BAUSCH Company Profile

✉ Email this page to a colleague

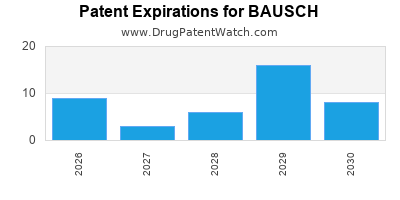

What is the competitive landscape for BAUSCH, and what generic alternatives to BAUSCH drugs are available?

BAUSCH has one hundred and seventy-six approved drugs.

There are one hundred and twenty-one US patents protecting BAUSCH drugs.

There are seven hundred and seventy-one patent family members on BAUSCH drugs in fifty-two countries and two hundred and eight supplementary protection certificates in sixteen countries.

Summary for BAUSCH

| International Patents: | 771 |

| US Patents: | 121 |

| Tradenames: | 155 |

| Ingredients: | 122 |

| NDAs: | 176 |

| Patent Litigation for BAUSCH: | See patent lawsuits for BAUSCH |

Drugs and US Patents for BAUSCH

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bausch And Lomb | ZYLET | loteprednol etabonate; tobramycin | SUSPENSION/DROPS;OPHTHALMIC | 050804-001 | Dec 14, 2004 | RX | Yes | Yes | ⤷ Try a Trial | ⤷ Try a Trial | |||||

| Bausch | CARDIZEM | diltiazem hydrochloride | TABLET;ORAL | 018602-002 | Nov 5, 1982 | AB | RX | Yes | No | ⤷ Try a Trial | ⤷ Try a Trial | ||||

| Bausch And Lomb | ZIRGAN | ganciclovir | GEL;OPHTHALMIC | 022211-001 | Sep 15, 2009 | RX | Yes | Yes | ⤷ Try a Trial | ⤷ Try a Trial | |||||

| Bausch | ZOVIRAX | acyclovir | CREAM;TOPICAL | 021478-001 | Dec 30, 2002 | AB | RX | Yes | No | ⤷ Try a Trial | ⤷ Try a Trial | ||||

| Bausch And Lomb Inc | LACRISERT | hydroxypropyl cellulose | INSERT;OPHTHALMIC | 018771-001 | Approved Prior to Jan 1, 1982 | RX | Yes | Yes | ⤷ Try a Trial | ⤷ Try a Trial | |||||

| Bausch | CARDIZEM LA | diltiazem hydrochloride | TABLET, EXTENDED RELEASE;ORAL | 021392-003 | Feb 6, 2003 | AB | RX | Yes | No | ⤷ Try a Trial | ⤷ Try a Trial | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for BAUSCH

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Bausch | RETIN-A MICRO | tretinoin | GEL;TOPICAL | 020475-002 | May 10, 2002 | 4,690,825 | ⤷ Try a Trial |

| Bausch | VIRAZOLE | ribavirin | FOR SOLUTION;INHALATION | 018859-001 | Dec 31, 1985 | 4,211,771 | ⤷ Try a Trial |

| Bausch | CESAMET | nabilone | CAPSULE;ORAL | 018677-001 | Dec 26, 1985 | 4,087,545 | ⤷ Try a Trial |

| Bausch | SOLODYN | minocycline hydrochloride | TABLET, EXTENDED RELEASE;ORAL | 050808-005 | Jul 23, 2009 | 5,908,838 | ⤷ Try a Trial |

| Bausch And Lomb Inc | MACUGEN | pegaptanib sodium | INJECTABLE;INTRAVITREAL | 021756-001 | Dec 17, 2004 | 6,426,335 | ⤷ Try a Trial |

| Bausch | TASMAR | tolcapone | TABLET;ORAL | 020697-002 | Jan 29, 1998 | 5,476,875 | ⤷ Try a Trial |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

Paragraph IV (Patent) Challenges for BAUSCH drugs

| Drugname | Dosage | Strength | Tradename | Submissiondate |

|---|---|---|---|---|

| ➤ Subscribe | Cream | 3.75% | ➤ Subscribe | 2012-08-08 |

| ➤ Subscribe | Extended-release Tablets | 522 mg | ➤ Subscribe | 2009-12-24 |

| ➤ Subscribe | For Inhalation Solution | 6 gm/vial | ➤ Subscribe | 2014-05-22 |

| ➤ Subscribe | Extended-release Tablets | 420 mg | ➤ Subscribe | 2005-04-25 |

| ➤ Subscribe | Rectal Gel | 5 mg/mL, 4mL pre-filled syringe | ➤ Subscribe | 2008-12-08 |

| ➤ Subscribe | Extended-release Tablet | 55 mg and 80 mg | ➤ Subscribe | 2010-12-02 |

| ➤ Subscribe | Gel | 1.2%/2.5% | ➤ Subscribe | 2012-12-20 |

| ➤ Subscribe | Extended-release Tablets | 150 mg and 300 mg | ➤ Subscribe | 2004-09-21 |

