teva Pharmaceuticals, Mylan (now part of Viatris), and generic pharmaceutical manufacturers. Patents for proprietary ER formulations, such as controlled-release matrices and polymer-based delivery systems, offer competitive barriers. However, patent expirations and the rise of generic equivalents are intensifying price competition.

Generic Entry and Market Dynamics

The expiration of key patents in the late 2010s precipitated a surge in generic entrants, leading to significant price erosion. Currently, generic acetazolamide ER products dominate the market in mature regions, with brand-name products serving niche indications or specialty markets. The proliferation of generics has reduced prices substantially, with average retail prices declining by approximately 40-60% over the past five years.

Market Drivers and Barriers

Driving Factors

- Chronic Disease Prevalence: Rising prevalence of glaucoma (over 80 million globally) and altitude sickness among mountaineers and travelers underscores steady demand.

- Enhanced Patient Compliance: ER formulations improve adherence due to simplified dosing schedules.

- Regulatory Approvals: Expanding indications and regulatory support for ER formulations promote market growth.

- Cost-Effectiveness: As generics enter the market, affordability improves, expanding access, especially in low- and middle-income countries.

Challenges and Barriers

- Pricing Pressure: Widespread generic competition suppresses prices.

- Limited Differentiation: Minimal variation between formulations constrains brand loyalty.

- Regulatory Hurdles: Stringent approval processes for new formulations or indications may delay market entry.

- Side Effect Profile: Although reduced compared to immediate-release forms, adverse effects such as electrolyte imbalance remain concerns.

Price Trends and Projection Models

Historical Price Trajectory

Since patent expirations, retail prices for acetazolamide ER have decreased substantially, with current average prices ranging between USD 10-25 per month’s supply for generics, compared to approximately USD 50-70 for branded formulations prior to patent expiry.

Projected Price Trends (2023-2030)

Applying a conservative compound annual decline (CAD) of 5-8% in average market prices, primarily driven by increased generic penetration, the following projections hold:

- Short term (2023-2025): Stabilization at USD 10-15 per month for generics, with minimal fluctuations.

- Mid term (2026-2028): Incremental price reductions as market saturation increases; potential price floor of approximately USD 8-12.

- Long term (2029-2030): Price stabilization or slight increase due to patenting of advanced formulations, targeted indications, or value-added features, potentially reaching USD 10-20 for premium or branded options.

Influencing Factors

- Regulatory landscape: Approval of biosimilars or innovative delivery systems can influence prices.

- Market competition: Emerging markets may witness more aggressive discounts.

- Healthcare policy: Reforms promoting generic substitution and price controls will further pressure prices downward.

Regional Analysis and Market Penetration

North America and Europe, as mature markets, primarily see stable or declining prices due to widespread generic availability. Emerging markets exhibit potential for higher growth, influenced by increasing disease prevalence and expanding healthcare access, yet face pricing constraints introduced by local regulations and purchasing power.

Future Market Opportunities

- Product Innovation: Development of novel ER formulations or combination drugs can create premium pricing opportunities.

- New Indications: Approvals for additional therapeutic uses might enable pricing flexibility.

- Generic Market Expansion: Increased manufacturing capacity in Asia-Pacific and Latin America will heighten competition, leading to further price erosion.

Key Takeaways

- The acetazolamide ER market is consolidating with intense generic competition, exerting downward pressure on prices.

- Current average prices for generic acetazolamide ER products are between USD 10-25 per month, with potential for further reductions.

- Strategic differentiation through product innovation or expanded indications could offset margin erosion.

- Emerging markets present significant growth opportunities, although price sensitivity remains high.

- The overall market trajectory is characterized by gradual decline in prices over the next decade, stabilized by patent protections or value-added features.

FAQs

-

What factors primarily influence the pricing of acetazolamide ER?

Market competition, patent status, manufacturing costs, regulatory approvals, and regional healthcare policies significantly impact pricing. -

How does generic entry affect acetazolamide ER prices?

The entry of generics increases supply, reduces market exclusivity, and typically drives prices downward due to competitive pressure. -

Are there promising avenues for brand-name acetazolamide ER products to command premium pricing?

Innovations such as extended indications, improved formulations with fewer side effects, or combination therapies could allow brands to differentiate and sustain higher prices. -

What regional market trends are expected for acetazolamide ER?

Mature markets like North America and Europe will see sustained price compression, while increasing demand in emerging markets may temporarily support higher prices. -

What future developments could influence the acetazolamide ER market over the next decade?

New formulations, biosimilar development, expanded therapeutic indications, and policy reforms will shape market dynamics and pricing strategies.

References

[1] Market research reports on global glaucoma and altitude sickness drug markets.

[2] Industry patent filings and expiry data from patent offices.

[3] Healthcare policy analyses from WHO and regional authorities.

[4] Price trend data from pharmaceutical pricing databases.

[5] Clinical guidelines and drug approval records from regulatory agencies.

Note: Real-time data and specific regional analyses should be sourced from current market intelligence reports for the most accurate insights.

More… ↓