Share This Page

Drug Price Trends for ACETAMINOPHEN ER

✉ Email this page to a colleague

Average Pharmacy Cost for ACETAMINOPHEN ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ACETAMINOPHEN ER 650 MG CAPLET | 49483-0699-01 | 0.06861 | EACH | 2025-12-17 |

| ACETAMINOPHEN ER 650 MG CAPLET | 00904-7314-60 | 0.06861 | EACH | 2025-12-17 |

| ACETAMINOPHEN ER 650 MG TABLET | 68084-0777-95 | 0.06861 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Acetaminophen ER

Introduction

Acetaminophen Extended Release (ER), commonly known as Tylenol Extended Release, is a widely used analgesic and antipyretic medication indicated for the management of mild to moderate pain and fever. Its pharmacokinetic profile allows for prolonged therapeutic effects, making it a preferred option for chronic pain management. As the pharmaceutical landscape evolves, understanding the market dynamics and price trajectories for Acetaminophen ER is crucial for stakeholders, including pharmaceutical companies, healthcare providers, investors, and policymakers.

Market Overview

Global Market Size and Growth

The global analgesic market was valued at approximately USD 13 billion in 2021 and is projected to reach USD 19 billion by 2027, with a compound annual growth rate (CAGR) of about 6%. Acetaminophen (paracetamol) holds a significant share within this segment due to its widespread use, affordability, and over-the-counter (OTC) availability. The extended-release formulations, including Acetaminophen ER, have cemented their position in chronic pain management due to their favorable dosing and compliance profile.

Market Drivers

-

Rising Prevalence of Chronic Pain: Chronic pain affects an estimated 20% of adults globally, driving demand for extended-release formulations that provide prolonged relief.

-

Consumer Preference for OTC Medications: OTC classification allows easier access, promoting bulk purchasing and overall drug consumption.

-

Advancements in Formulation Technology: Improved bioavailability and sustained-release mechanisms increase the efficacy and patient compliance, further expanding the market.

-

Expanding Aging Population: Older adults often require pain management with medications like Acetaminophen ER, augmenting demand.

Market Constraints and Challenges

-

Regulatory Scrutiny over Safety: The association of acetaminophen with hepatotoxicity at high doses raises safety concerns, prompting regulatory agencies like the FDA to enforce warning labels and dosage restrictions, potentially limiting market expansion.

-

Competition from Alternative Analgesics: Non-steroidal anti-inflammatory drugs (NSAIDs) and opioids compete directly, especially in chronic pain scenarios.

-

Generic Market Intensity: The dominance of generic formulations pressures pricing and margins for branded products.

-

Supply Chain Disruptions: Raw material shortages and manufacturing constraints can impact supply and market prices.

Competitive Landscape

Key Players

-

McNeil Consumer Healthcare (Johnson & Johnson): The primary producer of Tylenol ER, holding a significant market share.

-

Generic Manufacturers: Companies like Amneal, Lupin, and Mylan produce generic Acetaminophen ER due to patent expirations, intensifying price competition.

-

Emerging Natural and Alternative Therapies: These pose indirect competition by offering alternative pain management options.

Intellectual Property and Patent Status

The patent for Tylenor ER expired in the late 2010s, leading to a prolific generic market. The proliferation of generics has induced price erosion but sustained overall market volume.

Regulatory Environment

The FDA classifies acetaminophen as a non-prescription (OTC) drug, allowing broad consumer access. Recent safety warnings and dose limitations aim to mitigate hepatotoxicity risk, influencing market dynamics but not significantly curbing overall consumption.

European and Asian markets follow similar regulatory patterns, with some regions implementing stricter dosage controls, which could temper market growth outlooks locally.

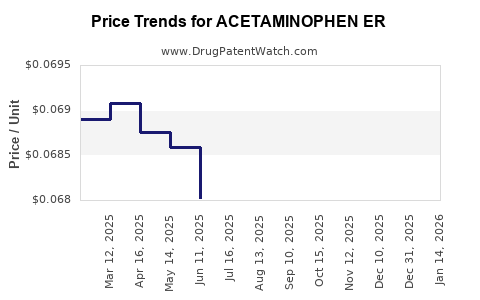

Price Trends and Projections

Historical Price Data

Historically, the introduction of generics in the US in late 2010s caused a sharp decline in Acetaminophen ER prices. The average retail price for a 100-count bottle of 650 mg ER tablets averaged USD 25–30 before patent expiration, which has since fallen to USD 8–12 in the current market (per Drug Price Info, 2022).