| ➤ Subscribe | Gel | 0.1% | ➤ Subscribe | 2010-07-08 |

| ➤ Subscribe | Ophthalmic Solution | 0.07% | ➤ Subscribe | 2013-07-26 |

| ➤ Subscribe | Capsules | 75 mg | ➤ Subscribe | 2011-06-06 |

| ➤ Subscribe | Vaginal Gel | 0.75% | ➤ Subscribe | 2004-09-02 |

| ➤ Subscribe | Cream | 5% | ➤ Subscribe | 2006-10-17 |

| ➤ Subscribe | Topical Solution | 10% | ➤ Subscribe | 2018-06-06 |

| ➤ Subscribe | Cream | 0.10% | ➤ Subscribe | 2008-01-31 |

| ➤ Subscribe | Extended-release Tablets | 348 mg | ➤ Subscribe | 2009-09-24 |

| ➤ Subscribe | Cream | 2.5% | ➤ Subscribe | 2014-06-17 |

| ➤ Subscribe | Extended-release Tablets | 120 mg, 180 mg, 240 mg, 300 mg and 360 mg | ➤ Subscribe | 2005-08-30 |

| ➤ Subscribe | Rectal Gel | 2.5 mg/0.5 mL, 5 mg/mL, 10 mg/2 mL, 15 mg/3 mL and 20 mg/4 mL | ➤ Subscribe | 2004-03-23 |

| ➤ Subscribe | Extended-release Tablets | 65 mg and 115 mg | ➤ Subscribe | 2009-11-19 |

| ➤ Subscribe | Rectal Gel | 5 mg/mL, 2mL pre-filled syringe | ➤ Subscribe | 2008-12-23 |

| ➤ Subscribe | Extended-release Tablet | 105 rng | ➤ Subscribe | 2010-12-28 |

| ➤ Subscribe | Gel | 1.2%/3.75% | ➤ Subscribe | 2015-09-30 |

| ➤ Subscribe | Ophthalmic Solution | 0.5% | ➤ Subscribe | 2012-10-19 |

| ➤ Subscribe | Gel | 0.04% | ➤ Subscribe | 2010-12-20 |

| ➤ Subscribe | Ophthalmic Solution | 1.5% | ➤ Subscribe | 2013-09-09 |

| ➤ Subscribe | Gel | 1.2%/0.025% | ➤ Subscribe | 2010-12-17 |

| ➤ Subscribe | Gel | 0.77% | ➤ Subscribe | 2006-05-10 |

| ➤ Subscribe | Lotion | 0.1% | ➤ Subscribe | 2016-08-31 |

| ➤ Subscribe | Extended-release Tablets | 174 mg | ➤ Subscribe | 2009-09-28 |

International Patents for BAUSCH Drugs

| Country | Patent Number | Estimated Expiration |

|---|---|---|

| Nicaragua | 201000015 | ⤷ Try a Trial |

| South Africa | 201301397 | ⤷ Try a Trial |

| Japan | 2018507252 | ⤷ Try a Trial |

| Denmark | 2320911 | ⤷ Try a Trial |

| World Intellectual Property Organization (WIPO) | 2016205001 | ⤷ Try a Trial |

| World Intellectual Property Organization (WIPO) | 2005068421 | ⤷ Try a Trial |

| >Country | >Patent Number | >Estimated Expiration |

Supplementary Protection Certificates for BAUSCH Drugs

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2316456 | CA 2017 00062 | Denmark | ⤷ Try a Trial | PRODUCT NAME: NALTREXON ELLER ET FARMACEUTISK ACCEPTABELT SALT DERAF, ISAER NALTREXONHYDROCHLORID, OG BUPROPION ELLER ET FARMACEUTISK ACCEPTABELT SALT DERAF, ISAER BUPROPIONHYDROCHLORID; REG. NO/DATE: EU/1/14/988 20150330 |

| 3461484 | C202130024 | Spain | ⤷ Try a Trial | PRODUCT NAME: NETARSUDIL O UN ENANTIOMERO, DIASTEREIOISOMERO, SAL O SALVADO DEL MISMO EN COMBINACION CON LATANOPROST O UNA SAL DEL MISMO; NATIONAL AUTHORISATION NUMBER: EU/1/20/1502; DATE OF AUTHORISATION: 20210107; NUMBER OF FIRST AUTHORISATION IN EUROPEAN ECONOMIC AREA (EEA): EU/1/20/1502; DATE OF FIRST AUTHORISATION IN EEA: 20210107 |

| 3043773 | 21C1057 | France | ⤷ Try a Trial | PRODUCT NAME: MOMETASONE OU L'UN DE SES SELS AVEC OLOPATADINE OU L'UN DE SES SELS; NAT. REGISTRATION NO/DATE: NL52121 20211026; FIRST REGISTRATION: AT - 140638 20210426 |

| 0206283 | 98C0041 | Belgium | ⤷ Try a Trial | PRODUCT NAME: LEVOFLOXACINUM HEMIHYDRICUM; NAT. REGISTRATION NO/DATE: 354 IS 370 F3 19980624; FIRST REGISTRATION: GB 134020011 19970606 |

| 2666774 | CR 2020 00037 | Denmark | ⤷ Try a Trial | PRODUCT NAME: RELEBACTAM, OPTIONALLY IN THE FORM OF THE MONOHYDRATE, IMIPENEM AND CILASTATIN, OPTIONALLY IN THE FORM OF THE SODIUM SALT; REG. NO/DATE: EU/1/19/1420 20200217 |

| 0268956 | SPC/GB98/040 | United Kingdom | ⤷ Try a Trial | PRODUCT NAME: RABEPRAZOLE, OPTIONALLY IN THE FORM OF A PHARMACEUTICALLY ACCEPTABLE SALT, INCLUDING THE SODIUM SALT; REGISTERED: UK 10555/0010 19980508; UK 10555/0008 19980508 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Similar Applicant Names

Here is a list of applicants with similar names.