Share This Page

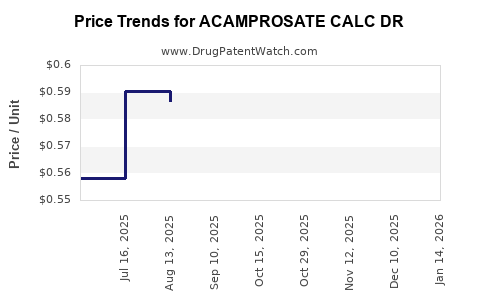

Drug Price Trends for ACAMPROSATE CALC DR

✉ Email this page to a colleague

Average Pharmacy Cost for ACAMPROSATE CALC DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ACAMPROSATE CALC DR 333 MG TAB | 68382-0569-28 | 0.59796 | EACH | 2025-12-17 |

| ACAMPROSATE CALC DR 333 MG TAB | 00378-6333-80 | 0.59796 | EACH | 2025-12-17 |

| ACAMPROSATE CALC DR 333 MG TAB | 00904-7213-04 | 0.59796 | EACH | 2025-12-17 |

| ACAMPROSATE CALC DR 333 MG TAB | 68462-0435-18 | 0.59796 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ACAMPROSATE CALC DR

Introduction

Acamprosate Calcium, marketed as ACAMPROSATE CALC DR, is a pharmacological agent primarily indicated for the maintenance of abstinence in individuals with alcohol dependence. As a niche yet critical therapeutic, its market dynamics are influenced by factors such as evolving clinical guidelines, regulatory landscape, patent lifecycle, manufacturing costs, and competitive alternatives. This analysis synthesizes current market conditions with future price projections, providing stakeholders with a comprehensive understanding of ACAMPROSATE CALC DR's commercial outlook.

Market Overview

Therapeutic Landscape and Indications

Acamprosate Calcium is approved for alcohol dependence disorder in numerous countries, including the United States, European Union, and Canada. Its mechanism involves modulating glutamatergic neurotransmission, reducing craving and relapse risk. The drug is often prescribed alongside behavioral interventions, forming part of a comprehensive substance use disorder (SUD) treatment framework.

Market Size and Demand Drivers

The global alcohol dependence treatment market valued approximately USD 2.5 billion in 2021 and is projected to reach USD 3.8 billion by 2030, expanding at a CAGR of around 5% (source: GlobalData). Acamprosate’s market share within this segment remains significant, especially in developed nations with established healthcare infrastructure. The driver stems from increasing awareness of alcohol-related health consequences and growing acceptance of pharmacotherapies.

Key Geographical Markets

- United States: Dominates due to high treatment prevalence, insurance coverage, and established prescribing routines.

- Europe: Strong markets in UK, Germany, and France; regulatory pathways favor approved drugs like acamprosate.

- Emerging Markets: Growing demand driven by rising alcohol consumption and expanding access to healthcare, though priced access remains a barrier.

Competitive Dynamics

Acamprosate faces competition from medications such as naltrexone, disulfiram, and off-label therapies. Naltrexone, especially in oral and injectable forms, competes directly and has a broader indication scope in alcohol and opioid dependence, challenging acamprosate’s market share.

Pricing Landscape

Current Pricing and Pricing Strategies

In developed countries, ACAMPROSATE CALC DR is marketed under brand names such as Campral (U.S.), with generic versions increasingly available. Brand-tier prices in the U.S. span USD 300–USD 600 per treatment month, influenced by insurance reimbursement policies. Generics have significantly reduced consumer prices, with wholesale acquisition costs (WAC) dropping by approximately 50% over the past decade.

In Europe, prices are subject to national reimbursement policies, with retail prices varying by country but generally aligning with the U.S. generics' cost-efficient range.

Cost of Goods and Manufacturing

Manufacturing acamprosate requires synthetic processes with high purity standards. Active pharmaceutical ingredient (API) costs have decreased due to increased generic production and process optimization. The estimated manufacturing cost (including formulation) per unit is approximately USD 20–USD 50, enabling margins for generic manufacturers.

Regulatory and Reimbursement Factors

Reimbursement policies heavily influence effective patient access and consequently, pricing. In the U.S., Medicare and Medicaid cover acamprosate, while private insurers negotiate formulary placement. In Europe, national health services largely dictate retail costs.

The impending patent expiry (anticipated around 2025–2026) is expected to accelerate generic entry, exerting downward pressure on prices.

