Share This Page

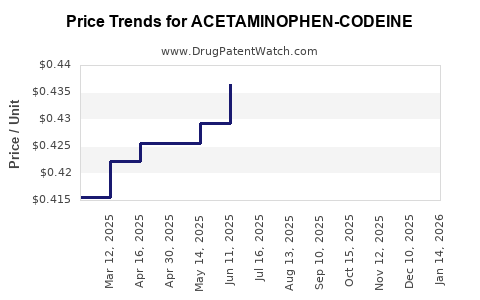

Drug Price Trends for ACETAMINOPHEN-CODEINE

✉ Email this page to a colleague

Average Pharmacy Cost for ACETAMINOPHEN-CODEINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ACETAMINOPHEN-CODEINE 120 MG-12 MG/5 ML SOLUTION | 64950-0374-16 | 0.46066 | ML | 2025-12-17 |

| ACETAMINOPHEN-CODEINE 120 MG-12 MG/5 ML SOLUTION | 64950-0374-16 | 0.45621 | ML | 2025-11-19 |

| ACETAMINOPHEN-CODEINE 120 MG-12 MG/5 ML SOLUTION | 64950-0374-16 | 0.45224 | ML | 2025-10-22 |

| ACETAMINOPHEN-CODEINE 120 MG-12 MG/5 ML SOLUTION | 64950-0374-16 | 0.44921 | ML | 2025-09-17 |

| ACETAMINOPHEN-CODEINE 120 MG-12 MG/5 ML SOLUTION | 64950-0374-16 | 0.44721 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Acetaminophen-Codeine

Introduction

Acetaminophen-Codeine combination drugs occupy a critical niche within global analgesic markets, primarily used for managing moderate to severe pain. This analysis evaluates current market dynamics, regulatory landscapes, manufacturing trends, and price trajectories for acetaminophen-codeine formulations, providing stakeholders with actionable insights into future market and pricing trajectories.

Market Overview

Global Demand and Usage Patterns

The global demand for acetaminophen-codeine has persisted due to its efficacy as an analgesic and antitussive agent. Predominantly prescribed in North America, Europe, and parts of Asia, these formulations are favored for their rapid onset and tolerability profile. The World Health Organization (WHO) reports sustained use in both prescription and over-the-counter (OTC) contexts, with considerable regional variation driven by regulatory frameworks and prescriber preferences (WHO, 2022).

Therapeutic Indications

Primarily indicated for moderate pain relief—such as postoperative discomfort, musculoskeletal issues, and dental pain—acetaminophen-codeine combinations are also employed as anti-tussives in cough suppressants. Their versatility sustains a steady demand across diverse medical settings.

Market Size and Growth Drivers

The global analgesic market is projected to reach approximately USD 20 billion by 2025, with acetaminophen-codeine representing a significant segment estimated at USD 2–3 billion (Research and Markets, 2022). Growth drivers include rising aging populations, increasing prevalence of chronic pain, and expanding pharmaceutical markets in emerging economies.

Regulatory and Legal Landscape

Variable Regulation and Impact on Market Access

Regulatory bodies' stance on codeine varies markedly. In countries like the UK and Canada, restrictions have tightened, limiting OTC access and imposing prescription-only controls, which influence market volume. The U.S. FDA classifies combination products containing codeine as Schedule III or V drugs, impacting sales channels and prescribing practices (FDA, 2021). These shifts suppress illicit use, but may inadvertently constrain legitimate demand and influence pricing strategies.

Impact of Abuse and Addiction Concerns

Growing awareness of opioid misuse has led to stricter controls, potential reformulations, and the development of alternative therapies. Such regulatory impulses directly impact supply chains and market competitiveness, further shaping price trends.

Manufacturing Dynamics

Supply Chain Considerations

The raw materials—primarily acetaminophen and codeine—are sourced from global suppliers, with China and India leading production. Disruptions due to geopolitical issues, trade tariffs, or pandemic-related constraints have caused volatility in procurement costs, thereby influencing market prices.

Generic Manufacturing Trends

The commoditization of acetaminophen-codeine as generic drugs has cultivated intense price competition. Patent expirations facilitate entry of multiple players, reducing average prices and pressuring profit margins.

Market Participants and Competitive Landscape

Key players include Teva Pharmaceuticals, Mylan (now part of Viatris), and Sun Pharmaceutical Industries. The market exhibits high fragmentation, with regional manufacturers tailoring formulations to local regulatory environments.

