Last updated: July 28, 2025

Introduction

Enalapril Maleate, a prominent angiotensin-converting enzyme (ACE) inhibitor, has established itself as a cornerstone in managing hypertension and heart failure. Originating from the pharmaceutical innovations of the late 1980s, the drug has demonstrated consistent therapeutic efficacy and safety, solidifying its position in the cardiovascular drug landscape. This comprehensive market analysis explores the current dynamics governing Enalapril Maleate, assesses its competitive positioning, evaluates emerging trends, and projects its pricing trajectory over the next five years.

Market Overview

Global Market Context

The global antihypertensive drugs market was valued at approximately USD 24 billion in 2021 and is projected to grow at a CAGR of around 3.8% through 2028, driven by increasing prevalence of hypertension, lifestyle-related cardiovascular diseases, and active aging populations[^1]. Enalapril Maleate contributes a significant segment to this market, owing to its longstanding approval, affordability, and proven clinical efficacy.

Therapeutic Demand Drivers

- Rising Hypertension Prevalence: Globally, over 1.3 billion adults suffer from hypertension, with projections indicating a continual increase, especially in low- and middle-income countries (LMICs) [^2].

- Cardiovascular Disease Burden: Heart failure rates are climbing, with ACE inhibitors like Enalapril Maleate forming first-line therapy.

- Generic Entry and Cost-efficiency: The patent expiry of Enalapril Maleate in many jurisdictions has led to a surge in generic formulations, significantly impacting pricing and accessibility.

- Preferential Use in Special Populations: Its safety profile in elderly and renally impaired patients sustains demand.

Market Segments

The Enalapril Maleate market is segmented by formulation (oral tablets, intravenous), strength, distribution channels (hospital, retail pharmacies), and regional markets. Oral formulations chiefly dominate, accounting for over 85% volume share globally.[^3]

Competitive Landscape

Key Players

- Novartis and Merck (MSD) historically held market dominance, primarily through proprietary formulations.

- Generics Manufacturers: Multiple companies in India, China, and emerging markets produce high-quality generic Enalapril Maleate, intensifying price competition.

- Biosimilar & Alternative Therapies: Although biosimilars are not relevant here, newer classes like ARBs (angiotensin receptor blockers) compete directly, influencing market shares.

Pricing Dynamics

The entry of generics has driven prices down substantially. Retail prices for generic Enalapril Maleate in the US fell by approximately 70% between 2005 and 2021[^4]. The standard dosage (10 mg) can cost as low as USD 5–10 per month in low-cost markets, while branded versions may fetch USD 20–30.

Regulatory Environment

Stringent regulatory pathways for generics, including bioequivalence studies, have facilitated rapid market entry, ensuring cost-effective competition but also pressuring innovation-driven pricing strategies for innovator drugs.

Emerging Trends Impacting Market and Pricing

Increased Generic Penetration

Patent expirations in various territories have led to a proliferation of generics, intensifying competitive pressures and lowering prices. The global bioequivalent generic Enalapril Maleate market is projected to grow at a CAGR of 4.5% over the next five years.

Shift Toward Fixed-Dose Combinations (FDCs)

Pharmaceutical companies are increasingly developing combination products incorporating Enalapril Maleate with other antihypertensive agents (e.g., hydrochlorothiazide), offering enhanced therapeutic convenience and compliance, thereby expanding market reach.

Digital and Remote Healthcare Adoption

Telehealth expansion and digital prescribing streamline access, particularly in underserved regions, potentially elevating demand volumes but exerting downward pressure on individual shot prices due to price competition and payor negotiations.

Pricing Policies and Reimbursement Strategies

Global initiatives favor cost containment; for example, government health agencies in the UK and India have adopted aggressive pricing caps for generics. Conversely, higher-income markets may experience more stable pricing due to reimbursement frameworks.

Patent and Regulatory Landscape

While primary patents expired in many regions, secondary patents and formulation exclusivities may influence patent cliff timing, impacting market entry and pricing stability.

