Share This Page

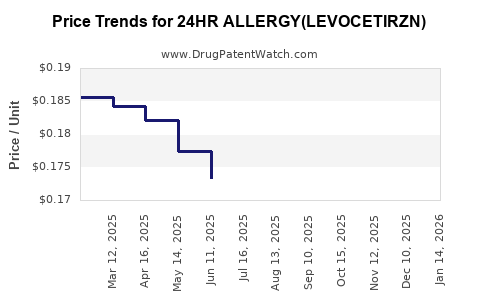

Drug Price Trends for 24HR ALLERGY(LEVOCETIRZN)

✉ Email this page to a colleague

Average Pharmacy Cost for 24HR ALLERGY(LEVOCETIRZN)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| 24HR ALLERGY(LEVOCETIRZN) 5 MG | 70000-0362-01 | 0.18760 | EACH | 2025-12-17 |

| 24HR ALLERGY(LEVOCETIRZN) 5 MG | 70000-0362-02 | 0.18760 | EACH | 2025-12-17 |

| 24HR ALLERGY(LEVOCETIRZN) 5 MG | 70000-0362-01 | 0.19000 | EACH | 2025-11-19 |

| 24HR ALLERGY(LEVOCETIRZN) 5 MG | 70000-0362-02 | 0.19000 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for 24HR ALLERGY (Levocetirizn)

Introduction

Levocetirizn, marketed under the brand name 24HR ALLERGY among others, is a second-generation antihistamine primarily used for allergy relief, including hay fever (allergic rhinitis) and chronic idiopathic urticaria. With its prolonged activity profile, 24HR ALLERGY has become a popular over-the-counter (OTC) and prescription medication globally. This analysis evaluates the current market landscape, competitive positioning, regulatory environment, and provides price forecasts over the next five years to support strategic decision-making.

Market Landscape and Demand Drivers

Global Prevalence of Allergic Conditions

The rising incidence of allergic rhinitis and chronic urticaria, fueled by urbanization, pollution, and climate change, sustains strong demand for safe, effective antihistamines like levocetirizn. The World Allergy Organization estimates that allergic rhinitis affects approximately 20-30% of the global population, with significant regional variations. The chronic nature of these conditions ensures sustained demand for long-acting antihistamines, supporting a steady market.

Therapeutic Alternatives and Competition

Levocetirizn’s primary competitors include other second-generation antihistamines such as loratadine (Claritin), cetirizine (Zyrtec), and fexofenadine (Allegra). These drugs compete based on efficacy, safety, dosing convenience, and pricing. The differential advantages of levocetirizn—higher affinity for peripheral H1-receptors and potentially fewer sedative effects—position it favorably among clinicians and consumers seeking effective allergy relief with minimal side effects.

Consumer Trends and Market Segments

There is an upward trend in self-medication, driven by OTC availability of levocetirizn products. Additionally, aging populations in developed markets and increased awareness contribute to higher prescription volumes, particularly for moderate-to-severe cases. Emerging markets exhibit growth potential due to expanding healthcare infrastructure and increased disease recognition.

Regulatory Environment

Levocetirizn is approved for OTC and prescription use in numerous countries, including the US, EU member states, and advanced markets in Asia. The regulatory pathway for novel formulations or combination products remains competitive, but generic entry has been consolidated in many regions, intensifying price competition.

Patents for original formulations have largely expired or are close to expiration, enabling a surge in generic and OTC versions that exert downward pressure on prices. Regulatory agencies’ evolving approval standards and patent litigation strategies shape market dynamics.

Current Pricing Landscape

Brand vs. Generic Pricing

In the US, branded levocetirizn products typically retail between $10–$25 per package (30-50 tablets), while generics dominate at lower price points of $5–$10 per package. OTC formulations are generally priced similarly or slightly higher due to convenience factors and branding premiums.

In Europe, retail prices for branded products vary between €8–€15, with generics broadly available at 40–70% of branded prices. In emerging markets, prices are often significantly lower, reflecting purchasing power and local regulatory controls.

Pricing Trends

Recent years have shown a decline in prices driven by patent expiration and increased generic competition. Direct-to-consumer advertising remains limited outside the US, but increased online availability has contributed to demand elasticity and price sensitivity.