Innovations and Reformulations

Recent efforts focus on abuse-deterrent formulations to mitigate misuse, which entail higher R&D costs but can command premium prices, thus influencing overall market pricing structures.

Price Projections

Current Pricing Dynamics

As of 2023, the average retail price for standard 30 mg codeine with 325 mg acetaminophen ranges between USD 0.10 and 0.25 per tablet, depending on geographic region and formulation brand—often reflecting high generic competition. Wholesale acquisition costs (WAC) hover around USD 0.05 per tablet (IQVIA, 2023).

Short-term (Next 2 Years)

The immediate term anticipates stable or slightly declining prices due to continued generic competition and increased regulatory scrutiny. Price suppression in mature markets is expected to persist, with minor regional variances influenced by national policies.

Medium to Long-term (3–5 Years)

Price trajectories depend heavily on regulatory developments:

- Increased Restrictions: Stricter controls could reduce market size, leading to price stabilization or slight increases in remaining demand segments.

- Reformulations and Abuse-Deterrent Technologies: These innovations could command higher prices, especially if patent protections or exclusivity rights are secured.

- Emerging Markets: Growing healthcare infrastructure and expanding prescription habits may bolster demand, potentially elevating prices in these regions by 2025.

Pricing Outlook Summary

- Stability: Generic, unbranded formulations likely will remain in the USD 0.05–0.20 range per tablet.

- Premium Segment: Abuse-deterrent or novel formulations may fetch up to USD 0.50–1.00 per tablet, especially in markets with high regulatory adherence and consumer demand for safer opioids.

Market Risks and Opportunities

Risks

- Regulatory crackdowns: Limits on prescribing and OTC sales could significantly diminish demand.

- Supply chain disruptions: Material shortages or geopolitical tensions threaten cost stability.

- Emerging substitutes: Development of non-opioid analgesics could erode market share.

Opportunities

- Formulation innovation: Abuse-deterrent and combination products may command higher margins.

- Market expansion: Emerging markets with expanding healthcare access offer growth avenues.

- Regulatory harmonization: Countries updating policies towards safer formulations could incentivize reformulations and premium pricing.

Key Takeaways

- The global acetaminophen-codeine market exhibits stability driven by persistent demand for moderate pain management, with regional regulatory frameworks significantly influencing availability and pricing.

- Price compression from generics and regulatory constraints are expected to persist over the short term, maintaining low-entry barriers but limiting premium pricing.

- Innovation in abuse-deterrent formulations and regional market expansion present pathways for premium pricing and growth.

- Supply chain vulnerabilities and evolving drug safety policies remain significant external risks.

- Stakeholders should monitor regulatory developments, formulation innovations, and regional market trends for strategic positioning.

FAQs

1. How do regulatory restrictions on codeine impact market prices?

Restrictions such as reclassification from OTC to prescription-only restrict supply channels and demand, often leading to price stabilization or declines. Conversely, reforms introducing abuse-deterrent formulations might allow for higher prices due to added safety features.

2. What are the primary drivers of cost variation in manufacturing acetaminophen-codeine?

Major factors include raw material costs—particularly opioid raw materials, which are subject to geopolitical and trade influences—manufacturing process efficiencies, regulatory compliance expenses, and packaging standards.

3. Will emerging markets create new pricing opportunities for acetaminophen-codeine?

Yes. Growth in healthcare infrastructure and increasing prescription practices in Asian, African, and Latin American markets are likely to create demand, potentially allowing for incremental pricing and market share expansion.

4. How is the development of abuse-deterrent formulations affecting the market?

These formulations command higher development costs but can justify higher prices due to enhanced safety profiles. They are gaining market traction in regions with strict opioid regulations and heightened abuse concerns.

5. What is the outlook for the generic acetaminophen-codeine market?

The sector is expected to remain highly competitive, with prices staying low due to aggressive generic manufacturing and regulatory influences. The focus will shift towards differentiation via formulations offering safety advantages or targeted regional access strategies.

Sources

[1] WHO. (2022). Global Pharmaceutical Market Trends.

[2] Research and Markets. (2022). Global Analgesics Market Analysis.

[3] FDA. (2021). Regulations on Opioid Combination Products.

[4] IQVIA. (2023). Pharmaceutical Market Data.

More… ↓