Last updated: July 29, 2025

Introduction

Acebutolol, a selective beta-1 adrenergic receptor blocker, is widely prescribed for managing hypertension, angina pectoris, and certain cardiac arrhythmias. Its unique attributes as an "intrinsic sympathomimetic activity" (ISA) agent differentiate it from other beta-blockers, contributing to its niche positioning in cardiovascular therapy. As with many cardiovascular drugs, it holds a significant position in the global pharmaceutical market. This analysis delves deeply into current market dynamics and projective pricing pathways for Acebutolol over the next five years.

Market Landscape

Global Market Size and Trends

While Acebutolol’s worldwide market size remains relatively niche compared to blockbuster beta-blockers like atenolol or metoprolol, it maintains steady demand owing to its specific clinical profile. The global beta-blocker market was valued at approximately USD 5.87 billion in 2021 and is expected to reach USD 8.17 billion by 2027, witnessing a CAGR of around 5.4% from 2022 to 2027 [1].

Acebutolol accounts for less than 2% of this revenue, primarily due to limited clinical indications and the availability of newer, more targeted medications with better safety profiles. Nonetheless, its specific efficacy in certain patient populations sustains a consistent, if modest, demand.

Market Drivers

- Preference for Cardioselective Agents: The shift towards cardioselective beta-blockers with fewer side effects sustains Acebutolol’s relevance.

- Chronic Disease Prevalence: Rising hypertension and angina prevalence support the baseline needs for beta-blockers.

- Generic Availability: Expiration of patents for Acebutolol formulations in multiple regions facilitates market penetration through generics, fostering affordability and broader access.

Market Challenges

- Competitive Dynamics: Competition from more modern beta-blockers with better side effect profiles (e.g., bisoprolol, nebivolol).

- Limited.indications: Its ISA property limits its use in certain patients, reducing market expansion opportunities.

- Stringent Regulatory Landscape: Increasing focus on adverse effect profiles influences prescribing patterns.

Regional Market Insights

- North America: São-critical market, driven primarily by established medical guidelines and high healthcare expenditure. Market growth is relatively stagnant due to an abundance of alternatives.

- Europe: Similar dynamics, with a trend towards newer agents, but a stable niche market remains for Acebutolol.

- Asia-Pacific: Growing prevalence of cardiovascular disease, coupled with a rising trend in generic drug usage, presents emerging opportunities.

- Latin America and Middle East: Lower market saturation but potential growth with increased healthcare infrastructure.

Pricing Dynamics

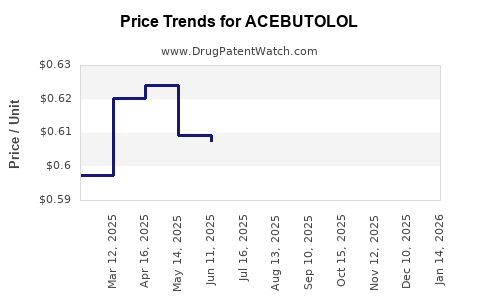

Current Pricing Overview

Presently, the retail price of Acebutolol varies significantly by region due to regulatory factors, manufacturing costs, and patent statuses. In the U.S., generic Acebutolol hydrochloride tablets can cost approximately USD 0.10 to USD 0.20 per tablet (100 mg), whereas branded versions are priced higher, around USD 0.30 to USD 0.50 per tablet [2].

In Europe, prices are comparable on a per-unit basis, with variations depending on national healthcare policies. Developing countries tend to have significantly lower prices driven by competition and market access programs.

Pricing Drivers and Constraints

- Generics Competition: As patents have expired, generic manufacturers dominate, exerting downward pressure on prices.

- Regulatory Controls: In many countries, price regulation or tender systems often cap drug prices, impacting profitability.

- Manufacturing Costs: Economies of scale reduce per-unit costs; however, raw material prices impact profit margins.

