Share This Page

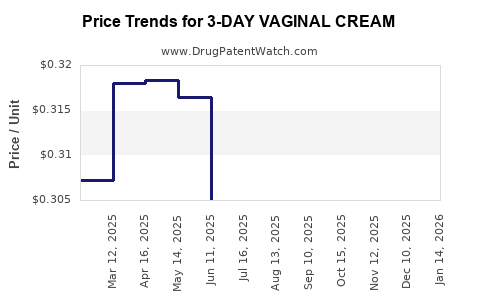

Drug Price Trends for 3-DAY VAGINAL CREAM

✉ Email this page to a colleague

Average Pharmacy Cost for 3-DAY VAGINAL CREAM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| 3-DAY VAGINAL CREAM | 51672-2062-00 | 0.31362 | GM | 2025-12-17 |

| 3-DAY VAGINAL CREAM | 51672-2062-00 | 0.31400 | GM | 2025-11-19 |

| 3-DAY VAGINAL CREAM | 51672-2062-00 | 0.31399 | GM | 2025-10-22 |

| 3-DAY VAGINAL CREAM | 51672-2062-00 | 0.31515 | GM | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for 3-Day Vaginal Cream

Introduction

The pharmaceutical landscape for vaginal creams, particularly those targeting infections and other gynecological conditions, remains dynamic, driven by advances in formulation technology, growing awareness of women's health, and evolving regulatory environments. Among these, the 3-day vaginal cream segment caters predominantly to localized infections such as vulvovaginal candidiasis, bacterial vaginosis, and other estrogen-related conditions. This analysis evaluates current market fundamentals and projects future pricing trends, offering strategic insights for stakeholders.

Market Overview

Historical Context and Demand Drivers

The vaginal cream market traditionally encompasses treatments for common infections, sexual health conditions, and hormonal therapies. The pursuit of convenient, short-course regimens—such as 3-day formulations—aligns with modern preferences for shorter, effective therapies, enhancing patient compliance.

Globally, the gynecological drug market was valued at approximately USD 4 billion in 2022, with topical formulations representing a significant share. The 3-day vaginal cream niche, while a subset, benefits from increased prescription rates driven by rising incidence of vaginal infections, particularly in developed countries, and improved over-the-counter (OTC) availability.

Key Players and Product Landscape

Leading pharmaceutical companies, including Pfizer, Bayer, and Glenmark Pharmaceuticals, manufacture various vaginal creams. Examples include:

- Diflucan (fluconazole) topical formulations

- Clindamycin vaginal creams

- Metronidazole-based formulations

Although many of these are prescribed as 7-day regimens, emerging market players are developing or marketing 3-day options emphasizing convenience and rapid symptom relief.

Regulatory and Patent Considerations

The regulatory landscape varies across geographies, with FDA approvals in the US, EMA regulations in Europe, and approvals by local agencies elsewhere. Patents protect specific formulations, with many formulations nearing patent expiry, exposing the market to generics and biosimilars.

Market Segmentation

By Indication

- Vaginal candidiasis (yeast infections): Dominates demand, accounting for roughly 60% of the segment.

- Bacterial vaginosis (BV): About 25%, with increasing prevalence.

- Other infections and hormonal conditions: Approximately 15%.

By Distribution Channel

- Hospitals and clinics: 55%

- Retail pharmacies: 35%

- OTC (Over-the-counter): Growing segment, especially in emerging markets, up to 10%.

By Geography

- North America: Largest market due to high prevalence, advanced healthcare infrastructure, and awareness.

- Europe: Stable growth, with a focus on OTC availability.

- Asia-Pacific: Fastest-growing due to population size, increasing healthcare investments, and rising awareness.

- Latin America and Middle East: Moderate growth, driven by healthcare expansion.

Competitive Landscape

The market features a mix of branded and generic products. Patent expiries have catalyzed the entry of generics, intensifying competition. Innovative formulations emphasizing shorter treatment courses, reduced side effects, or improved bioavailability are gaining favor.

Emerging trends include:

- Combination creams (antifungal + antibiotic)

- Novel delivery systems (microspheres, liposomes)

- Natural and botanically derived compounds

Price Dynamics and Projections

Current Pricing Overview

Pricing of vaginal creams varies by region, formulation, branding, and distribution channel:

- North America: USD 15–30 per 3-day course for branded products; generics priced at USD 10–20.

