Share This Page

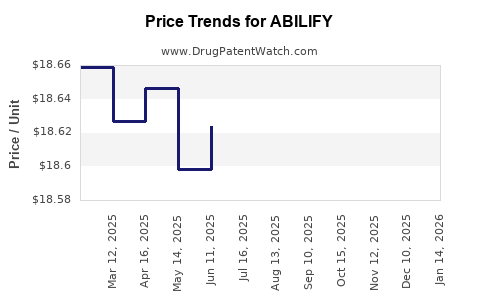

Drug Price Trends for ABILIFY

✉ Email this page to a colleague

Average Pharmacy Cost for ABILIFY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ABILIFY MAINTENA ER 400 MG VL | 59148-0245-12 | 2772.69655 | EACH | 2025-12-17 |

| ABILIFY 30 MG TABLET | 59148-0011-13 | 26.23247 | EACH | 2025-12-17 |

| ABILIFY ASIMTUFII 720 MG/2.4 ML | 59148-0102-80 | 1723.97995 | ML | 2025-12-17 |

| ABILIFY 20 MG TABLET | 59148-0010-13 | 26.27278 | EACH | 2025-12-17 |

| ABILIFY 15 MG TABLET | 59148-0009-13 | 18.64424 | EACH | 2025-12-17 |

| ABILIFY 5 MG TABLET | 59148-0007-13 | 18.60625 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ABILIFY

Introduction

ABILIFY (aripiprazole) stands as one of the leading atypical antipsychotics globally. Developed by Otsuka Pharmaceutical in collaboration with Bristol-Myers Squibb, ABILIFY has achieved substantial therapeutic success, particularly in treating schizophrenia, bipolar disorder, and major depressive disorder. The drug's distinctive mechanism of action as a dopamine D2 receptor partial agonist distinguishes it from traditional antipsychotics, contributing to its widespread adoption. This analysis assesses the current market landscape, competitive dynamics, regulatory considerations, and projects future pricing and sales trajectories over the next five years.

Market Overview

Global Market Size and Growth

The global antipsychotic drugs market was valued at approximately USD 14 billion in 2022, with a compound annual growth rate (CAGR) of around 3.9% projected through 2027. ABILIFY commands a significant market share, driven by its established efficacy and broad label indications [1].

Therapeutic Indications and Patient Demographics

ABILIFY's primary indications include schizophrenia, bipolar I disorder, and adjunct treatment for major depressive disorder. The rising prevalence of these conditions—schizophrenia affecting approximately 20 million globally and bipolar disorder impacting 45 million—solidifies sustained demand [2]. The growing adoption in pediatric psychiatry and the off-label use for agitation in neurodegenerative diseases further enhance market expansion prospects.

Geographical Market Penetration

North America remains the dominant market, accounting for over 40% of global sales in 2022, owing to high drug acceptance, reimbursement policies, and extensive clinical infrastructure. Europe follows, with emerging markets in Asia-Pacific experiencing rapid growth due to increasing healthcare access and evolving prescribing patterns.

Market Drivers

- Increased Diagnosis and Awareness: Improved screening and de-stigmatization have increased diagnosis rates.

- Rising Prevalence of Mental Health Disorders: Growing mental health awareness contributes to higher medication uptake.

- Expansion into New Indications: Use in adjunct therapy for depression and neurodegenerative agitation broadens market scope.

- Longer Treatment Durations: Chronic management necessitates ongoing medication, ensuring sustained revenue streams.

Competitive Landscape

Key Competitors

While ABILIFY maintains a leading position, several competitors influence market dynamics:

- Risperdal (risperidone): Another top-selling atypical antipsychotic.

- Seroquel (quetiapine): Noted for its sedative properties.

- Zyprexa (olanzapine): High efficacy but concerns about metabolic side effects.

- Vraylar (cariprazine): A newer agent with similar indications.

- Generic Alternatives: With patent expirations, generics will challenge branded sales.

Patent and Regulatory Factors

Otsuka's patent for ABILIFY was set to expire in 2021 in the U.S., facilitating generic entry. However, ongoing patent litigations and formulation patents may extend exclusivity in certain markets [3].