Price Projections for the Next Five Years

Based on current market trends and historical pricing data, the following projection parameters are established:

- Stabilization of Prices: Due to widespread generic availability, retail prices are expected to remain relatively flat in mature markets, with annual fluctuations within the 2-3% range primarily driven by inflation or procurement costs.

- Potential Price Reductions: In countries where tendering and procurement policies aim for cost containment, prices could decline by up to 5% annually.

- Market Entry of Biosimilars and Newer Agents: Although unlikely for Acebutolol due to its chemical nature, any innovative therapy with similar indications could exert competitive pricing pressure.

Projected Price Range (2023-2028):

| Year |

Estimated Price per 100 mg Tablet (USD) |

Rationale |

| 2023 |

0.10 – 0.20 |

Stable generic competition; inflationary pressures. |

| 2024 |

0.10 – 0.19 |

Slight decline expected from tender and regulatory influences. |

| 2025 |

0.09 – 0.18 |

Ongoing generic competition; market saturation in mature regions. |

| 2026 |

0.09 – 0.17 |

Continued cost containment measures. |

| 2027 |

0.08 – 0.17 |

Emerging markets remain price-sensitive. |

| 2028 |

0.08 – 0.16 |

Potential further declines driven by market consolidation. |

Note: These projections assume no significant patent litigation or unforeseen regulatory actions extending exclusivity or imposing restrictions.

Regulatory and Market Impacts

Upcoming regulatory changes could influence both the market size and pricing structure. For example, increased emphasis on generic drug safety and bioequivalence standards could impact manufacturing costs, potentially influencing prices. Additionally, evolving clinical guidelines favoring newer agents might diminish Acebutolol’s market share, indirectly affecting its pricing and availability.

Strategic Implications for Stakeholders

- Manufacturers: Focus on cost efficiencies and exploring emerging markets to sustain profitability amid declining prices.

- Healthcare Providers: Prioritize understanding regional availability and pricing to optimize prescribing practices.

- Investors: Recognize the limited growth potential but stable niche market, making Acebutolol a conservative asset within a portfolio of cardiovascular generics.

Key Takeaways

- Acebutolol remains a niche but stable component within the global beta-blocker market, primarily driven by its selective beta-1 activity and clinical utility.

- Its widespread generic availability ensures low-cost access but caps significant price increases, with projections indicating modest declines over the next five years.

- Regional disparities in pricing dynamics depend heavily on healthcare policies, procurement mechanisms, and market maturity.

- The overarching trend favors cost-sensitive markets, where lower prices and high volumes can compensate for narrow profit margins.

- While market growth is limited, sustained demand in specific cardiovascular indications preserves Acebutolol’s market presence.

FAQs

1. Will Acebutolol’s market share increase with the aging global population?

While the aging population elevates the prevalence of hypertension and related cardiovascular conditions, the market share for Acebutolol specifically is unlikely to increase significantly due to competition from newer, more tolerable beta-blockers.

2. Are there upcoming patents or exclusivity periods that could impact Acebutolol prices?

Most formulations of Acebutolol have expired patent protections, leading to dominant generic markets. No recent or anticipated patent extensions are expected to influence prices significantly.

3. How do regional regulatory policies influence Acebutolol pricing?

Countries with stringent price regulation or centralized procurement systems tend to maintain lower retail prices, directly impacting profit margins but ensuring broader access.

4. Is there potential for biosimilar competition for Acebutolol?

Biosimilars generally pertain to biologics; Acebutolol, being a small-molecule drug, faces competition mainly from generics. No biosimilar pathway exists for this agent.

5. How might shifts in clinical guidelines affect Acebutolol’s market demand?

Guidelines favoring newer, more selective beta-blockers or agents with fewer side effects could reduce demand for Acebutolol, leading to price stabilization or further decline.

Sources

[1] Grand View Research. Beta-Blockers Market Size, Share & Trends Analysis Report, 2022.

[2] GoodRx Data. Current pricing information for generic Acebutolol hydrochloride tablets.