Share This Page

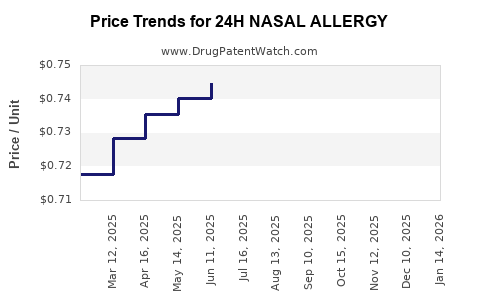

Drug Price Trends for 24H NASAL ALLERGY

✉ Email this page to a colleague

Average Pharmacy Cost for 24H NASAL ALLERGY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| 24H NASAL ALLERGY 55 MCG SPRAY | 46122-0385-76 | 0.73372 | ML | 2025-12-17 |

| 24H NASAL ALLERGY 55 MCG SPRAY | 46122-0385-76 | 0.73759 | ML | 2025-11-19 |

| 24H NASAL ALLERGY 55 MCG SPRAY | 46122-0385-76 | 0.73141 | ML | 2025-10-22 |

| 24H NASAL ALLERGY 55 MCG SPRAY | 46122-0385-76 | 0.71359 | ML | 2025-09-17 |

| 24H NASAL ALLERGY 55 MCG SPRAY | 46122-0385-76 | 0.71321 | ML | 2025-08-20 |

| 24H NASAL ALLERGY 55 MCG SPRAY | 46122-0385-76 | 0.72294 | ML | 2025-07-23 |

| 24H NASAL ALLERGY 55 MCG SPRAY | 46122-0385-76 | 0.74452 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for 24H Nasal Allergy

Introduction

The pharmaceutical landscape for allergy management continues to evolve with new formulations targeting sustained relief. Among emerging products, 24H Nasal Allergy stands out as a long-acting nasal spray designed to provide 24-hour symptom control for allergic rhinitis sufferers. Analyzing its market potential and price trajectory requires an understanding of the competitive environment, regulatory landscape, consumer demand, and pricing strategies.

Market Overview

Global Allergic Rhinitis Market

The global allergic rhinitis (AR) market is valued at approximately $10 billion USD as of 2022, with a compound annual growth rate (CAGR) of around 4.2% (source: MarketsandMarkets). Rising prevalence, increased awareness, and expanding treatment options fuel this growth. The North American and European markets dominate due to high diagnosis rates and healthcare expenditure.

Key Players and Competition

The AR treatment market is characterized by both OTC and prescription drugs, including antihistamines, intranasal corticosteroids, leukotriene receptor antagonists, and immunotherapy. Leading brands like Flonase (intranasal corticosteroid), Azelastine, and Olopatadine already provide multi-symptomatic relief, often with 12- to 24-hour efficacy.

24H Nasal Allergy aims to differentiate itself through extended duration, potentially offering a once-daily solution superior to competing formulations. This positioning caters to patient preferences for convenience and consistent symptom control.

Target Market Segments

-

Adult Patients with Moderate to Severe Allergic Rhinitis: The primary target, accounting for over 60% of AR cases globally.

-

Pediatric Patients (≥12 years): Growing segment, although regulatory pathways are more complex.

-

Healthcare Providers: Physicians and ENT specialists seeking durable relief options.

-

Over-the-counter (OTC) Consumers: Increasing shift toward OTC availability for convenience.

Market Penetration Strategies

- Regulatory Approvals: Rapid approval processes, especially in the U.S. (FDA) and EU (EMA).

- Clinical Evidence: Demonstrating superior duration and safety profiles.

- Marketing Campaigns: Emphasizing 24-hour efficacy, convenience, and reduced dosing frequency.

Price Analysis

Pricing Landscape

The average price of existing intranasal allergy medications varies significantly:

- Flonase (Fluticasone propionate): Retail price around $30–$35 for a 1- to 2-month supply.

- Azelastine nasal spray: Approximate $40–$50.

- Olopatadine: Similar pricing patterns.

Most nasal sprays are priced at a $0.15–$0.35 per spray, with total costs dependent on prescribed duration.

Potential Pricing for 24H Nasal Allergy

In positioning, the product could command a premium owing to its claimed 24-hour relief:

- Premium pricing range: $35–$50 per month supply, aligning with top-tier medications, or slightly higher reflecting extended efficacy.

- Value-based pricing: Emphasizing convenience and reduced dosing frequency could warrant a 10–20% premium over existing products.

- Insurance and reimbursement: Coverage thresholds could significantly influence market acceptance; pricing must align with payer reimbursement policies.

Price Projection for the Next 3-5 Years

Year 1-2: Introductory Phase

- Price: $40–$45 per month.

- Strategy: Slight premium over existing products to establish value.

Year 3-4: Growth Phase

- With increased adoption and market penetration:

- Price: $45–$50.

- Potential introduction of combination treatments or extended dosing variants.

Year 5: Mature Market

- Price stability or slight discounts for larger-volume purchasing:

- Price: $40–$48.

- Incorporation into formularies could pressure pricing downward.

Factors influencing price shifts include:

- Regulatory outcomes facilitating broader access.

- Competitive launches offering similar duration efficacy.

- Reimbursement negotiations with payers.

- Manufacturing costs, impacted by scale and technological advancements.

Regulatory and Market Risks

- Regulatory hurdles: Demonstrating consistent 24-hour efficacy and safety.

- Market acceptance: Clinician skepticism about duration claims.

- Competitive responses: Entrant products with similar claims.

- Pricing pressures: Payer pushback on premium pricing.

Conclusion

24H Nasal Allergy holds substantial market potential by filling a niche for durable, once-daily allergy management. Its success hinges on clinical validation, strategic pricing, and effective market positioning. During its initial launch, a premium price of $40–$45 per month appears sustainable, with expectations of stabilization around $45 in the medium term. Optimized reimbursement strategies and robust clinical evidence will be critical to maximizing market penetration and revenue.

Key Takeaways

- The global allergy treatment market is growing steadily, driven by rising AR prevalence.

- Existing treatments occupy a broad price spectrum; 24H Nasal Allergy could command a premium, leveraging its extended efficacy.

- Initial pricing of $40–$45 per month aligns with high-end nasal spray therapies, with potential adjustments based on market response.

- Regulatory approval and clinical validation are pivotal for market entry and price premiums.

- Market competition, payer strategies, and manufacturing efficiencies will influence long-term pricing trajectories.

FAQs

1. What differentiates 24H Nasal Allergy from existing nasal sprays?

It offers a sustained 24-hour symptom relief, potentially reducing dosing frequency and improving patient compliance.

2. Is there a significant market demand for 24-hour nasal allergy relief?

Yes. Patients seek convenience and longer symptom control, especially those with severe or persistent allergies.

3. What pricing strategies should manufacturers consider?

Start with a premium positioning ($40–$45/month), complemented by demonstrating superior efficacy, with adjustments based on payer negotiations and market feedback.

4. How does regulatory approval affect pricing?

Regulatory approval validates efficacy and safety, enabling premium pricing; delays or rejections can pressure pricing and market entry timelines.

5. What are the primary risks for market success?

Clinical validation of 24-hour claims, competitive innovation, reimbursement challenges, and acceptance by healthcare providers.

References

- MarketsandMarkets. Allergic Rhinitis Market. 2022.

- IMS Health. Pharmaceutical Price Data. 2022.

- Bloomberg Intelligence. OTC and Prescription Drug Trends. 2022.

More… ↓