Last updated: July 28, 2025

Introduction

Acute awareness of the iron chelation therapy market underscores the strategic importance of ACCRUFER (deferasirox), developed by Novartis. Approved primarily for transfusional iron overload in patients with hemoglobinopathies, ACCRUFER has become a cornerstone in managing iron toxicity. This analysis provides a detailed overview of the current market landscape, competitive positioning, price drivers, and projections for ACCRUFER over the coming years.

Market Landscape

Therapeutic indications and patient demographics

ACCRUFER's primary indication is iron overload secondary to chronic transfusions, especially in patients with sickle cell disease (SCD), β-thalassemia major, and myelodysplastic syndromes (MDS). The global prevalence of these conditions continues to rise, fueled by increasing diagnostic awareness and supportive care improvements.

The global β-thalassemia prevalence is estimated at approximately 15-20 million carriers, with about 200,000 affected individuals worldwide. SCD impacts roughly 20-25 million people globally, predominantly in Africa, the Middle East, and India (WHO). MDS incidence correlates with aging populations, with over 20,000 new cases annually in the U.S. alone (SEER data).

Increasing survival rates and a growing population of patients requiring lifelong transfusions amplify the market demand for effective chelation therapies like ACCRUFER.

Competitive landscape

ACCRUFER competes primarily with Exjade (deferasirox dispersible tablets), Ferriprox (deferiprone), and Desferal (deferoxamine). While Desferal remains effective, its parenteral administration limits adherence. Ferriprox is an alternative oral chelator but is associated with distinct safety concerns, especially agranulocytosis.

In recent years, novel oral chelators (e.g., trovidine, deferiprone) and the emergence of biosimilars Pharmaceuticals viewed as potential competitors have challenged ACCRUFER's market share. Nonetheless, ACCRUFER's established efficacy, patient familiarity, and flexible dosing maintain its leadership position.

Market penetration and adoption trends

Despite initial adoption barriers (cost, side-effects), ACCRUFER's flexible dosing schedule and once-daily administration support increased patient compliance. The expanding package of clinical evidence and regulatory endorsements further secure its position, especially in regions with high transfusion rates.

Pricing Dynamics

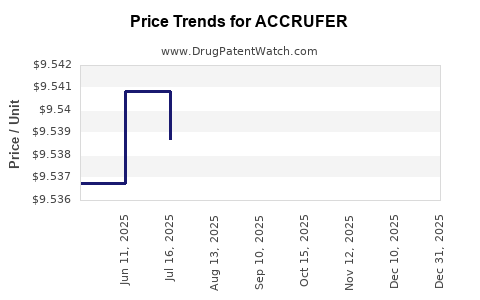

Current pricing landscape

In the U.S., the average wholesale price (AWP) for ACCRUFER ranges between $74,000 and $96,000 annually per patient, depending on dosage and patient weight. In European markets, prices are similarly high but vary based on healthcare provisioning and reimbursement policies.

Market Drivers Influencing Price Strategies

- Evolving reimbursement policies: Payers in the U.S. and Europe often negotiate drug prices based on clinical value and budget impact, influencing market prices.

- Manufacturers' strategic pricing: Novartis employs value-based pricing models, emphasizing the drug's efficacy and safety profile.

- Patent protections and biosimilar entry: Patent expiry in select regions may lead to price reductions, although patent protection until 2024–2026 sustains current pricing in key markets.

Price Projections (2023-2030)

Factors influencing future pricing

- Patent expiry and biosimilar entry: Patent expiration is forecasted through 2024–2026 in major markets like the U.S. and Europe. The entry of biosimilars might drive prices downward in these regions, with expected reductions in the range of 20-40%.

- Market expansion in emerging economies: Increasing adoption in India, China, and Latin America, where prices are typically lower, could pressure overall average prices downward.

- Regulatory and policy changes: Value-based agreements, risk-sharing arrangements, and policy reforms to reduce healthcare costs will influence drug pricing strategies.

Forecast Summary

| Year |

Price Range (USD per patient/year) |

Key Factors |

| 2023 |

$74,000 – $96,000 |

Patent protections maintained; limited biosimilar presence |

| 2024 |

$70,000 – $92,000 |

Patent expiry begins in select markets; biosimilar introduction |

| 2025 |

$65,000 – $88,000 |

Increased biosimilar competition; regional price pressure |

| 2026 |

$60,000 – $85,000 |

Broader biosimilar market penetration |

| 2027–2030 |

$55,000 – $80,000 |

Widespread biosimilar adoption; ongoing healthcare policy reforms |

Note: Actual prices will vary by geography, reimbursement negotiations, and patient-specific dosing.

Strategic Recommendations for Stakeholders

- Pharmaceutical companies should monitor biosimilar developments and prepare for price competition, deploying value-based pricing strategies.

- Healthcare providers should consider adoption of ACCRUFER based on long-term cost-benefit assessments aligned with improved adherence and patient outcomes.

- Policymakers should facilitate policies that balance affordability with innovation incentives, ensuring sustained access while managing expenditure.

Conclusion

ACCRUFER remains a leading oral iron chelator in a competitive and evolving market landscape. While patent protections safeguard current pricing until the mid-2020s, impending biosimilar entries and regulatory shifts are expected to exert downward pressures. Market strategies incorporating price flexibility, regional expansion, and value demonstration will be crucial for maximizing commercial potential and patient access during the next decade.

Key Takeaways

- The global iron chelation market is driven by increasing transfusional patient populations, notably among hemoglobinopathies and MDS.

- ACCRUFER's premium position is supported by its efficacy, safety profile, and patient-friendly dosing.

- Price projections indicate gradual reductions driven by biosimilar competition post-patent expiration, with prices declining by approximately 20-40% over 2024–2026.

- Regional differences in pricing, reimbursement policies, and healthcare infrastructure significantly impact actual market prices.

- Strategic planning around biosimilar entry, regulatory changes, and value-based agreements will be essential to sustain market relevance and profitability.

FAQs

1. When are generic or biosimilar versions of ACCRUFER expected to enter the market?

Generic versions are anticipated following patent expiry around 2024–2026 in major markets. Biosimilars, if developed, could enter as early as 2024, depending on regulatory approval and market acceptance.

2. How does ACCRUFER compare cost-wise to alternative chelators?

ACCRUFER's annual cost ranges between $74,000 and $96,000 in the U.S., often higher than generic deferasirox formulations but justified by clinical data and safety profile. Alternatives like deferiprone and deferoxamine differ markedly in price, administration, and side-effect profiles.

3. What regional factors influence ACCRUFER’s price and market penetration?

Healthcare policies, reimbursement systems, patent laws, and income levels significantly impact pricing and access, with developed countries maintaining higher prices due to established reimbursement structures.

4. How will the anticipated biosimilar competition affect ACCRUFER’s market share?

Biosimilar entry is expected to increase price competition, potentially reducing ACCRUFER’s market share, unless brand loyalty, superior efficacy, or safety profiles sustain demand.

5. What are the key considerations for payers regarding ACCRUFER’s pricing?

Payers balance the drug’s clinical benefits against its high cost, often negotiating outcomes-based agreements and formulary placements to optimize budget impact while ensuring patient access.

Sources

[1] World Health Organization (WHO). Sickle Cell Disease Fact Sheet.

[2] SEER Program, Surveillance, Epidemiology, and End Results Database.

[3] Novartis AG. ACCRUFER Prescribing Information.

[4] MarketWatch. Hemoglobinopathies Global Market Analysis.

[5] IQVIA. Global Pharmaceutical Pricing and Reimbursement Report.