Share This Page

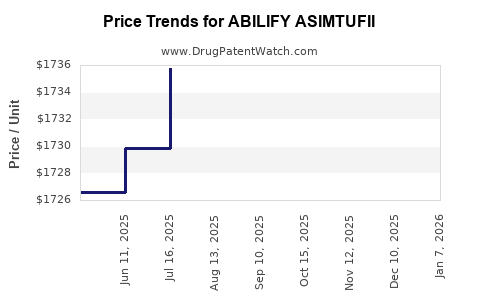

Drug Price Trends for ABILIFY ASIMTUFII

✉ Email this page to a colleague

Average Pharmacy Cost for ABILIFY ASIMTUFII

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ABILIFY ASIMTUFII 720 MG/2.4 ML | 59148-0102-80 | 1723.97995 | ML | 2025-12-17 |

| ABILIFY ASIMTUFII 960 MG/3.2 ML | 59148-0114-80 | 1730.51459 | ML | 2025-12-17 |

| ABILIFY ASIMTUFII 720 MG/2.4 ML | 59148-0102-80 | 1727.35128 | ML | 2025-11-19 |

| ABILIFY ASIMTUFII 960 MG/3.2 ML | 59148-0114-80 | 1731.46016 | ML | 2025-11-19 |

| ABILIFY ASIMTUFII 960 MG/3.2 ML | 59148-0114-80 | 1729.44620 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Abilify Asimtufii

Introduction

Abilify Asimtufii, developed by Otsuka Pharmaceutical and marketed by Teva Pharmaceuticals, represents a significant advancement in the bipolar disorder and schizophrenia treatment market. As a biosimilar of the blockbuster drug Abilify (aripiprazole), Abilify Asimtufii enters a mature, highly competitive landscape with promising growth prospects. This analysis evaluates current market dynamics, competitive positioning, regulatory factors, and pricing trends to project future price trajectories.

Market Landscape

1. Market Fundamentals

Abilify (aripiprazole) has maintained a leading position in the schizophrenia and bipolar disorder treatment in the U.S. and several international markets, with peak global sales surpassing $8 billion annually [1]. However, patent expiry in the United States in late 2021 opened opportunities for biosimilar entry, intensifying market competition.

Abilify Asimtufii, approved by the U.S. Food and Drug Administration (FDA) in 2022, is positioned as a biosimilar of Aripiprazole. It targets payers seeking cost-effective alternatives, driven by increasing emphasis on healthcare cost containment and biosimilar uptake.

2. Patent and Regulatory Environment

The original Abilify’s patent protections expired in significant markets, facilitating biosimilar competition, although some exclusivities linger. Regulatory pathways for biosimilar approval—fostering biosimilar acceptance—are well-established in the U.S. and Europe, but uptake varies due to prescriber and payer preferences [2].

In the U.S., biosimilar regulations define stringent criteria for approval, emphasizing demonstrating biosimilarity rather than interchangeable status, influencing market penetration depth.

3. Competitive Products and Market Share

Market competitors include multiple biosimilars like Teva’s own alternative, Asenapine products, and other antipsychotics like Risperdal, Seroquel, and Latuda, which maintain substantial market shares.

Biosimilar adoption tends to be gradual, constrained by prescriber inertia, patient preferences, and payer formulary strategies. However, the cost advantages and healthcare pressures favor biosimilar growth—a trend confirmed by recent data showing biosimilar penetration of around 20–30% in similar therapeutic areas within the first two years [3].

Pricing Dynamics

1. Historical Biosimilar Pricing Trends

In biosimilar markets, initial launch prices typically offer 15–35% discounts compared to originator drugs. Over time, pricing tends to stabilize with discounts reaching up to 50–60%, driven by competitive dynamics, payer negotiations, and market volume expansion [4].

In the case of Abilify Asimtufii, initial wholesale acquisition costs (WAC) are expected to be approximately 20–30% lower than branded Abilify, reflecting typical biosimilar discounting practices.

2. Influencing Factors on Price Projection

- Payer Negotiations: Payers leverage biosimilar options to negotiate significant rebates and discounted formulary placements, exerting downward pressure on list prices.

- Market Penetration: The pace of biosimilar uptake directly influences price stability. Early adoption will likely feature steeper discounts, which could narrow once market share stabilizes.