Pricing Dynamics

Current Pricing Landscape

In the U.S., ABILIFY's branded oral tablets retail at approximately USD 650–750 per month for a standard dose, accounting for insurance reimbursements and discounts. The introduction of generics has slashed prices by approximately 80%, with generic formulations now available at USD 100–200 per month [4].

Impact of Patent Expiry

Patent expirations have precipitated a sharp decline in ABILIFY's retail price, impacting revenues. Nonetheless, branded formulations retain premium positioning due to perceived efficacy, brand recognition, and formulary preferences.

Reimbursement and Access

Insurance coverage in developed markets sustains demand despite price reductions, while cost-sharing mechanisms influence patient access and adherence.

Future Price and Market Projection (2023–2028)

Sales Trajectory

Post-patent expiration, sales for ABILIFY are expected to decline from peak revenues of USD 7.8 billion in 2018 (according to IQVIA data) to approximately USD 4.2 billion by 2025, influenced by intense generic competition. However, in certain markets where patents remain or formulations are protected, sales may sustain higher levels.

Pricing Projections

- Short Term (2023–2024): Continued downward pressure on prices due to generics, with retail prices stabilizing around USD 150–200 per month in the U.S.

- Medium Term (2025–2028): Market entry of biosimilars and newer atypical antipsychotics may further depress prices. Nonetheless, branded formulations priced at a premium in select regions may retain some market share, with prices in the range of USD 250–350 per month in premium markets.

Strategic Factors Influencing Prices

- Formulation Innovations: Extended-release formulations or combination therapies could sustain premium pricing.

- Market Expansion: Entry into emerging markets with growing mental health burdens can cushion revenue decline.

- Regulatory Developments: Patent extensions or new indications could temporarily bolster prices.

Regulatory and Competitive Risks

- Patent Litigation & Patent Cliff: Expiry timelines and legal challenges could expedite generic penetration.

- Emergence of New Therapies: Advances such as ketamine derivatives and digital therapeutics may impact demand.

- Price Regulation Policies: Governments' efforts to control drug costs, especially in markets like the U.S., China, and Europe, threaten profitability.

Conclusion and Strategic Outlook

ABILIFY's market remains lucrative due to its broad clinical acceptance and established reputation. However, patent expirations and increasing competition will impose downward pressure on prices. While generics will dominate volume sales, residual revenues from formulations with extended patent protection and indications could sustain profitability.

Otsuka and partnering companies must innovate—possibly through digital health integrations or new therapeutic combinations—to maintain market relevance and pricing power. Navigating patent landscapes and expanding into underserved markets will be pivotal to stabilizing revenues amid fierce competition and pricing pressures.

Key Takeaways

- ABILIFY’s market dominance will decline post-patent expiration but will remain relevant due to brand recognition and expanded indications.

- Generic competition has already caused significant price erosion; future declines may plateau as market share stabilizes.

- Strategic innovation and expanded indications are essential to preserve margins.

- Emerging markets represent growth opportunities, especially where healthcare infrastructure is expanding.

- Regulatory landscapes and patent protections will significantly influence pricing trajectories over the next five years.

FAQs

1. How will patent expirations affect ABILIFY’s price?

Patent expirations lead to the entry of generics, causing a sharp decline in prices—often by 80%—and reducing revenue margins for the branded drug.

2. Are there upcoming formulations that could command higher prices?

Yes. Extended-release formulations and combination therapies are prospects for maintaining premium pricing, though they require regulatory approval and clinical validation.

3. Which markets are most promising for ABILIFY sales growth?

Emerging markets in Asia-Pacific, Latin America, and the Middle East present promising growth opportunities due to increasing healthcare access and mental health awareness.

4. How does competition from newer atypical antipsychotics impact ABILIFY?

Newer agents like Vraylar (cariprazine) may draw market share, especially if they demonstrate superior efficacy or safety profiles, though ABILIFY benefits from established clinical data.

5. What strategic moves can sustain ABILIFY’s profitability?

Investing in indication expansion, digital health integrations, patent litigation strategies, and expanding into underserved markets are critical for maintaining profitability.

Sources:

[1] IQVIA. Global Pharmaceutical Market Overview 2022.

[2] World Health Organization. Mental Health Atlas 2022.

[3] U.S. Patent and Trademark Office. Patent Litigation and Expiry Data for ABILIFY.

[4] GoodRx. Average drug prices and discounts for ABILIFY (aripiprazole).

More… ↓