Last updated: July 27, 2025

Introduction

Bausch and Lomb (B&L) remains a prominent player within the global ophthalmic pharmaceuticals and eye health industry. As part of its comprehensive portfolio, it specializes in eye health products ranging from prescription medicines to over-the-counter (OTC) solutions, including contact lenses, lens care products, and surgical offerings. This analysis delves into B&L’s market positioning, core strengths, competitive landscape, and strategic initiatives driving its growth amid intensifying industry pressures.

Market Position of Bausch and Lomb

B&L, founded in 1853 and acquired by Bausch Health Companies in 2013, operates as a core segment within the broader ophthalmic market valued at approximately $48 billion in 2022, with projected CAGR of 3.8% through 2027 (Source: MarketWatch). The firm holds a significant share, especially within the contact lens and eye care sectors, aligning it among industry leaders like Johnson & Johnson, Novartis, and Alcon.

In the contact lens domain, B&L commands an estimated 20% market share globally, driven by its longstanding Acuvue brand, which has sustained dominance through innovation and extensive distribution networks. Its prescription ophthalmic products, including treatments for glaucoma and dry eye disease, bolster the firm’s diversified footprint, rivaling the portfolios of Novartis and Alcon.

Geographic Reach: B&L’s market presence spans North America, Europe, and Asia-Pacific, with North America contributing approximately 50% of revenues, reflective of high adoption rates and mature infrastructure. Growth strategies focus on expanding emerging markets where ophthalmic diseases are rising due to demographic shifts and increased health awareness.

Core Strengths

1. Brand Equity & Product Portfolio

B&L benefits from a robust portfolio anchored by the Acuvue line—one of the most recognized disposable contact lenses globally. Its reputation for comfort, safety, and innovation sustains high consumer loyalty. Additionally, its prescription treatments for ocular conditions like dry eye (e.g., Restasis) and glaucoma (e.g., Cosopt) provide stable revenue streams.

2. Research & Development (R&D) Capabilities

The company's commitment to R&D enables continuous innovation, crucial in a technology-driven industry. Recent launches, such as the extended-wear silicone hydrogel lenses, exemplify B&L’s focus on technology advancements, differentiating it from competitors and capturing unmet clinical needs.

3. Distribution & Global Reach

B&L's extensive global distribution network ensures widespread availability, supported by strategic partnerships with hospitals, clinics, and ophthalmologists. Its supply chain resilience allows rapid product deployment across diverse markets amid regulatory hurdles.

4. Regulatory & Patent Portfolio

Strong patent protections underpin product exclusivity and market advantage. B&L’s regulatory expertise facilitates timely approvals in multiple jurisdictions, mitigating generic threat penetration.

5. Strategic Acquisitions & Partnerships

B&L’s acquisition of entities such as Spark Therapeutics enhances its portfolio diversity. Strategic collaborations with research institutions accelerate innovation pipelines, fostering a competitive edge.

Competitive Landscape

The ophthalmic pharmaceutical industry is generally competitive, characterized by innovation, patent race dynamics, and strategic alliances. Major competitors such as Johnson & Johnson’s Vision Care, Alcon (a Novartis subsidiary), and CooperVision vie for market share through technological innovation, marketing, and geographic expansion.

Key Competitive Strategies:

- Product Innovation: Continuous R&D to develop lenses requiring less maintenance or offering superior oxygen permeability.

- Market Expansion: Penetrating emerging markets through localized product offerings and pricing strategies.

- Acquisitions & Alliances: Strategic acquisitions to broaden product pipelines; collaborations with health tech firms to integrate digital health solutions.

- Regulatory Navigation: Maintaining agility in obtaining approvals for novel therapies and devices.