Market Projections (2023-2028)

Revenue Forecasts

The global antihistamine market, valued around $5 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of approximately 5–6% through 2028. Levocetirizn, representing a significant share of this market, is expected to benefit from increasing prescription rates and OTC availability.

Sales Volume Trends

The elevated adoption of OTC levocetirizn products, along with expansion into emerging markets, suggests a steady annual volume growth of around 4–5%. The increasing prevalence of allergic conditions supports sustained demand, especially in developed countries with better healthcare access.

Price Trajectory

-

Short-term (2023–2025): Prices will likely stabilize or slightly decline as generic versions proliferate. Branded products may maintain premium pricing in select markets with minimal generic stock, but overall downward pressure persists.

-

Medium to Long-term (2026–2028): As patent protections decline further and generic manufacturers expand, prices are expected to decrease by an additional 10–20% across most markets. The rise of direct-to-consumer online sales could further compress margins and retail prices.

Key Market Factors Impacting Pricing

- Generic Competition: Increased manufacturing and regulatory approvals lower prices.

- Regulatory Changes: Potential reclassification of levocetirizn from prescription to OTC status in certain regions could increase volume but pressure prices downwards.

- Health Policy Changes: Payor and insurance coverage policies, especially in the US, influence retail pricing and patient out-of-pocket expenses.

- Innovations and Formulation Developments: Introduction of combination products or long-acting formulations could command premium pricing, temporarily offsetting downward trends.

Strategic Implications for Stakeholders

For pharmaceutical companies, sustaining profitability will depend on developing differentiated formulations, optimizing supply chain efficiencies, and navigating regulatory pathways to maintain market share. Price competition will intensify, emphasizing brand loyalty and patient adherence.

For investors, the market offers opportunities in building portfolios of generic levocetirizn products, especially in emerging markets where growth is rapid. Pricing strategies should adapt to local market dynamics to maximize margins.

Key Takeaways

- Demand stability driven by allergy prevalence and consumer preference for OTC products supports a resilient market.

- Pricing trends are shifting downward due to patent expiry and generic proliferation, with prices expected to decline by 10–20% over the next five years.

- Market expansion into emerging markets and increased OTC availability will be primary growth drivers.

- Regulatory and patent landscape influences pricing trajectories; staying abreast of policy changes is critical.

- Innovation in formulations may temporarily offset price declines and create niche premium markets.

Conclusion

The global market for levocetirizn (24HR ALLERGY) exhibits resilient demand with an evolving competitive and regulatory landscape. Price projections indicate a gradual decline driven by generics and increased market penetration, but growth opportunities endure through market expansion, formulation innovation, and strategic positioning in emerging economies. Stakeholders should balance cost efficiency with innovation to sustain profitability amidst price erosion.

5 FAQs

Q1: How will patent expirations affect levocetirizn prices?

A: Patent expirations typically lead to increased generic competition, resulting in significant price reductions—often between 10–20% over several years—due to increased supply and market saturation.

Q2: Are there opportunities for premium pricing with new formulations?

A: Yes. Developing long-acting, combination, or pediatric formulations can command higher prices temporarily, especially in niche markets or with improved adherence profiles.

Q3: Which regions present the highest growth potential?

A: Emerging markets in Asia, Latin America, and Africa offer rapid growth due to expanding healthcare infrastructure, rising allergy prevalence, and increasing OTC availability.

Q4: What regulatory changes could impact pricing strategies?

A: Moves to reclassify levocetirizn from prescription to OTC status, or approval of biosimilars and alternative delivery methods, could influence market dynamics and pricing.

Q5: How does online sales influence levocetirizn pricing?

A: Online distribution channels increase price transparency and competition, often leading to further price reductions, but also offer new avenues for branding and user engagement.

Sources:

- World Allergy Organization Reports, 2022.

- IQVIA, Global Pharmaceutical Market Data, 2022.

- U.S. FDA Drug Approvals and Patent Status, 2022.

- European Medicines Agency (EMA), Market Authorizations, 2022.

- Industry Market Research Reports, 2023.

More… ↓