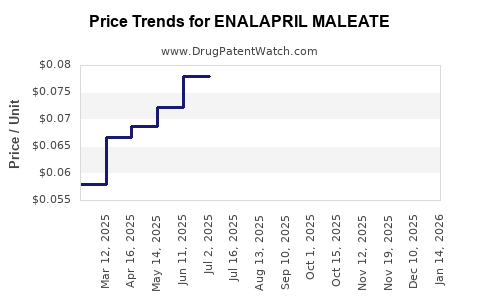

Price Projections (2023–2028)

Assumptions

- Continued proliferation of generic formulations.

- Stable regulatory and reimbursement environments.

- Increasing demand driven by hypertension prevalence.

- Moderate inflation and currency fluctuations factored into pricing.

Projected Trends

- Base Case: Average retail price per 30-tablet pack of 10 mg Enalapril Maleate will decline from approximately USD 10 in 2022 to USD 6–8 by 2028 in high-income markets, driven by generic competition.

- Emerging Markets: Prices may stabilize around USD 3–5 per pack, benefiting from local manufacturing and supply chain efficiencies.

- Premium Segment: Limited, primarily in specialized formulations or combination therapies, potentially maintaining higher margins.

- Impact of Biosimilars and Alternative Therapies: Will exert a moderating influence on prices, fostering continuous downward adjustments.

Region-Specific Insights

| Region |

2023 Price Projection (USD) |

2028 Price Projection (USD) |

Key Drivers |

| North America |

8–10 |

6–8 |

Mature generics market, strong reimbursement |

| Europe |

7–9 |

5–7 |

Price regulation policies |

| Asia-Pacific |

3–5 |

2–4 |

High generic penetration, local manufacturing |

| Latin America |

4–6 |

3–5 |

Cost-sensitive markets, government procurement strategies |

Market Outlook Summary

The Enalapril Maleate market is positioned for sustained demand growth, predominantly driven by developing nations’ expanding hypertensive populations. Price erosion will likely continue due to intense generic competition, budget-conscious healthcare policies, and evolving treatment paradigms favoring combination therapies. Despite pricing pressures, Enalapril Maleate’s integral role in cardiovascular management ensures enduring market relevance, with opportunities arising from formulation innovations and expanding indications, notably in heart failure management.

Key Takeaways

- Declining Prices Due to Generics: Entry of multiple manufacturing players has caused a significant reduction in retail prices, especially in emerging markets.

- Demand Growth in Developing Nations: Rising hypertension prevalence ensures continued demand, balancing pricing pressures.

- Innovation in Formulations: Fixed-dose combinations and novel delivery systems may create premium segments, slightly offsetting downward price trends.

- Regulatory and Reimbursement Impact: Policy frameworks in high-income countries will influence regional price stability versus more aggressive price reductions in LMICs.

- Market Stability and Opportunities: Despite pricing pressures, Enalapril Maleate remains a mainstay therapy, with opportunities for derivatives and combination products.

FAQs

1. How will patent expirations influence Enalapril Maleate pricing?

Patent expirations have facilitated a surge in generic manufacturing, driving down prices globally. This trend is expected to persist, especially in regions with robust generic capacity, maintaining the drug’s affordability and expanding access.

2. What competitive factors could affect future pricing?

Emergence of biosimilars, new therapeutic agents, and fixed-dose combination formulations will exert pricing pressure. Additionally, regulatory policies promoting cost containment can further influence retail prices.

3. Are there any upcoming formulations or indications that may impact demand?

Yes, combination therapies incorporating Enalapril Maleate are gaining popularity for improved compliance. Its emerging role in heart failure treatments beyond hypertension could also influence demand dynamics.

4. How do regional differences impact the price trajectory?

High-income markets tend to maintain relatively stable prices due to reimbursement systems, whereas price sensitivity in LMICs fosters accelerated downward adjustments owing to local manufacturing and government procurement policies.

5. What strategies can manufacturers adopt to sustain profitability?

Focusing on innovative formulations, expanding indication portfolios, optimizing cost efficiencies, and targeting niche markets with value-added products can help mitigate adverse pricing trends.

Sources

[^1]: Grand View Research. "Hypertension Drugs Market Size & Share Analysis." 2022.

[^2]: World Health Organization. "Hypertension Facts." 2021.

[^3]: IQVIA. "Global Prescription Drug Market Data." 2022.

[^4]: Medicare Payment Advisory Commission. "Trends in Prescription Drug Prices." 2021.