PADAGIS US Company Profile

✉ Email this page to a colleague

What is the competitive landscape for PADAGIS US, and when can generic versions of PADAGIS US drugs launch?

PADAGIS US has eighty-seven approved drugs.

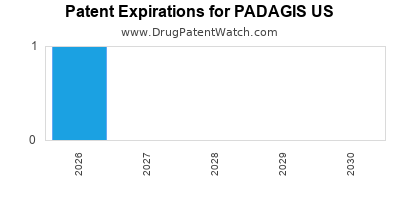

There is one US patent protecting PADAGIS US drugs.

There are twenty-two patent family members on PADAGIS US drugs in fourteen countries and one hundred and twenty-one supplementary protection certificates in fifteen countries.

Drugs and US Patents for PADAGIS US

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Padagis Us | CENTANY | mupirocin | OINTMENT;TOPICAL | 050788-001 | Dec 4, 2002 | BX | RX | No | No | ⤷ Try a Trial | ⤷ Try a Trial | ||||

| Padagis Us | CLOBETASOL PROPIONATE | clobetasol propionate | GEL;TOPICAL | 075027-001 | Oct 31, 1997 | AB | RX | No | No | ⤷ Try a Trial | ⤷ Try a Trial | ||||

| Padagis Us | CLINDESSE | clindamycin phosphate | CREAM;VAGINAL | 050793-001 | Nov 30, 2004 | RX | Yes | Yes | 9,789,057 | ⤷ Try a Trial | Y | ⤷ Try a Trial | |||

| Padagis Us | BROMOCRIPTINE MESYLATE | bromocriptine mesylate | TABLET;ORAL | 077646-001 | Oct 1, 2008 | AB | RX | No | Yes | ⤷ Try a Trial | ⤷ Try a Trial | ||||

| Padagis Us | TRETINOIN | tretinoin | CREAM;TOPICAL | 075213-001 | Dec 24, 1998 | AB | RX | No | No | ⤷ Try a Trial | ⤷ Try a Trial | ||||

| Padagis Us | CICLOPIROX | ciclopirox | SHAMPOO;TOPICAL | 078594-001 | Feb 16, 2010 | AT | RX | No | No | ⤷ Try a Trial | ⤷ Try a Trial | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for PADAGIS US

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Padagis Us | CLINDESSE | clindamycin phosphate | CREAM;VAGINAL | 050793-001 | Nov 30, 2004 | 6,899,890 | ⤷ Try a Trial |

| Padagis Us | CLINDESSE | clindamycin phosphate | CREAM;VAGINAL | 050793-001 | Nov 30, 2004 | 5,266,329 | ⤷ Try a Trial |

| Padagis Us | BUTOCONAZOLE NITRATE | butoconazole nitrate | CREAM;VAGINAL | 019881-001 | Feb 7, 1997 | 4,078,071 | ⤷ Try a Trial |

| Padagis Us | BUTOCONAZOLE NITRATE | butoconazole nitrate | CREAM;VAGINAL | 019881-001 | Feb 7, 1997 | 4,551,148 | ⤷ Try a Trial |

| Padagis Us | ENTOCORT EC | budesonide | CAPSULE, DELAYED RELEASE;ORAL | 021324-001 | Oct 2, 2001 | 5,643,602*PED | ⤷ Try a Trial |

| Padagis Us | CLINDESSE | clindamycin phosphate | CREAM;VAGINAL | 050793-001 | Nov 30, 2004 | 5,993,856 | ⤷ Try a Trial |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

Paragraph IV (Patent) Challenges for PADAGIS US drugs

| Drugname | Dosage | Strength | Tradename | Submissiondate |

|---|---|---|---|---|

| ➤ Subscribe | Enteric Coated Capsules | 3 mg | ➤ Subscribe | 2008-02-01 |

| ➤ Subscribe | Vaginal Cream | 2% | ➤ Subscribe | 2015-02-05 |

International Patents for PADAGIS US Drugs

| Country | Patent Number | Estimated Expiration |

|---|---|---|

| Peru | 20070974 | ⤷ Try a Trial |

| Japan | 2007505927 | ⤷ Try a Trial |

| Eurasian Patent Organization | 200870154 | ⤷ Try a Trial |

| Australia | 2006332519 | ⤷ Try a Trial |

| China | 101374502 | ⤷ Try a Trial |

| Brazil | PI0414500 | ⤷ Try a Trial |

| >Country | >Patent Number | >Estimated Expiration |

Supplementary Protection Certificates for PADAGIS US Drugs

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 0933372 | PA2008006,C0933372 | Lithuania | ⤷ Try a Trial | PRODUCT NAME: FOSAMPRENAVIR CALCIUM; REGISTRATION NO/DATE: EU/1/04/282/001-002 20040712 |

| 1380301 | CA 2009 00017 | Denmark | ⤷ Try a Trial | PRODUCT NAME: ETHINYLESTRADIOL (SOM BETADEXCLATHRAT) OG DROSPIRENON; NAT. REG. NO/DATE: 42417 (DK) 20080619; FIRST REG. NO/DATE: NL 33842 20070629 |

| 1441735 | 08C0026 | France | ⤷ Try a Trial | PRODUCT NAME: RALTEGRAVIR POTASSIUM; REGISTRATION NO/DATE: EU/1/07/436/001 20080102 |

| 2957286 | 2018C/047 | Belgium | ⤷ Try a Trial | PRODUCT NAME: PATIROMER SORBITEX CALCIUM; AUTHORISATION NUMBER AND DATE: EU/1/17/1179 20170721 |

| 0584952 | 99C0004 | Belgium | ⤷ Try a Trial | PRODUCT NAME: ESTRADIOL, HEMIHYDRATE, NORETHISTERONE, ACETATE; NAT. REGISTRATION NO/DATE: NL 23753 19981210; FIRST REGISTRATION: SE - 14 007 19980306 |

| 2782584 | 301153 | Netherlands | ⤷ Try a Trial | PRODUCT NAME: COMPOSITION CONTAINING BOTH ESTRADIOL (17SS-ESTRADIOL), OPTIONALLY IN THE FORM OF A PHARMACEUTICALLY ACCEPTABLE SALT, HYDRATE OR SOLVATE THEREOF (INCLUDING IN HEMIHYDRATE FORM), AND PROGESTERONE; NATIONAL REGISTRATION NO/DATE: RVG 125821 20210611; FIRST REGISTRATION: BE BE582231 20210406 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Similar Applicant Names

Here is a list of applicants with similar names.