Current Pricing Landscape

-

Brand-Name Products (Tylenol ER): Maintain premium pricing at approximately USD 10–14 per bottle due to brand loyalty, perceived quality, and manufacturing costs.

-

Generics: Prices are significantly lower, with some versions selling for as low as USD 4–6 per bottle, driven by fierce competition.

Future Price Projections (2023–2028)

Based on market trends, demographic shifts, and regulatory factors, the pricing outlook appears as follows:

-

Brand-Name Products: Prices are expected to stabilize at USD 11–15 per bottle, with negligible upward movement owing to generic competition. Slight inflation-adjusted increases (~2% annually) may occur due to raw material costs.

-

Generics: Prices are anticipated to remain within USD 4–8 per bottle, with continued downward pressure in highly saturated markets. The entry of new generic manufacturers could further erode premiums.

-

Impact of Safety Regulations: Stricter dose caps and label warnings may slightly reduce consumption volumes but are unlikely to influence unit prices markedly.

Market Outlook and Growth Opportunities

-

Regional Variations: In emerging markets like China and India, prices are lower but growing demand could drive volume increases. Import tariffs, regulatory approvals, and local manufacturing can influence local price points.

-

Prescription vs. OTC: While primarily OTC, certain formulations might transition to prescription status in specific jurisdictions, impacting pricing and profit margins.

-

Innovations and Formulation Improvements: Advances such as combination therapies or improved bioavailability may command premium prices, fostering niche markets.

-

Potential Impact of New Formulations: Novel extended-release mechanisms with enhanced safety profiles could command higher prices and improve market share.

Risks and Uncertainties

-

Regulatory Restrictions: Implementation of stricter dosage limits or usage warnings could suppress demand.

-

Supply Chain Challenges: Disruptions in raw material supply chains, particularly in Asia, could impact manufacturing costs and pricing.

-

Market Entry of Alternative Therapies: Rising use of cannabidiol, capsicum extracts, or other non-traditional pain therapies could reduce Acetaminophen ER market share.

-

Public Awareness and Safety Concerns: Heightened media coverage of hepatotoxicity risk may influence consumer behavior, affecting sales volumes.

Conclusion

The market for Acetaminophen ER remains robust, driven by aging populations, chronic pain management needs, and its OTC accessibility. The landscape favors sustained low to mid-single-digit growth, predominantly influenced by demographic trends and regulatory safety measures. Price erosion is expected to continue, especially among generic products, though brand-name formulations may maintain premium pricing relative to generics.

Stakeholders should monitor regulatory updates, manufacturing costs, and emerging competitors to adapt strategies accordingly. Innovation in formulation and securing differentiated offerings can open avenues for premium pricing and market expansion.

Key Takeaways

- The global Acetaminophen ER market is mature, with prices declining due to generic competition but steady demand driven by chronic pain management needs.

- Price projections suggest stabilization of brand-name prices around USD 11–15, with generics maintaining USD 4–8 per bottle through 2028.

- Regulatory safety warnings and evolving formulations will influence future market dynamics, with potential opportunities in niche formulations and regional markets.

- Competition from alternative therapies and regulatory restrictions pose significant risks; thus, innovation and adaptation are critical for sustained market success.

- Stakeholders should consider regional market differences, supply chain stability, and safety regulations as vital factors influencing pricing strategies and market entry.

FAQs

1. How has the expiration of patents affected Acetaminophen ER pricing?

Patent expiration facilitated the entry of numerous generics, leading to significant price reduction, with prices dropping approximately 60–70% since patent expiry.

2. What regulatory factors could influence future Acetaminophen ER prices?

Increased safety warnings, dose restrictions, and potential classification changes from OTC to prescription could reduce demand volume and influence pricing.

3. Are there significant regional differences in Acetaminophen ER pricing?

Yes. Developed markets like North America and Europe tend to have higher prices due to brand loyalty and regulatory environments, while emerging markets experience lower prices but growing demand.

4. What are the main challenges facing the Acetaminophen ER market?

Key challenges include safety concerns over hepatotoxicity, pricing pressures from generics, regulatory restrictions, and competition from alternative pain therapies.

5. What strategies could companies adopt to maintain profitability?

Innovation in formulation, expanding regional presence, developing combination therapies, and leveraging brand loyalty are effective strategies to sustain profitability despite price erosion.

References

[1] MarketWatch. (2022). Global analgesic drugs market size and forecast.

[2] IQVIA. (2021). OTC drug sales and market analysis.

[3] FDA. (2020). Acetaminophen safety warnings and label updates.

[4] WHO. (2019). Chronic pain epidemiology and management.

[5] Deloitte. (2022). Pharmaceutical industry outlook and innovation strategies.

More… ↓