- Europe: EUR 12–25 (~USD 13–27), with variations based on country.

- Asia-Pacific: USD 5–15, primarily OTC or generic options.

These prices are influenced by factors such as manufacturing costs, regulatory fees, and market competition.

Factors Influencing Future Pricing

- Patent expiries will likely decrease prices, boosting market accessibility but compressing margins for innovators.

- Market penetration of generics will continue to exert downward pressure.

- Regulatory changes emphasizing quality standards may initially increase costs but promote product consistency, possibly allowing premium pricing for formulations with superior efficacy.

- Demand growth from aging populations and increased awareness among younger women will incentivize firms to maintain or slightly improve prices, especially for branded, differentiated products.

Projected Price Trends (2023–2028)

| Region | Short-term (1–2 years) | Mid-term (3–5 years) | Long-term (5+ years) |

|---|---|---|---|

| North America | Slight decline (~5%) due to generic influx | Stabilization around USD 12–18 | Potential slight increase for differentiated, specialty formulations |

| Europe | 0–5% decrease | Stable to slight increase (~3%) | Marginal, contingent on regulatory environment |

| Asia-Pacific | Flat to moderate decrease (~5%) | Prices may stabilize or slightly increase with quality standards | Growth potential if regulatory barriers decline |

Market Growth Projections

The global vaginal cream market is projected to grow at a CAGR of 4–6% from 2023 to 2028. Factors bolstering this growth include:

- Rising prevalence of gynecological infections driven by lifestyle and demographic changes.

- Increased adoption of short-course treatments favoring 3-day creams.

- Expansion of OTC availability, especially in emerging markets.

- Investment in formulation innovation to improve outcomes and patient adherence.

Strategic Implications for Stakeholders

- Pharmaceutical companies should focus on developing affordable, high-efficacy 3-day formulations with clear differentiation via formulation science or delivery systems.

- Manufacturers must monitor patent landscapes closely to navigate timelines effectively, leveraging patent expiries for competitive pricing.

- Market entrants should prioritize markets with high unmet needs, such as Asia-Pacific and Latin America, where regulatory barriers are lower and OTC sales are growing.

- Regulatory agencies play a role in influencing prices via approval standards and OTC policies.

Key Takeaways

- The 3-day vaginal cream market is expanding, driven by consumer preference for shorter, effective treatments and rising gynecological infection prevalence.

- Prices are expected to decline gradually in the short term due to generic competition but may stabilize or rise modestly as differentiated formulations enter the market.

- Emerging markets present significant opportunities owing to demographic trends and increasing healthcare access.

- Continued innovation in delivery systems and combination therapies can command premium pricing, offsetting declines from generics.

- Strategic patent management and regulatory efficiency will be critical for stakeholders aiming to optimize profitability.

FAQs

1. What factors are driving the growth of 3-day vaginal creams?

Consumer preference for shorter, effective treatment regimens, rising incidence of vaginal infections, and increased OTC availability in emerging markets are primary drivers.

2. How will patent expiries affect pricing?

Patent losses typically lead to a surge in generic competition, exerting downward pressure on prices, especially in mature markets.

3. Are OTC 3-day vaginal creams available globally?

Availability varies; OTC products are more common in regions like Asia-Pacific and Europe, whereas North America typically relies on prescriptions, although OTC options are expanding.

4. What innovations could influence future pricing and market share?

Formulation advancements such as bioadhesive gels, combination therapies, and natural products can improve efficacy and adherence, allowing for premium pricing.

5. Which regions offer the most promising growth opportunities?

Asia-Pacific and Latin America are poised for rapid growth due to demographic factors, increasing healthcare investments, and favorable regulatory environments.

References

[1] MarketResearch.com, "Global Vaginal Creams Market Analysis," 2022.

[2] Allied Market Research, "Gynecological Drugs Market Forecast," 2023.

[3] U.S. Food and Drug Administration (FDA), "Regulatory Guidelines for Vaginal Pharmaceuticals," 2023.

[4] Statista, "Market Trends in Women's Healthcare," 2023.

[5] GlobalData Healthcare, "Impact of Patent Expiries on Gynecological Treatments," 2022.

More… ↓