SWOT Analysis

| Strengths |

Weaknesses |

| Strong brand presence (Acuvue) |

Dependence on mature markets (North America) |

| Diversified ophthalmic portfolio |

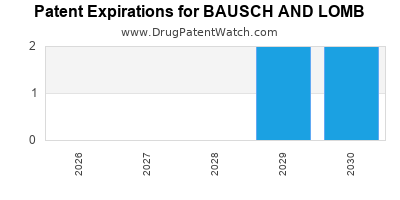

Patent expirations risk |

| Innovation-driven R&D |

High R&D expenditures |

| Opportunities |

Threats |

| Growing aging populations globally |

Patent litigation and generics |

| Expansion into emerging markets |

Regulatory constraints |

| Digital health integration |

Competitive price pressures |

Strategic Insights

1. Innovation-Driven Growth

B&L must sustain investment in advanced materials (e.g., silicone hydrogel), digital technologies (e.g., tele-ophthalmology), and personalized medicine to differentiate from competitors. Leveraging AI and IoT for eye health management can establish new revenue streams.

2. Market Diversification

Expanding presence in emerging markets like Asia-Pacific, Latin America, and Africa, where ophthalmic diseases are prevalent and healthcare infrastructure is improving, will be critical. Tailoring products to local preferences and affordability will facilitate penetration.

3. Pipeline Optimization & Regulatory Strategy

Prioritizing high-potential products in late-stage development, especially biosimilars or novel drug delivery systems, aligns with industry trends. A proactive regulatory approach mitigates delays and secures first-to-market advantages.

4. Partnerships & Mergers

Collaborations with optometrists, hospitals, and technology firms can accelerate innovation and distribution expansion. Potential mergers or acquisitions should target specialty ophthalmics or digital health startups.

5. Sustainability & Corporate Responsibility

Integrating sustainability initiatives—such as eco-friendly packaging and reduced carbon footprint—can enhance brand image and meet stakeholder expectations, aligning with global healthcare industry trends.

Conclusion

Bausch and Lomb stands as a resilient leader in ophthalmic pharmaceuticals and eye care, buoyed by its strong brand, innovative capacity, and broad geographic footprint. To navigate an increasingly competitive landscape, strategic focus on innovation, market expansion, and digital integration becomes paramount. Its ability to adapt to evolving consumer demands and regulatory environments will significantly determine maintaining and enhancing its market position amid rising competition.

Key Takeaways

- B&L’s dominance in contact lenses, particularly the Acuvue brand, offers a sustainable revenue base, but diversification into biosimilars and digital health can unlock new growth avenues.

- Continuous innovation and R&D remain central to differentiating in a highly competitive, patent-sensitive industry.

- Expanding into emerging markets and tailoring product offerings for local needs will mitigate risks associated with saturated mature markets.

- Strategic alliances, M&A activity, and patent management will underpin B&L’s ability to sustain competitive advantage.

- Incorporating sustainability and digital health solutions positions B&L favorably with future-oriented consumers and regulators.

FAQs

1. How does Bausch and Lomb distinguish itself from competitors like Johnson & Johnson?

B&L employs a focused innovation approach in contact lenses and ophthalmic pharmaceuticals, leveraging its longstanding expertise and dedicated R&D investments, while J&J maintains a broader diversified healthcare portfolio. B&L’s specialization in eye care allows for concentrated branding and innovation strategies.

2. What are the primary growth drivers for B&L in the next five years?

Emerging market expansion, technological innovation in lens materials and digital eye health solutions, and pipeline development in biosimilars and therapeutics are key drivers.

3. How vulnerable is B&L to patent expirations?

While patent expirations pose risk, B&L mitigates this through continuous pipeline innovation, strategic acquisitions, and expanding into emerging markets less sensitive to patent cliffs.

4. What role does digital health play in B&L’s strategic outlook?

Digital health provides opportunities for remote eye care, patient monitoring, and personalized treatments, aligning with B&L’s innovation trajectory and enhancing customer engagement.

5. How is B&L addressing sustainability amid industry pressures?

The company is adopting eco-friendly manufacturing practices, reducing packaging waste, and optimizing supply chains to lower environmental impact, aligning with global sustainability standards.

References

- MarketWatch, "Global Ophthalmic Pharmaceuticals Market," 2022.

- Bausch and Lomb Annual Report, 2022.

- IQVIA Institute Reports, 2022.

- Allied Market Research, "Contact Lens Market," 2022.