Last updated: July 27, 2025

Introduction

Pyrimethamine, a dihydrofolate reductase inhibitor primarily used as an antimalarial and antiparasitic agent, has experienced variable market dynamics influenced by evolving healthcare needs, regulatory landscapes, and emerging resistance patterns. Its financial trajectory, shaped by clinical efficacy, patent status, and development pipelines, offers strategic insights into its commercial potential within the pharmaceutical market.

Historical Overview and Therapeutic Indications

Initially approved in the 1950s, pyrimethamine gained prominence as a cornerstone in antimalarial therapy, particularly for Plasmodium falciparum infections. Over subsequent decades, it expanded into treating toxoplasmosis and parasitic infections, often in combination regimes — notably with sulfadiazine for toxoplasmosis (1). Its established clinical utility has cemented its place in parasitology, especially in regions with limited healthcare resources.

Market Dynamics Influencing Pyrimethamine

1. Resistance Trends and Efficacy Challenges

A critical determinant impacting pyrimethamine's market is the emergence of drug resistance, notably in malaria-endemic regions. Plasmodium falciparum has developed mutations in dihydrofolate reductase genes, diminishing drug efficacy (2). Such resistance pressures have curtailed its standalone use, prompting shifts towards combination therapies with artemisinin derivatives or newer agents, reducing pyrimethamine’s market share.

2. Regulatory Landscape and Patent Considerations

Unlike many modern pharmaceuticals, pyrimethamine’s patent protections have long expired, placing it in the generic domain for decades. This status diminishes profitability potential and constrains investment in research. Regulatory agencies have also tightened approval criteria, especially amid concerns about resistance and safety profiles, further limiting new market opportunities (3).

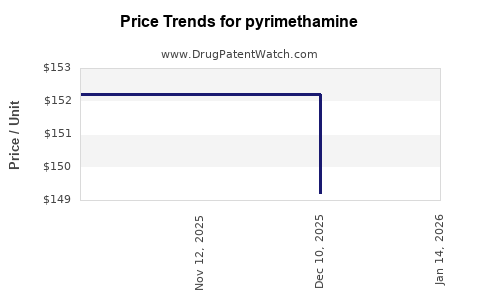

3. Supply Chain and Manufacturing Factors

Generic manufacturers dominate pyrimethamine production, ensuring low retail prices in endemic regions. However, supply chain disruptions or manufacturing capacity constraints can influence availability and pricing structures, thereby affecting market stability and revenues.

4. Competition from Modern Therapeutics

The advent of more effective, resistance-proof antimalarials and antiparasitic agents diminishes pyrimethamine’s therapeutic prominence. Drugs such as artemisinin-based combination therapies (ACTs) have become the standard of care, marginalizing pyrimethamine’s role (4). Nonetheless, its continued use in niche indications sustains a residual market.

5. Demographic and Epidemiological Trends

While global malaria mortality has declined due to comprehensive control programs, endemic regions sustain demand for affordable, effective drugs like pyrimethamine. However, shifting demographics, urbanization, and integrated vector management strategies influence disease prevalence and therapeutic needs, directly affecting market size.

Financial Trajectory and Market Outlook

1. Current Market Size and Segments

The global antimalarial drugs market was valued at approximately USD 4 billion in 2021, with pyrimethamine constituting a minor fraction primarily attributable to existing stockpiles, off-label uses, or niche indications (5). Its market is predominantly localized in resource-limited settings across Africa and Asia.

2. Revenue Drivers and Challenges

Limited patent protection and high generic competition suppress pricing power. The drug’s revenue predominantly derives from government procurement programs, humanitarian aid, and international health organizations. Despite ongoing demand, profitability remains modest, with revenues plateauing due to resistance and competition (6).

3. Research and Development Investments

Few pharmaceutical companies invest significantly in pyrimethamine innovation. Occasional efforts focus on developing new formulations with improved pharmacokinetics or resistance mitigation mechanisms. However, these programs often face hurdles related to regulatory approval, market demand, and the availability of superior alternatives.

4. Future Growth Potential

Looking ahead, the prospects for pyrimethamine hinge on addressing resistance issues and potential new indications. For instance, investigations into its role in cancer therapy or repurposing for emerging parasitological threats could unlock market opportunities. Currently, however, the outlook remains subdued, with growth driven mainly by existing supply-demand dynamics rather than innovative breakthroughs.

Regulatory and Ethical Considerations

Given its age and established use, pyrimethamine faces minimal regulatory hurdles for continued use in approved indications. However, emerging concerns around resistance and safety profiles necessitate vigilant pharmacovigilance. International organizations are likely to influence pricing and distribution, especially in low-income regions, impacting revenue streams.

Conclusion and Strategic Implications

The market dynamics for pyrimethamine are characterized by decline or stagnation owing to resistance development, generic competition, and the availability of superior therapies. Its financial trajectory reflects low profitability prospects, with steady demand confined to specific geographic and clinical niches. Future investments should focus on overcoming resistance barriers, exploring novel formulations, or repurposing opportunities to sustain its relevance.

Key Takeaways

- Resistance Mitigates Market Potential: Growing resistance in malaria-endemic regions limits pyrimethamine's efficacy and adoption, challenging its long-term profitability.

- Generic Status Limits Revenue Growth: Patent expiration has led to widespread generic availability, suppressing pricing power and profit margins.

- Innovation Opportunities Are Limited: R&D investments are scarce due to the drug’s age, with minimal prospects for breakthrough innovations beyond incremental formulations.

- Niche and Emergency Uses Sustain Demand: Despite overarching decline, pyrimethamine continues to serve specific clinical and regional needs, especially where alternative therapies are inaccessible.

- Global Health Funding Shapes Demand: International aid and procurement policies affect supply and sustained demand, primarily in resource-limited settings.

FAQs

1. Why has pyrimethamine's market share declined globally?

Resistance development in Plasmodium falciparum, competition from newer antimalarial agents like artemisinin-based therapies, and its status as a generic drug have significantly reduced its market share.

2. Are there ongoing efforts to develop resistance-proof pyrimethamine formulations?

Research is limited; most efforts focus on developing combination therapies or alternative drugs. Pyrimethamine’s existing pharmacological limitations hamper substantial innovation.

3. What role does pyrimethamine play in current malaria treatment protocols?

It is mainly used in combination regimens for toxoplasmosis and as an adjunct in certain malaria treatments in resource-constrained settings, though its use has diminished with newer therapies.

4. Could pyrimethamine be repurposed for non-parasitic indications?

Preclinical studies explore its role in cancer therapy and other indications, but none have reached widespread clinical adoption. Such repurposing faces significant regulatory and commercial hurdles.

5. How do global health policies influence pyrimethamine's market?

International agencies and governments dictate procurement priorities, often favoring newer, more effective therapies, which limits pyrimethamine’s commercial growth despite ongoing clinical demand.

References

- World Health Organization. Malaria Treatment Guidelines. 2021.

- P. Shaffer et al., “Genetic Markers of Pyrimethamine Resistance in Plasmodium falciparum,” Antimicrobial Agents and Chemotherapy, 2019.

- U.S. Food and Drug Administration. Drug Approvals and Patent Data. 2022.

- WHO. Guidelines for the Treatment of Malaria. 2022.

- MarketWatch. Global Antimalarial Drugs Market Analysis. 2021.

- GlobalData. Pharmaceutical Market Trends and Outlook. 2022.