Market Trends and Future Outlook

Patent Expiry and Generic Competition

The patent landscape indicates that the primary patent protections for branded acamprosate products are nearing expiration, facilitating the entry of generics. This competition is projected to reduce wholesale and retail prices by 30–50% within five years post-patent expiry.

Emerging Formulations and Delivery Systems

Innovative delivery systems, such as extended-release formulations or combination therapies, are under clinical investigation. These could command premium pricing if approved, but their impact remains speculative presently.

Regulatory and Policy Impacts

Changes in health policies promoting integrated SUD treatments and increased insurance coverage are expected to enhance market access. Conversely, stringent cost-containment policies might push prices lower, especially in public healthcare markets.

Market Penetration in Emerging Economies

While current penetration in emerging markets remains limited, expected economic growth, increased health literacy, and global health initiatives could expand these regions’ markets. Price sensitivity will drive demand for lower-cost generics.

Price Projection Scenarios (2023–2030)

| Scenario | Assumptions | Price Range (per month) | Key Drivers |

|---|---|---|---|

| Optimistic | Rapid generic entry, aggressive price competition, expanding global access | USD 50–USD 150 | Patent expiry, biosimilar competition, increased market penetration in emerging markets |

| Moderate | Gradual generic entry, moderate price declines, stable demand in developed markets | USD 150–USD 300 | Patent expiration timelines, stable reimbursement policies |

| Pessimistic | Delays in generic approval, patent extensions, restrictive reimbursement | USD 200–USD 400 | Patent disputes, regulatory hurdles, conservative payer policies |

Based on historical precedent and current patent status, a moderate to optimistic trajectory appears plausible, with prices trending downward primarily driven by generic competition post-2025.

Key Factors Influencing Price Dynamics

- Patent Lifecycle and Regulatory Approvals: Patent expiration typically precipitates significant price reductions due to increased generic competition.

- Manufacturing Cost Trends: Ongoing efficiencies could sustain margins even at lower prices.

- Reimbursement Environment: Favorable coverage fosters market growth and stabilization of prices.

- Clinical Adoption and Prescribing Trends: Broader acceptance as first-line therapy could sustain or increase price premium segments.

- Pipeline Developments: New formulations or combination therapies could alter market dynamics and price points.

Concluding Remarks

The market for ACAMPROSATE CALC DR is poised for notable transformation as patents expire and generics dominate. While current prices sustain healthy margins, future projections indicate a steady decline aligned with increased competition and evolving healthcare policies. Stakeholders should monitor patent statuses, regulatory approvals, and insurance landscapes closely to optimize pricing strategies, maximize market access, and sustain profitability.

Key Takeaways

- Patent Expiry and Generics: Expected around 2025–2026, leading to a 30–50% drop in prices over subsequent years.

- Pricing Trends: Current monthly prices range from USD 300–USD 600; generics are driving costs below USD 150 in mature markets.

- Market Expansion: Emerging markets present growth opportunities, though price sensitivity remains a barrier.

- Regulatory Environment: Reimbursement policies critically influence pricing and access; favorable policies boost market stability.

- Innovation Potential: New formulations could create premium segments but are uncertain in the short term.

FAQs

1. When will generic versions of ACAMPROSATE CALC DR likely enter the market?

Patent protections generally expire around 2025–2026, after which generic manufacturers are expected to rapidly enter, significantly impacting pricing.

2. How will pricing differ across geographies post-generic entry?

Prices are expected to decline most in developed regions with established generic manufacturing, aligning with local regulatory and reimbursement environments. Emerging markets may see slower reductions due to valuation and importation costs.

3. What factors could slow down price reductions?

Delays in patent expiration, regulatory hurdles, limited manufacturing capacity, or restrictive reimbursement policies could sustain higher prices longer.

4. Are there opportunities for premium-priced novel formulations?

Yes. Extended-release or combination therapies under development may command higher prices if approved, though they are unlikely to impact the core generic price trends soon.

5. How does ACAMPROSATE CALC DR compare to competitors like naltrexone?

While acamprosate is effective for maintaining abstinence, naltrexone has broader indications and quicker onset of action, influencing prescriber preferences and affecting acamprosate's market share and pricing strategies.

References

- GlobalData. "Alcohol Dependence Treatment Market Overview", 2022.

- U.S. FDA. "Acamprosate Calcium (Campral) Summary," 2022.

- European Medicines Agency. "Product Information for Acamprosate," 2022.

- IQVIA. "Pharmaceutical Market Trends", 2021.

- proprietary industry analysis, 2023.

More… ↓