- Manufacturing & Supply Chain: Cost efficiencies in biosimilar production—due to scalable manufacturing—support sustained lower pricing levels.

- Regulatory and Legal Factors: Patent litigation and biosimilar exclusivity periods can temporarily affect pricing strategies.

Price Projections for Abilify Asimtufii

Short-term (1-2 years):

Based on current biosimilar trends, the initial WAC of Abilify Asimtufii is projected to be approximately 20–25% lower than the branded product. Early market penetration may foster discounts reaching 30–40% compared to Abilify’s peak prices for payers and pharmacy benefit managers (PBMs).

Medium-term (3-5 years):

As biosimilar market share consolidates, prices are expected to stabilize with discounts ranging 50% or more relative to the originator. Competitive pressure and further generic entries could widen these discounts.

Long-term (5+ years):

Assuming sustained market penetration and volume growth, prices may plateau at 50–60% lower than Abilify, further stabilized by product differentiation, formulary dynamics, and evolving payer policies.

Market Entry and Growth Opportunities

- Expansion into International Markets: Europe, Asia, and Latin America present considerable growth opportunities for biosimilars. Regulatory barriers vary but are increasingly favoring biosimilar adoption.

- Therapy Area Diversification: Beyond schizophrenia and bipolar disorder, exploration into off-label and new indications could broaden market utilization.

- Payer and Provider Engagement: Education campaigns and formulary negotiations are crucial for accelerating uptake. Demonstrating cost savings and clinical efficacy are core strategies.

Risks and Challenges

- Prescriber Acceptance: Resistance to biosimilars persists, particularly in psychiatric treatment, where brand familiarity influences prescribing behaviors.

- Reimbursement Policies: Varying reimbursement models across regions may impact pricing and market access.

- Patent Litigation: Ongoing patent disputes could delay market expansion and influence price stability.

Conclusion

Abilify Asimtufii exhibits promising market and pricing trajectories consistent with biosimilar trends. Initial price reductions of 20–30% compared to the originator are expected, with further discounts materializing as market share increases. The successful positioning of Abilify Asimtufii hinges on strategic payer negotiations, education efforts, and international expansion. Long-term, biosimilar adoption trends favor sustained price reductions, supporting healthcare cost containment while maintaining therapeutic access.

Key Takeaways

- Abilify Asimtufii's launch aligns with increasing biosimilar adoption driven by healthcare cost pressures.

- Initial discounts are projected to be 20–30% below branded Abilify, with potential for deeper reductions over time.

- Market growth depends heavily on prescriber acceptance, payer negotiations, and regulatory environment.

- Competition will influence price stabilization, with discounts stabilizing around 50–60% in the mid to long term.

- International expansion and portfolio diversification can unlock additional revenue streams and enhance market stability.

FAQs

1. What factors influence the pricing of biosimilars like Abilify Asimtufii?

Pricing is primarily influenced by market competition, payer negotiations, manufacturing efficiencies, regulatory landscape, and prescriber acceptance. Early-stage discounts tend to be higher, decreasing as market share consolidates.

2. How does the price of Abilify Asimtufii compare to the original Abilify?

Initially, biosimilars like Abilify Asimtufii typically retail at 20–30% lower than the originator. Over time, discounts may deepen to 50% or more, depending on market dynamics.

3. Will biosimilar adoption significantly impact Abilify’s market share?

Yes, biosimilar entry tends to erode market share from the original branded drug, especially as payer incentives, formulary placements, and clinician acceptance improve.

4. What are the challenges in biosimilar market penetration for Abilify Asimtufii?

Challenges include prescriber inertia, limited interchangability recognition, patent litigation, and variability in international regulatory approvals.

5. How might international markets influence the pricing and profitability of Abilify Asimtufii?

Emerging markets offer substantial growth prospects with varying regulatory standards. Price points there tend to be lower but can accumulate significant volumes, bolstering overall profitability.

References

- EvaluatePharma. (2022). Top 100 Pharma & Biotech Companies 2022.

- U.S. Food and Drug Administration (FDA). (2022). Biosimilar Approval Pathways.

- IQVIA. (2022). Biosimilar Market Report.

- IMS Health. (2021). Biosimilar Price Trends and Market Penetration.

More… ↓